The Fifth Wave: A New Central Bank Gold Agreement?

For practically twenty years now since September 1999, a cartel of central banks in Europe have been running a coordinated scheme in the gold market. Officially known as the Central Bank Gold Agreements (CBGAs), the agreements have taken the shape of rolling five-year periods (CBGA1, CBGA2, CBGA3 and CBGA4) in which the central bank syndicate members claim to coordinate their physical gold sales for the altruistic ‘benefit’ of helping the wider gold market and limiting gold sales.

While taken at face value by the mainstream financial media and the World Gold Council (WGC) as a set of agreements to remove uncertainty from the market and put a floor under the gold price, there has never been any investigation from the same media and WGC as to:

whether the gold sales which the central banks claim to be planning in each five year period have already taken place with the planned sales merely being book squaring exercises;

whether the CBGA agreements might be a ‘hidden in plain sight’ way to re-distribute gold holdings among the world’s central banks as global monetary power has shifted east;

whether the CBGA agreements might be a ‘hidden in plain sight’ mechanism to use western central bank (G10) gold holdings as partial payments in Saudi ‘gold for oil’ transactions;

whether the CBGAs are a gold pool mechanism to firefight physical gold bar shortages at LBMA bullion banks.

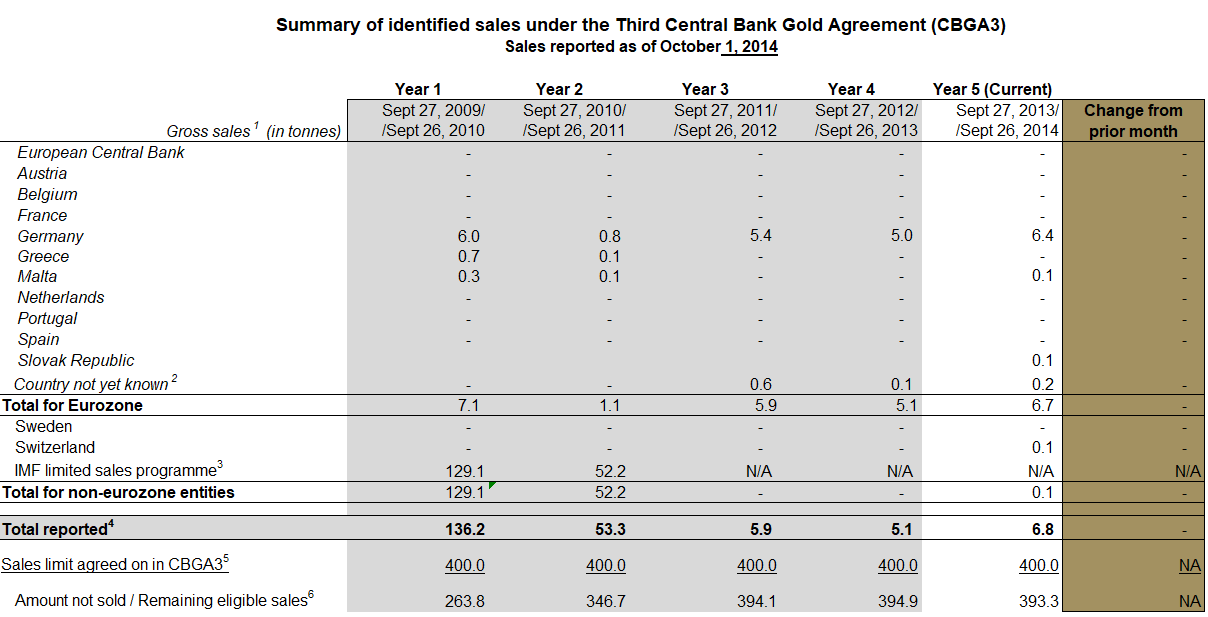

With the first CBGA having covered September 1999 to September 2004, the second from September 2004 to September 2009, and the third from September 2009 to September 2014, there are only another three months left to run in the fourth and current agreement which began in September 2014.

