The Silver Squeeze vs. Wall Street Corruption

What started in mid-January as a coordinated reaction against GameStop short sellers by a group of Reddit discussion forum day traders, has now turned into something entirely larger.

By now you will probably be aware of the recent meteoric rise in the share price of US company GameStop (GME) in late January after Reddit board r/WallStreetBets (WSB) organized to buy and push up the stock price of GME following its heavy shorting by Wall Street hedge funds.

Short Squeeze

Shorting is a strategy by which a listed company’s shares are borrowed and sold so as to drive the share price lower, with the intention of buying back at a lower price and profiting on the difference. However, the worst outcome for a short seller is when the share price rises and shares have to be bought back at a loss. Hence, when the share price turns and rises, this can often lead to a ‘short squeeze’ where panicked short sellers scramble to buy the shares in fear of further losses, in the process helping to drive the price even higher.

Tomorrow am at 11:30 EST Citron will livestream the 5 reasons GameStop $GME buyers at these levels are the suckers at this poker game. Stock back to $20 fast. We understand short interest better than you and will explain. Thank you to viewers for pos feedback on last live tweet

— Citron Research (@CitronResearch) January 19, 2021

In GameStop’s case, the strategy of the Reddit / WSB horde was to buy – and promote the buying of – shares of GameStop so as to create a short squeeze trap for the hedge fund shorts, and in doing so also profit. Such was the intensity and power of this coordinated buying that GameStop shares rose at one point by more than 2500% in January from the January low of $18 to an intraday high of over $480.

Main Street vs Wall Street

As GameStop’s share price rose and rose, this loosely arranged throng of day traders and retail investors under the Reddit / WSB banner then extended their attention to additional heavily shorted shares, in the process sending share prices of names such as AMC Entertainment (AMC) and Blackberry (BB) multiples higher. This in turn triggered the large US retail brokerage platforms such as Robinhood, Webull and TD Ameritrade to restrict and limit their retail customers buy orders, subduing trading volume in these shares and causes their prices to fall, which in the process is creating even further anger against Wall Street and accusations of collusion between brokerages and hedge funds.

The phenomenon (of retail investors taking the opposite side of Wall Street hedge funds) did not go unnoticed by the SEC and US Treasury, so whatever about the level of share prices, this in itself is a coup for small traders and investors.

But as well as a gutsy attack against Wall Street’s hedge funds, the emergence of this WallStreetBets phenomenon is also the emergence of an entirely new movement, a movement frustrated over the rigged casino that is Wall Street, a movement with animosity towards hedge funds and investment banks, and a movement that has anger towards the financial status quo and the multi-billion dollar bailouts of Wall Street banks. In short, it is a philosophical attack against Wall Street by Main Street, a movement that Wall Street did not see coming, and a movement that despite the gyrations of the GameStop and AMC share prices, has been a spark that has triggered something far larger.

It sounds like @reddit has selected its next target

— WallStreetBets (@wallstreetbets) January 25, 2021

Silver – At the heart of the Financial System

This is where it gets very interesting. Out of the GameStop drama, which caught the attention of the world’s financial and mainstream media, the growing r/WallStreetBets crowd has now turned its attention to another market that has been shorted by Wall Street, a market whose entire pricing structure for many years has been capped and controlled by Wall Street banks, and distorted by fractionally-backed synthetic supply and limited physical supply. That market is silver and it’s price is the US dollar silver price.

There has never been a day in Fintwit history during which there has been so much animosity towards Wall Street plus as the same time the energy of potential “game changing” possibilities.

— BullionStar (@BullionStar) January 29, 2021

Why this is important is that silver, as a monetary metal, goes to the very heart of the financial system, but also critically, in taking on the cartel of New York and London bullion banks which control the silver market, this new movement is simultaneously attempting to rescue a free a market price (which for years has been held hostage by the bullion banks), while attempting to buy up silver’s available physical supply. It can also be seen as a battle between a sound money (silver) and a government created form of money (fiat).

BullionStar Youtube – #SilverSqueeze Series: Why is Silver being targeted now?

Now, there has already been the first salvo in a potentially huge silver price squeeze and silver supply squeeze, with the spot silver price nearing $30. Many people around the world have tuned in to the WallStreetBets silver move and the #silversqueeze trend, and its by now also been picked up by every major financial news provider.

