ScotiaBank Sells Its New York COMEX Vault

On Monday 1 March, CME Group, which runs COMEX, made a short announcement saying that long time COMEX approved gold and silver vault operator, Bank of Nova Scotia was withdrawing its New York vault from being COMEX approved and that the withdrawal was ‘effective immediately’.

The full text of the release, titled “Withdrawal of Regularity for Gold, Silver, Platinum, and Palladium” is as follows, and can also be seen at this link here:

“Notice herby is given that the New York Mercantile Exchange, Inc. (“NYMEX”) and Commodity Exchange, Inc. (“COMEX”) (collectively, the “Exchanges”) received a request from The Bank of Nova Scotia to voluntarily withdraw their approved gold, silver, platinum, and palladium regularity at their Jamaica, NY facility. Manfra, Tordella & Brookes, Inc. will assume responsibility for the registered and eligible material at this facility effective immediately.

This withdrawal is effective immediately.”

Beside JFK Airport

For those who don’t know, the Scotia vault, owned by Scotia Mocatta Depository (SMD), is located right beside JFK Airport, at “International Airport Center, 230-59 International Airport Center Boulevard, Building C, Rockaway Blvd, Jamaica, New York 11413”, the same location as the Agility Logistics center, and can be seen here and here.

Scotia moved to this facility beside JFK Airport in 2006 from a vault facility that it had been using since late 2001 under 26 Broadway in Manhattan, an old Rockefeller building. That vault facility under 26 Broadway was the former Iron Mountain Depository Corporation (IMD) vault which Scotia had acquired when The Bank of Nova Scotia took over IMD in 1997.

However, prior to September 2001, Scotia’s COMEX approved precious metals vault had been in a sub-basement under 4 World Trade Centre, which it had taken over from Swiss Bank Corporation in the 1990s. Prior to the WTC implosions, WTC 4 was the home of the COMEX and NYMEX trading floors, as well as the trading floors of the New York Board of Trade (NYBOT), the Coffee, Sugar and Cocoa Exchange (CSCE) and the New York Cotton Exchange (NYCE)

After 4 World Trade Centre collapsed on September 11 2001 following the WTC 1 and WTC 2 (and WTC 7) buildings’ explosions and implosions (during which notably COMEX gold was unbelievably being trucked out of tunnels at the same time), Scotia moved its COMEX approved vault back to the 26 Broadway vault in late 2001, and remained there until 2006.

Manfra, Tordella, and Brookes, also known as MTB, is a New York based bullion dealer which also runs a COMEX approved precious metals vault in Manhattan, in the International Gem Tower building at 50 West 47th Street, in midtown Manhattan. Since 2000, MTB has been part of the Swiss MKS PAMP group.

On the same day, 1 March 2021, that Scotia Mocatta withdrew its vault from being COMEX approved, MTB, and it parent company, the Swiss based MKS PAMP group, both made announcements on their websites that MTB had:

“completed the strategic acquisition of a leading North American financial institution’s COMEX (CME) approved depository and logistics center” including a “world class 15,000 square foot secure facility” that will give them “proximity to major international and domestic logistics hubs [beside JFK airport], additional vaulting capacity [Scotia’s vaults], and experienced staff”.

The acquisition, said MTB / MKS PAMP, helps offer “enhanced depository and fulfillment services to COMEX warrant holders, financial institutions, industrial, and bullion clients”.

See the MKS PAMP announcement here, and the identical MTB announcement here.

In effect, without stating the name of Scotia, MTB / MKS PAMP confirmed that MTB has taken over the Scotia Mocatta COMEX approved vault located in International Airport Center, 230-59, Building C, beside JFK airport.

