BullionStar Blogs

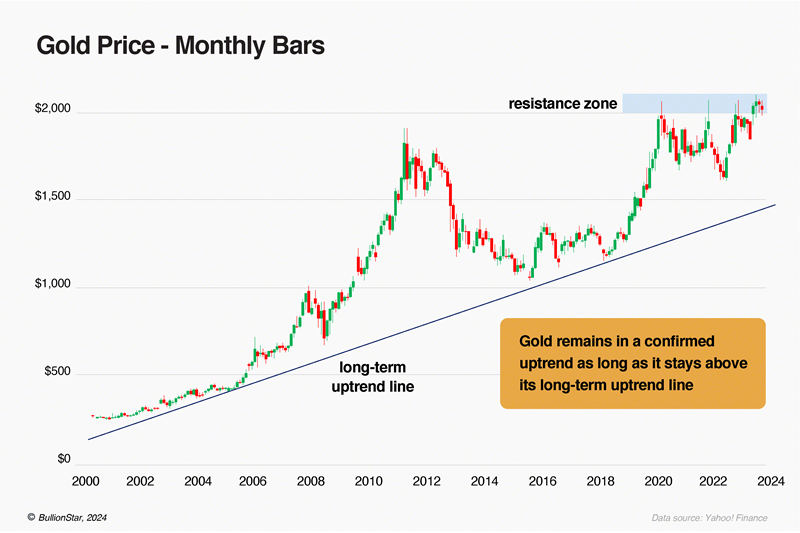

BullionStar is renowned for presenting original research and expertise

covering the most important trends in the precious metals markets.

Customer Support Languages

BullionStar is renowned for presenting original research and expertise

covering the most important trends in the precious metals markets.

Buy from BullionStar

Sell to BullionStar

Gold

Silver

Platinum

| We use cookies to enhance the user experience and to analyse traffic. Cookies are also used for the purpose of handling our system and services. By using our website, you accept that cookies are used. You can change the usage of cookies in your browser. The usage of cookies and the collection of customer information by BullionStar is guided by our Privacy Policy. |

OK

|