Predictable Retaliation by the Establishment

The bullion banks, the COMEX operator CME group, and mainstream financial media have all acted predictably to stop the price advance and to dampen sentiment – the bullion banks knocking down the paper price of silver on COMEX from near $30 to below $27, the CME Group raising margin requirements on silver futures, and the MSM such as Bloomberg running slanted stories with headlines such as “Silver Sinks as Investor Frenzy Cools and Reddit Backlash Grows”.

Interesting timeline this morning #Silver

— Daniel March (@Daniel_March3) February 2, 2021

1) CME raises silver futures requirements 5am (https://t.co/3uphq1HgQc)

2) Silver dropping 4% between Asia/London 7am (https://t.co/nRklunc6pj)

3) JPM downgrading the mining sector 10am (https://t.co/IwJ1Nd7Dee) pic.twitter.com/MMB4p11iEo

In the now widely used #SilverSqueeze meme, the terminology short ‘squeeze’ is suitable here because the silver market is heavily shorted by the bullion banks such as JP Morgan both through COMEX silver future contracts and unallocated silver positions in London. Unallocated here refers to ‘silver credit’ which the LBMA bullion banks in London create out of thin air to use as their trading unit in the ‘London Silver Market’. But this silver credit is merely a claim on the bullion banks’ ability to source real silver.

In a similar way to the goal of the WSB / Reddit day trader group and their supporters which they applied to the GameStop strategy – the #SilverSqueeze plan is to send the price of silver higher, both to cause stress and losses to the short holders, but to also make a statement against the corruption of the financial and bullion bank system in having for years subdued the silver price mis-priced physical silver.

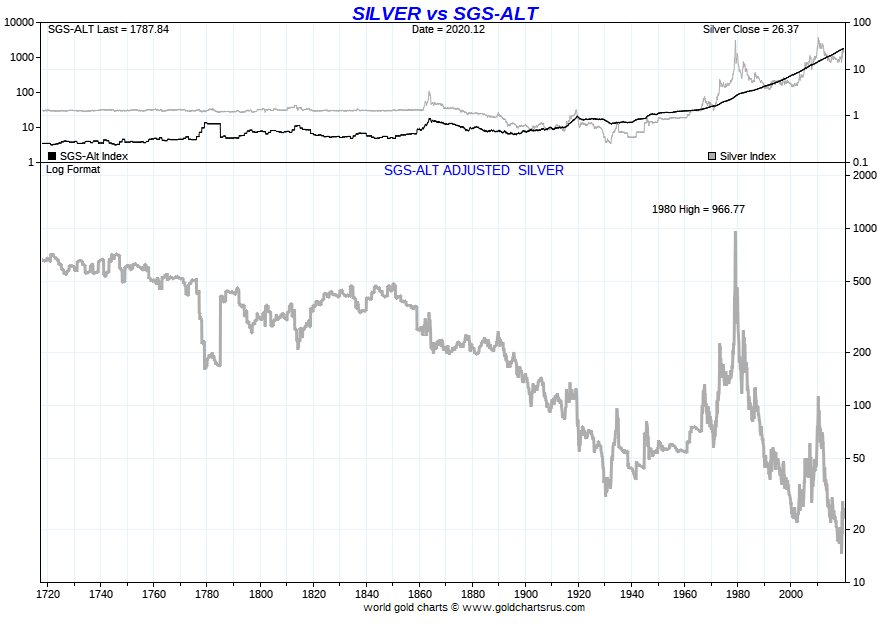

$1000 – Based on US Gov CPI Data

When using ShadowStats CPI calculations based on the US government’s historic inflation methodology (before the Bureau of labor Statistics CPI methodology was politically corrupted), the real (inflation-adjusted) silver prices silver are stratospheric, with an time 1980 high of nearly US$ 1000 per ounce. As we said just 2 weeks ago in a conveniently timed article called “The Staggering Levels of Real “Inflation-Adjusted” Gold and Silver Prices“:

“Everyone with an interest in the free functioning of markets must begin to sit up and question what is going on."