Now that the fourth CBGA is about to run out (at the end of September 2019), the most compelling question right now is whether this central bank cartel will ride again for another five years, i.e. whether there be a fifth CBGA spanning 2019 up to September 2024. As of the time of writing there has not been any renewal announcement.

As regards previous CBGA renewal announcements, CBGA2 was announced on 8 March 2004, CBGA3 was announced on 7 August 2009, and CBGA4 on 19 May 2014. So while CBGA2 and CBGA4 had been announced 4-6 months before their respective renewal dates, the 2009 renewal was only announced in August 2009, one month before it was renewed.

The reason for the renewal delay in 2009 looks to have been connected to the cartel waiting for the go ahead from the IMF regarding 403 tonnes of IMF gold sales which were officially clarified around about that time. But this now begs the question, if there is to be a renewal of the current CBGA, why is it being delayed right now? Will there be a new CBGA? Is it even necessary? Have there been further gold outflows from the same central banks in the last five years which need to now be accounted for? Whatever the case, if there is to be renewal announcement forthcoming this year, expect it to come out in the next few weeks.

Already Decided Sales = Already Sold

Despite all the hot air and puff written by the World Gold Council and financial media about the various Central Bank Gold Agreements over the last 20 years, the texts of the 4 announcements to date have been very short and concise, and it is to these texts that we must turn if we are to make some sense of what the signatory central banks are really up to.

Taking CBGA1 as a template, this first agreement was announced on 26 September 1999 during, surprise, surprise, the annual meeting of the International Monetary Fund (IMF) in Washington DC, and for this reason it is also known as the ‘Washington Agreement on Gold’.

CBGA1 was signed by 15 central banks from Europe, including 11 Eurozone member banks such as the Bundesbank, the Banque de France and Banca Italia, the European Central Bank (ECB) itself, as well as the Swedish Riksbank, the Bank of England and the Swiss National Bank. Although the US did not officially take part, its is significant that CBGA1 was announced in Washington. It is also significant that CBGA1 was announced just as the Euro was being launched, a time when European central banks were pulling back from gold lending.

Formed of a nexus of the members of the former London Gold Pool (Switzerland, Germany, France, Italy, Netherlands, Belgium, the UK) and also populated by most of the the G10 and G7 central banks, the core group of the current Central Bank Gold Agreement cartel also reads like a late 90s version of the same secretive central banks which met at the Bank of International Settlements (BIS) in 1979 and the early 1980s to hatch a plan for a secretive new 1980s gold pool.

In CBGA1, the signatory central banks revealed that even at the announcement date on 26 September 1999 they had already ‘decided’ the gold sales that they claimed they would be making over the subsequent five years, and that this would amount to about 2000 tonnes. The text of CBGA1 is as follows:

1. Gold will remain an important element of global monetary reserves.

2. The undersigned institutions will not enter the market as sellers, with the exception of already decided sales.

3. The gold sales already decided will be achieved through a concerted programme of sales over the next five years. Annual sales will not exceed approximately 400 tons and total sales over this period will not exceed 2,000 tons.

4. The signatories to this agreement have agreed not to expand their gold leasings and their use of gold futures and options over this period.

5. This agreement will be reviewed after five years.

Unsurprisingly lauded by the World Gold Council as introducing transparency into the gold market, CBGA1 does nothing of the sort, but does cleverly:

– Allow the cartel to psychologically put gold sales on the table

– Associate physical gold supply as having an impact on price when the real impact of price is from trading of gold futures on COMEX and synthetic gold trading in London

– Introduce a preconceived plan that would allow already executed sales and botched gold loans to be officially explained

– Reiterate the manipulative power of these central banks for intervening in the gold market using gold lending and gold derivatives – with no plans to reduce these activities

– Reiterate to the general market that this is a selling syndicate whose gold holdings are an overhang of global supply.