It is now clear that the Reddit crowd and the forces that they’ve awakened, have sat up and questioned what is going on in the silver market, and are also now realising that the bullion banks have heavily shorted the silver market using synthetic silver positions (LBMA unallocated) and huge volumes of COMEX silver futures to suppress the silver price, that are not backed by any real metal.

Physical Silver – The Achilles Heal of the Bullion Banks

Impressively, WallStreetBets discussion forums correctly identified that to have any chance of success, they would need to create demand for physical silver such as buying physical silver investment bars and coins directly, or by buying the iShares Silver Trust (SLV), or by taking delivery of a COMEX silver futures contract.

This is because taking physical silver creates demand for physical, takes physical out of the market, and creates a squeeze on the paper silver market by making it harder for ‘paper’ trading to determine price without reference to the limited availability of physical silver. But for any chance of success, the strategy will need to squeeze the entire silver bullion market.

If Silver market is proven to be fraudulent, you better believe Gold market will be next. HUGE implications especially for countries that have de-dollarized and central banks with large Gold holdings. #silversqueeze

— Cameron Winklevoss (@cameron) January 31, 2021

The SLV and JP Morgan

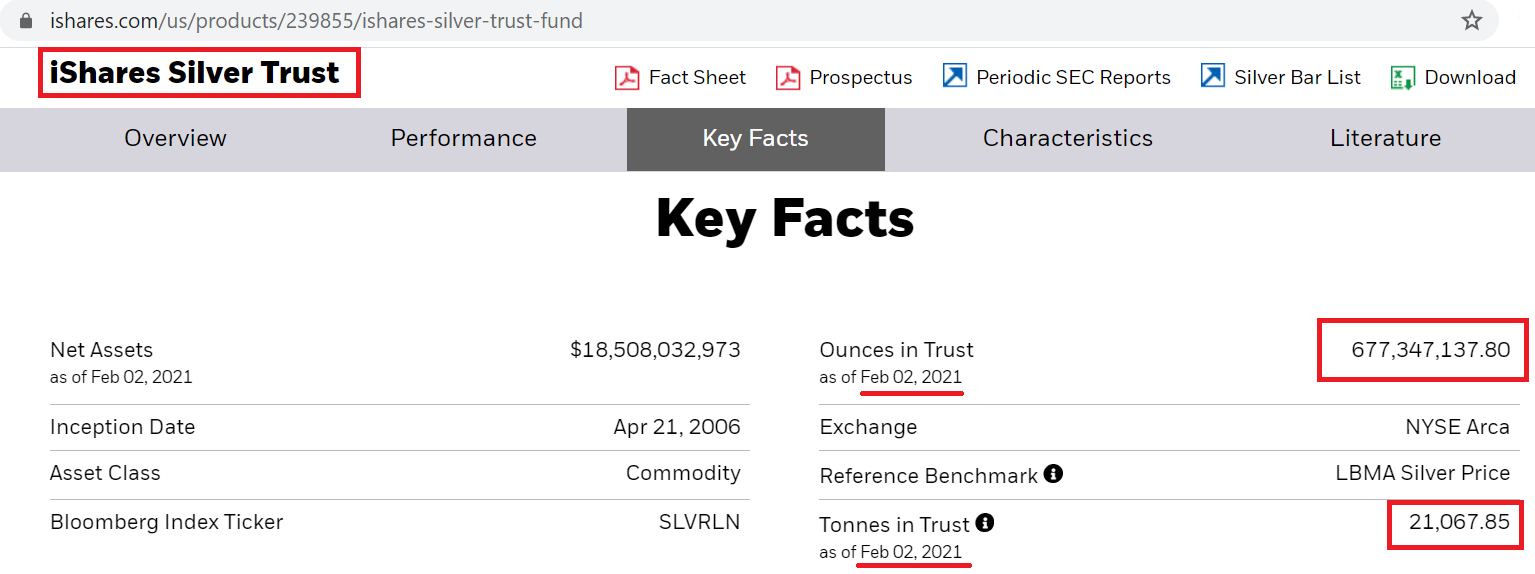

While iShares Silver Trust (SLV) units holders do not own any physical silver (the Trust owns the silver), and unit holders cannot convert their units into physical silver, due to the structure of SLV, all dollar fund inflows into SLV will create demand for physical silver. That is, if you believe the SLV custodian Jp Morgan.