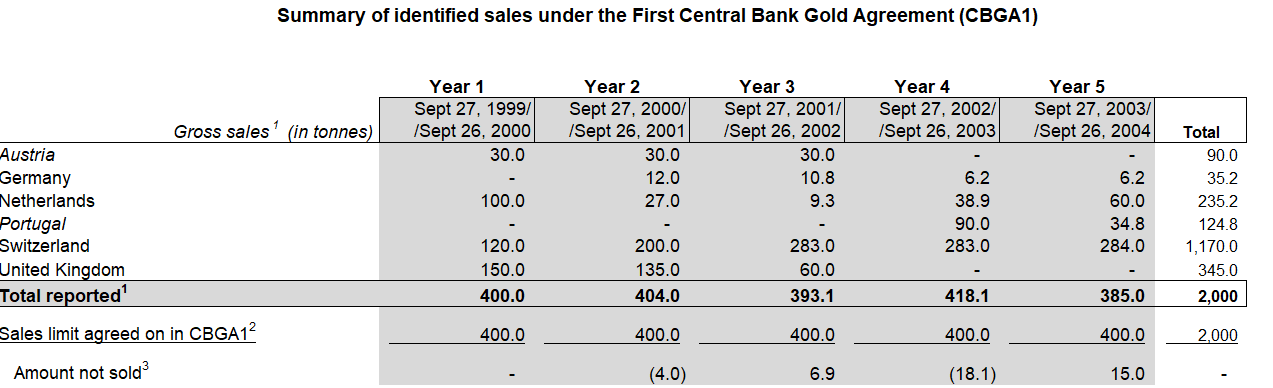

Given that it was signaled by the ‘already decided sales’ wording, the combined signatory central banks of CBGA1 covering the five year period up September 2004, did predictably fill their planned quota of exactly 2000 tonnes over five years, with the sales being mainly attributed to Switzerland (more than 1200 tonnes), the UK (nearly 300 tonnes), and also Austria, the Netherlands and Portugal, and to a lessor extent France and Germany.

During the same time from 26 September 1999 to 26 September 2004, the US dollar gold price rose by 50% from US$ 273 to US$ 411. Not very shrewd timing by these central banks to sell gold, unless you understand that the real sales had already been made and the gold claimed to be sold had already left the vaults before CBGA1 began.

If you needed to square off unannounced sales of 2000 tonnes of gold from 1990s gold loans and book these as sales, or redistribute gold to the People’s Bank of China, the middle eastern oil producers, or to physical gold short bullion banks, what better way to do it than pretend you are helping the gold market to “limit gold bar sales into the market", when actually shifting huge quantities of gold off western central bank balance sheets that had previously exited from western central bank vaults. And all during a time when the gold price was rising significantly.

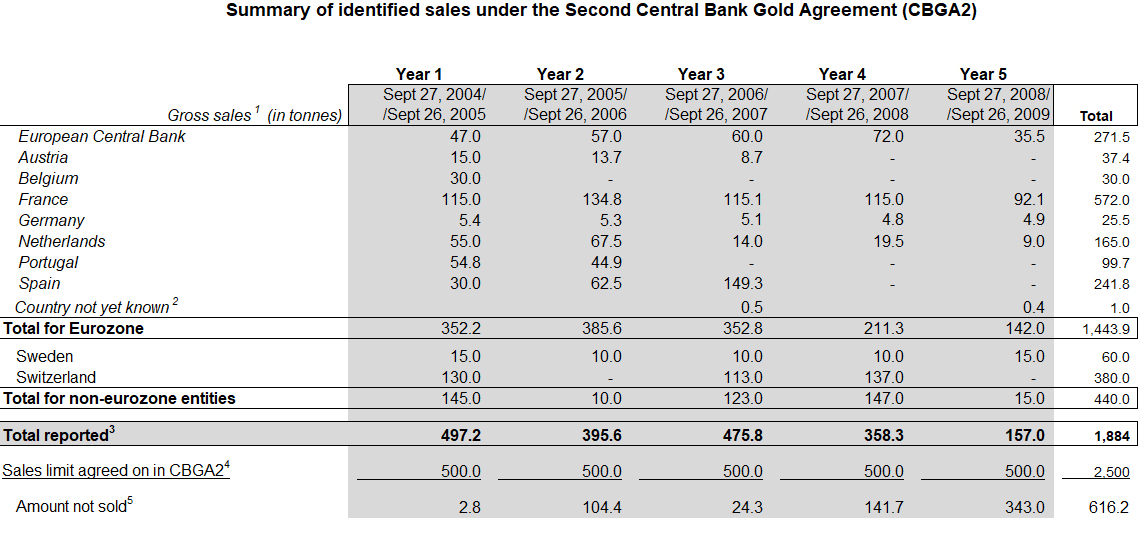

When CBGA2 was announced in March 2004, the Bank of England, a signatory to CBGA1, was noted for its absence, while the Bank of Greece, which had by then joined the Euro, also signed up to the CBGA consortium. Most importantly, in 2004 the cartel members upped the five-year sales program limit to 2500 tonnes, or 500 tonnes per year, while maintaining their outstanding gold lending and gold derivatives activities. Not very altruistic behavior from a central bank cartel which claims to have the best interests of the broader gold market in mind.

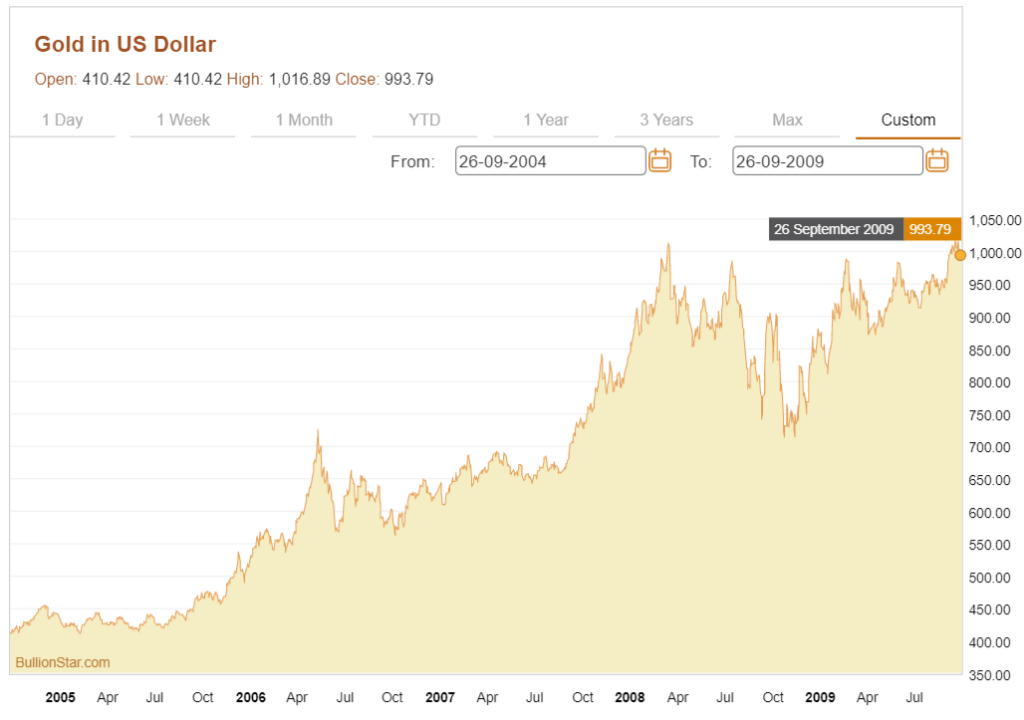

Between 2004 and September 2009, the ECB, France, and Switzerland were the three main gold sellers, with additional gold sales from Spain, the Netherlands, Sweden and Portugal. Over this second five year period, another 1900 tonnes of gold was claimed to be shifted out of these European central banks, front-loaded between 2004-2008. This was during a time when the US dollar gold price rose by 142%. Not a great time to sell gold, wouldn’t you agree. Unless the gold had already been disposed of years before.