This is because based on the Trust structure and Prospectus, every dollar inflow into SLV is packaged into baskets of securities by the Trust’s Authorized Participants (dealers) and these baskets are then exchanged with physical silver bars which are allocated to the Trust by the SLV custodian JP Morgan.

But there is a catch. This is the same JP Morgan which has been repeatedly prosecuted for manipulating silver price, and was, for example, fined $920 million by the US Justice Department last September for defrauding investors over 8 years " involving tens of thousands of episodes of unlawful trading in the markets for precious metals futures contracts". So do you trust JP Morgan to be honest about how it sources silver for the SLV?

On paper (no pun intended), it’s the job of JP Morgan as custodian to execute allocations into SLV and source physical silver metal either in, or to bring metal into, the vaults where SLV holds its silver. For SLV, these are the vaults of JP Morgan in London and New York, and the vaults of Brinks and Malca-Amit in London.

BullionStar Youtube – #SilverSqueeze Series: What are the most important things to look at in the Silver market currently?

And so with huge dollar inflows into SLV, as happened on Friday 29 January, Monday 01 January and Tuesday 2 February, JP Morgan at short notice has claimed it has found enough silver to add to the iShares Silver Trust. And this is a staggering amount of silver.

In total, SLV claims to have added a mammoth 3415 tonnes of silver since last Thursday (28 January), which just happened to be lying around in the SLV sub-custodian vault of Brinks in Park Royal, London, which is the vault where the SLV weight list says the silver was added to. This 3415 tonnes is 14% of annual mine supply and 10% of all the silver the LBMA says is in London. But do you believe the custodian JP Morgan?

Who would part with 3415 tonnes of physical silver at the beginnings of a #SilverSqueeze? Not a price maximising investor. Perhaps the silver is being leased, but then that in itself could be against SLV rules and would be double counting.

Conclusion

One of the big questions for the rest of the week then is whether large inflows into SLV continue, and whether JP Morgan will be able to find enough physical silver to add to the Trust. Its conceivable that the bullion banks knocked down the COMEX silver price on Tuesday 2 February specifically to try to dissuade investors from putting more money into SLV, so as to try to stop the huge physical silver additions that SLV is having to make (or claim to make) with every new dollar inflow. But if that was their intention, it did not work.

There are therefore potential added risks of buying into SLV in that in the event of the inability of JP Morgan to source enough physical silver, this would lead to a failure of SLV in following its Prospectus rules of investing in physical silver. But at the same time, if SLV does see continued massive dollar inflows, and if it hits a wall on not being able to acquire physical silver in London or New York, then this would cause shockwaves across the entire silver and gold markets, across all the banks involved in those market, and across the wider financial markets.

But given the risks of SLV and its opacity, in terms of the #SilverSqueeze, it is far more effective to buy physical investment silver directly. See BullionStar’s recent blog post “#SilverSqueeze: Physical Silver Shortage vs. Paper Silver" for more on this topic.

Popular Blog Posts by Ronan Manly

How Many Silver Bars Are in the LBMA's London Vaults?

How Many Silver Bars Are in the LBMA's London Vaults?

ECB Gold Stored in 5 Locations, Won't Disclose Gold Bar List

ECB Gold Stored in 5 Locations, Won't Disclose Gold Bar List

German Government Escalates War On Gold

German Government Escalates War On Gold

Polish Central Bank Airlifts 8,000 Gold Bars From London

Polish Central Bank Airlifts 8,000 Gold Bars From London

Quantum Leap as ABN AMRO Questions Gold Price Discovery

Quantum Leap as ABN AMRO Questions Gold Price Discovery

How Militaries Use Gold Coins as Emergency Money

How Militaries Use Gold Coins as Emergency Money

JP Morgan's Nowak Charged With Rigging Precious Metals

JP Morgan's Nowak Charged With Rigging Precious Metals

Hungary Announces 10-Fold Jump in Gold Reserves

Hungary Announces 10-Fold Jump in Gold Reserves

Planned in Advance by Central Banks: a 2020 System Reset

Planned in Advance by Central Banks: a 2020 System Reset

Surging Silver Demand to Intensify Structural Deficit

Surging Silver Demand to Intensify Structural Deficit

Ronan Manly

Ronan Manly 11 Comments

11 Comments