The wording of the 2nd CBGA announcement also referred to “gold sales already decided and to be decided" and “already decided sales“. The question is – decided when? Ita a fact that all of the Swiss gold sales had already been decided before CBGA1 in the second half of the 1990s with the SNB initially using the BIS trading desk to square off the first tranches of ‘sales’. For example, see section “Gold Sales 2000 – 2008" of the Swiss National Bank (SNB) here:

“These gold sales programs were pre-planned in the 1990s by the SNB and elements within the Swiss Government even though the central bank at that time did not have authorisation to sell any gold. However, through a series of manoeuvres, this ‘sell gold’ contingent within the Swiss central bank and finance ministry axis succeeded in convincing the Swiss government and people to self-detonate their nation’s store of wealth."

Staying with the assumption that the second batch of gold sales had also already taken place in the 1900s, when did nearly 4000 tonnes of gold (2000 tonnes claimed to be sold between 2000 – 2004 in CBGA1 and 1900 tonnes claimed to be sold between 2004-2009 in CBGA2) actually flow out of western central bank gold vaults such as the gold vaults of the FRB in New York? The answer, according to analysis by the perceptive ‘Victor‘ was in the 1980s and 1990s. See section 3 and section 4 of “Central Bank Gold Leasing" here, in which he explains his theory:

“The central banks of the Eurosystem had sold and leased a substantial amount of gold as of 1999. Some of this gold had been allocated to new owners before 1999. But these central banks have not given up title to any of their gold ever since. All official gold sales by these central banks after 1999 were only on paper, closing an open lease and not demanding the gold back.“

Under this assumption, the nearly 4000 tonnes claimed to be sold by European central banks over 1999 to 2009 was not sold at all, since it had already left the vaults of those banks prior to 1999. Banks such as the Swiss National Bank, Banque de France, the Bank of England and Banco de España. I agree with Victor’s analysis and had noticed some of the same outflows such as a) the Swiss National Bank gold sales where the Swiss gold said to have been sold over 2000 – 2008 left the vaults of the Federal Reserve in New York in the 1990s, and b) the same patterns with the so-called on-market IMF gold sales of 2010.

@KoosJansen @VictorCleaner Swiss sold 250 MT in 2007/08. SNB say no FRBNY holdings then. Swiss withdrew most NY gold in 1990s, BEFORE sales

— Ronan Manly (@ronanmanly) December 8, 2014

@JamesGRickards I’ve established that IMF on-market 2010 gold sales (181 tonnes) used BIS as agent, with BIS buying entire order in advance

— Ronan Manly (@ronanmanly) August 4, 2015

When CBGA3 came into effect in September 2009, the central banks of Slovenia, Cyprus, Malta and Slovakia were listed as part of the cartel, having officially signed up at various time during CBGA2. But note that the minor central banks in Europe are only listed as CBGA signatories as they are members of the Euro, and are not in any way players in the 1990s gold outflows from the vaults. The main western central bank players in gold, as always, are France, Germany, Italy, the Netherlands, Belgium, Switzerland, and the United Kingdom. They rope in other western European central banks such as Austria, Spain and Portugal, as and when needed. The US monetary authorities, as always, have a hidden hand in proceedings.

The third CBGA also rolled the wording of the concerted programme of sales back to an annual quota of 400 tonnes, or another 2000 tonnes overall. CBGA3 was notable in that the member central banks went quiet leaving the selling to the International Monetary Fund (IMF). The CBGA3 announcement had even foreseen this when in August 2009 it said that:

“The signatories recognize the intention of the IMF to sell 403 tonnes of gold and noted that such sales can be accommodated within the above ceilings.“

The 403 tonnes of IMF gold being referred to here (actually 403.3 tonnes) is claimed by the IMF to have been sold in two sets of transactions, one of them referred to by the IMF as off-market sales which transferred 200 tonnes of gold to the Reserve Bank of India and another 22 tonnes to the central banks of Mauritius, Sri Lanka and Bangladesh, and a ‘top secret’ 181.3 tonnes (misleadingly called on-market sales). For full details of these sales see “IMF Gold Sales – Where ‘Transparency’ means ‘Secrecy’“. My theory is that this 181.3 tonnes of gold had been transferred to the Chinese central bank, and this looks like it happened in 2007-2008. Victor’s conjecture is that:

“The IMF leased gold during the financial crisis in 2007 and 2008 and allowed allocation of this gold to the borrower. Only later, in 2009 and 2010, this gold was officially sold and the lease closed in a paper transaction."

Note that the SNB ‘gold sales’ and the IMF ‘gold sales’ both used the services of the Bank for International Settlements (BIS), the central banks’ central bank, which is headquartered in Basel in Switzerland.

Philipp Hildebrand, ex-governor of the SNB, revealed in 2005 that the SNB had used the BIS as follows. This now looks like it was just a pricing exercise:

“At the outset, the SNB decided to use the BIS as its selling agent. Between May 2000 and March 2001, the BIS sold 220 tonnes on behalf of the SNB. For the first 120 tonnes, the SNB paid the BIS a fixed commission while the performance risk resided with the SNB. For the next 100 tonnes, the BIS agreed to pay the average price of the AM and PM London gold fixing plus a small fixed premium.“

Here again, you can also see the high level international coordination of central bank gold transactions between the European cartel and the IMF and the BIS, with the Washington Agreement (CBGA1) announced at the IMF annual meeting, and the IMF itself cropping up again in CBGA3, as well as the BIS being used to price the sales and square off gold loans. A lot of international coordination for a pet rock, wouldn’t you say?

The CBGA cartel central banks did not claim to sell any gold under CBGA3, (apart from about 26 tonnes which the Bundesbank sold for minting commemorative bullion coins), because the real sales connected to gold that had been lost in the 1990s had already been fictitiously accounted for in CBGA1 and CNGA2. Apart from the IMF gold sales trick, CBGA3 was just rolled out to make CBGA2 and CBGA1 look more credible. The CBGA3 announcement from September 2009 makes clear nothing was planned to be sold under CBGA by the European central banks:

“The gold sales already decided and to be decided by the undersigned institutions will be achieved through a concerted programme of sales over a period of five years"

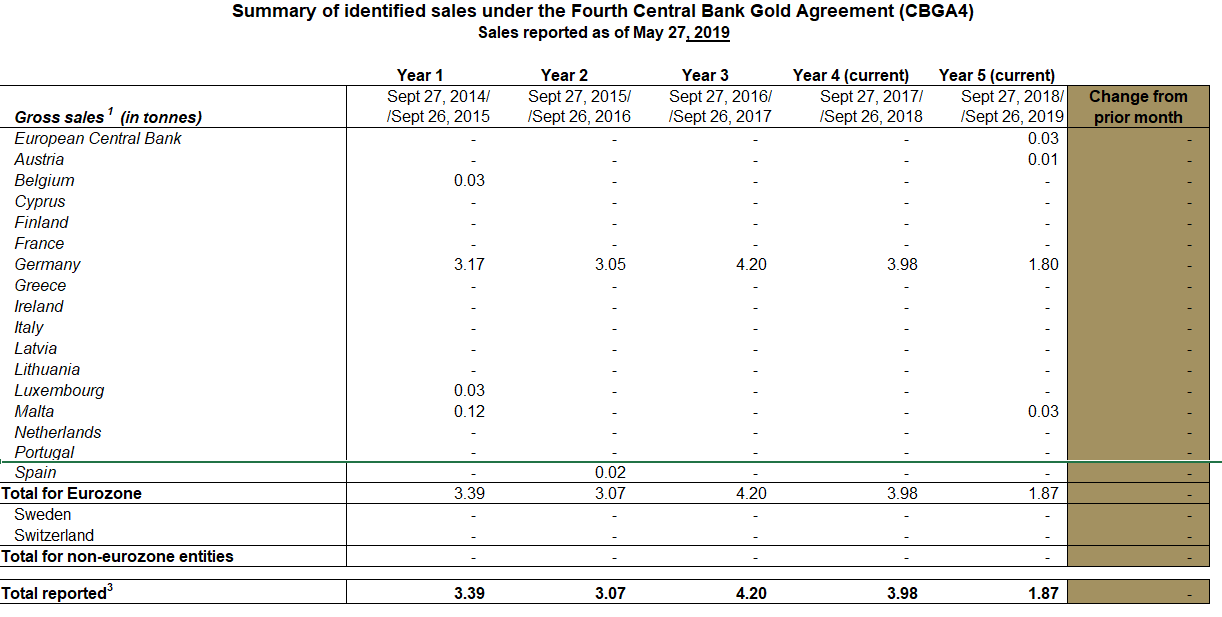

CBGA4

The announcement for the CBGA4 sleight of hand, which ran from September 2014, is reproduced below. This fourth wave CBGA also revealed that the cartel had no plans to sell any gold during that time. Again, the reason being that the cartel had already achieved over CBGA 1 and 2 what they had set to do, i.e. pretend to sell about 4000 tonnes of gold that had really exited the banks’ custodian vaults prior to 1999: The wording of CBGA4 is as follows:

- Gold remains an important element of global monetary reserves;

- The signatories will continue to coordinate their gold transactions so as to avoid market disturbances;

- The signatories note that, currently, they do not have any plans to sell significant amounts of gold;

- This agreement, which applies as of 27 September 2014, following the expiry of the current agreement, will be reviewed after five years.

- Overall, the only gold sold in CBGA4 was about 16 tonnes by the German Bundesbank, which again was for the minting of commemorative bullion coins.

CBGA4 also conveniently didn’t mention gold leasing arrangements or the use of futures and options. Presumably this meant that the gold leasing arrangements of the signatories remained at the levels that they had already been at during the three prior agreements.

One final point. With major gold buying continuing by the central banks of Russia, China, India, Turkey, and Kazakhstan etc, why then have the signatories to the CBGA agreements, i.e. the European central banks, not bought any gold at all over the 1999-2019 time frame or at least since the financial crisis of 2008-2009? Could the answer be that they have agreed among themselves not to?

That is an interesting theory, and one that has been sounded out by Mortymer of Twitter, that the CBGA signatories actually have a non-public annex to their agreements, which is that they have agreed in private not to buy any gold. Whether this is true, only history will reveal, but it certainty seems possible. It would not be the first time that G10 and Switzerland central banks agreed among themselves not to purchase gold. They did so in the mid 1970s as the 1976 IMF annual report (page 54) (large pdf file) makes clear:

“the countries in the Group of Ten and Switzerland also agreed that there be no action to peg the price of gold, and that the total stock of gold in the hands of the Fund and the monetary authorities of the Group of Ten and Switzerland would not be increased. These arrangements were open to adherence by other member countries, and are to be reviewed after two years. They entered into effect on February 1, 1976; in addition to the Group of Ten and Switzerland, adherence has been indicated by Portugal“

Conclusion

One very noteworthy line of the CBGA4 announcement, highlighted above, is that on 14 May 2014 when the ECB made its announcement, the central bank syndicate had the cheek to say that they would “continue to coordinate their gold transactions so as to avoid market disturbances.” The Swiss National Bank (SNB), which has autonomy to make its own statements, also issued a press release the same day with similar if not stronger wording, saying that:

“The participants in the gold agreement will continue to coordinate their gold transactions so as to avoid market turmoil.“

If you ponder what is actually meant by ‘market turmoil’ and ‘market disturbances’, you will note that gold as an asset class nearly always performs well in market turmoil and market disturbances! That’s why it’s a safe haven asset, because it has high liquidity and lacks counterparty risk and is a ‘go to’ asset in times of market turmoil. The very nature of gold is as a safe haven asset that performs well during market turmoil.

Then, why would these central banks want to prevent an outcome that is gold positive? The answer is that they don’t. What they really want is to use gold transactions or the threat of gold transactions and their gold supply overhang to prevent gold performing well, to prevent a high gold price, an outcome which they are terrified would induce market disturbances and market turmoil in the very central bank system of fiat currencies and bond and stock markets that they work fervently to protect.

The central bank cartel’s claim that the coordinated sales transactions are designed to avoid market turmoil is true, but not in the way they imply. It’s a hidden in plain sight nod to the fact that their threat of gold sales is to prevent market turmoil in every other asset class that they watch over. Just not the physical gold market.

Why, as Chris Powell of GATA points out, are the same central banks not concerned about market turmoil in the soybean market or other commodity markets? Just concerned about market turmoil and gold, the market turmoil that would be released by real price discovery in gold causing market turmoil across other asset classes.

The Swedish Riksbank also issued a press release on 14th May 2014 with the telling title of “Continued regulation of gold sales". The wording of that statement was even more brazen, claiming:

“The previous agreements have been successful and have contributed to increased transparency regarding the central banks’ gold sales."

How ironic, given the real motives and background of the CBGA, which has been explained above. And increased transparency? The fact of the matter is that there was no transparency whatsoever in any of the claimed central bank sales, for example, as regards venue used, executing broker, identity of counterparty, transaction date, settlement date (or deferred settlement date), method of sale, information on whether bullion was actually transferred, publication of weight lists, and other sales modalities. And astonishingly, the IMF on-market gold sales remain classified.

None of this seems to matter though to the court lackey mainstream financial media and the grovelling World Gold Council which interpret the agreements in the way that the central banks wanted them to be interpreted, consistently failing to ask any probing questions or conduct any probing analysis.

So will there be a new central bank gold agreement announced in the next few weeks? Word on the street is that large institutions are being quizzed by the obedient World Gold Council and being asked if they in favour of a new CBGA or not. Given that the whole CBGA scheme was a cover whose main purpose has already been achieved, there is no compelling logic for a fifth CBGA, except of course unless there have been further physical gold flows out of western central banks which need to be squared off in the books.

Now that the gold price in US dollars has broken out to a 5 year high, will the cartel put out a press release with suitable wording to temper the gold market’s new found enthusiasm?

A whole lot of work for a Pet Rock. But a Pet Rock that Western central banks are terrified has the potential to cause market turmoil for their precariously built fiat monetary system.

Popular Blog Posts by Ronan Manly

How Many Silver Bars Are in the LBMA's London Vaults?

How Many Silver Bars Are in the LBMA's London Vaults?

ECB Gold Stored in 5 Locations, Won't Disclose Gold Bar List

ECB Gold Stored in 5 Locations, Won't Disclose Gold Bar List

German Government Escalates War On Gold

German Government Escalates War On Gold

Polish Central Bank Airlifts 8,000 Gold Bars From London

Polish Central Bank Airlifts 8,000 Gold Bars From London

Quantum Leap as ABN AMRO Questions Gold Price Discovery

Quantum Leap as ABN AMRO Questions Gold Price Discovery

How Militaries Use Gold Coins as Emergency Money

How Militaries Use Gold Coins as Emergency Money

JP Morgan's Nowak Charged With Rigging Precious Metals

JP Morgan's Nowak Charged With Rigging Precious Metals

Hungary Announces 10-Fold Jump in Gold Reserves

Hungary Announces 10-Fold Jump in Gold Reserves

Planned in Advance by Central Banks: a 2020 System Reset

Planned in Advance by Central Banks: a 2020 System Reset

Surging Silver Demand to Intensify Structural Deficit

Surging Silver Demand to Intensify Structural Deficit

Ronan Manly

Ronan Manly 6 Comments

6 Comments