Scotia Metal Transfers to MTB

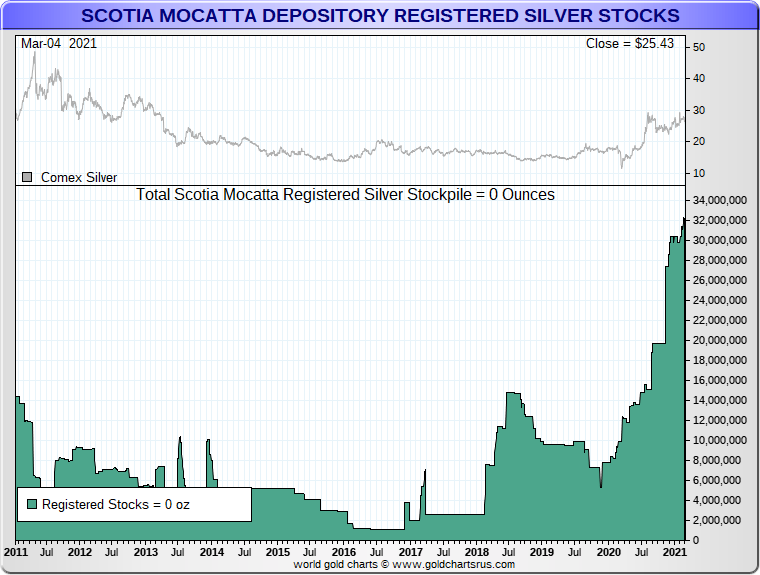

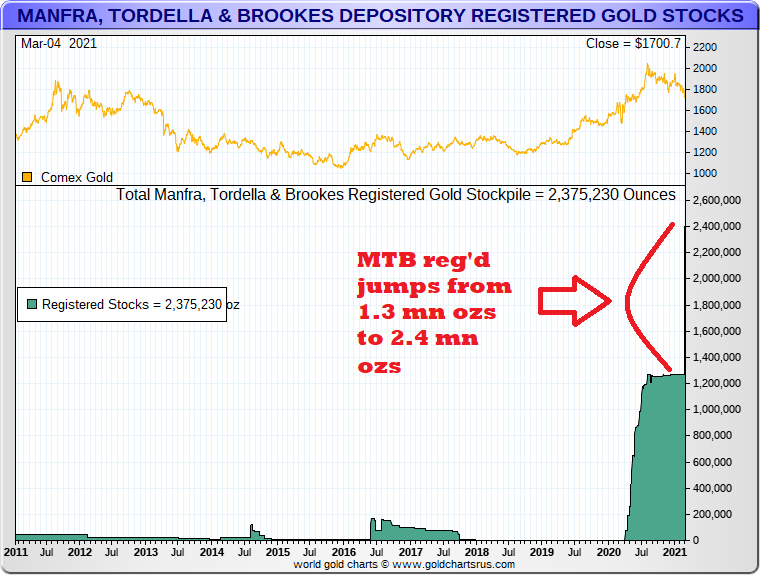

Anyone who regularly looks at the COMEX daily “Warehouse and Depository Stocks” reports for gold, silver, platinum and palladium on the CME Group (COMEX) website will have also noticed that not only did MTB take over Scotia Mocatta’s New York COMEX approved vault in the first week of March, but, MTB also took over the custody of all the COMEX registered and COMEX eligible gold, silver, platinum and palladium stock and inventory that were being stored in Scotia’s COMEX vault beside JFK.

This was evident from the COMEX gold, silver and platinum / palladium stock reports for Report Date Wednesday 3 March (Activity Date Tuesday 2 March), where the listing and metal holdings under the “THE BANK OF NOVA SCOTIA” suddenly disappeared, and the listing and metal holdings under “MANFRA, TORDELLA & BROOKES, INC” increased by the amount of metal that had been reported previously under Scotia.

As a reminder, in COMEX parlance, ‘Registered’ precious metal bars have vault warrants attached and can be used to settle COMEX futures contracts. ‘Eligible’ metal is just any metal that happens to be in a COMEX approved vault which is in the form of a precious metals bar which is acceptable for COMEX delivery. Eligible metal does not have to have anything to do with COMEX trading, and a lot of the time doesn’t have anything to do with COMEX trading.

The transfers from Scotia to MTB were most pronounced in silver, where a huge 32,301.490.91 ozs (or 1004 tonnes) of silver which had been in the registered category under Scotia came into the registered category of MTB. Prior to the transfer, MTB was reporting only 1,233,649.98 ozs in registered, so the transfer from Scotia gave MTB a new Registered total of 33,535,140.89 ozs, or 27 times more silver than it previously held. This was the highest Registered silver holding of any COMEX approved vault operator, even ahead of JP Morgan’s claimed 32.5 million ozs holding.

By 3 March, MTB had 668,437 ozs of silver in eligible and 32.26 million ozs of silver in registered for a total of 33.93 millon ozs.

By 4 March MTB received in another 579,290 ozs into eligible, saw a massive 4.48 million move from registered to eligible (someone doesn’t want their silver under warrant), and had a total of 28,782,469 ozs in Registered, and 5,730,255 ozs in eligible, for a total of 34.51 million ozs overall. The Scotia transfers now put the MTB vaults in 2nd position of Registered COMEX silver holdings (just behind JP Morgan) and in 4th position of total COMEX silver holdings behind JP Morgan, Brinks and CNT.

In gold, prior to the transfers, MTB had about 1.265 million ozs of gold in the registered category, with 20,000 in eligible, while Scotia had about 1.15 million ozs in registered and a small amount in eligible. Following the transfers, MTB now has about 2.4 million ozs in registered and about 60,000 ozs in eligible. So the MTB gold listing on the COMEX gold inventory report has increased by about 87%.

Platinum and palladium in the Scotia vault has also been added to the MTB totals and the latest figures for MTB now have a total of 112,378 ozs of platinum, nearly all of which is in registered, and 9,676 ozs of palladium (all in registered).

You can see the most recent COMEX inventory gold, silver and platinum / palladium holdings in Excel links on a COMEX webpage here.

An important point to note here is that the gold, silver, platinum and palladium that were in Scotia’s Queen’s vault beside JFK airport are probably still in the Scotia vault (with the vault now owned by MTB). It would have been logistically illogical to move all the metal in the Scotia vault, to the MTB vault in midtown Manhattan.

So basically, it looks to be a case of the COMEX reports having just reclassified all metal that was held in the Scotia vault and now reporting it under “Manfra, Tordella, and Brookes” (MTB) along with the metal in MTB’s original vault in Manhattan. This means that it will not be possible to know how much of the reported metal listed under MTB is in Manhattan, and how much is in the vault beside JFK airport.

Scotia Mocatta – A Slow Motion Car Crash

For those who may be having déjà vu about Scotia Mocatta previously withdrawing from the precious metals markets, you would be forgiven, as admittedly, Scotia’s withdrawal has been going on for what seems like years now, and can only be described as a slow motion car crash. For financial reporters in Reuters and Bloomberg, Scotia exiting the gold and silver markets is the “gift that keeps on giving”, year after year, because it never seem to end. This is because, like an octopus, Scotia has been intertwined into precious metals markets all around the world for decades and decades, from the London gold and silver markets to New York (COMEX) to Toronto (its Headquarters) and to as far afield as India and Dubai and China.

As you can see from its vaulting operation, Scotia was one of the key players in COMEX precious metals for a long long time. But even following the New York vault sale, Scotia is still involved with COMEX, with Scotia Capital (USA) Inc still being a clearing firm on COMEX as can be seen on the clearing member firm list here, and also on the COMEX delivery report (Issues and Stops) here.

But that’s only part of the larger Scotia picture. Because Scotia continues also to be one of the lynchpins in the London gold and silver markets along with the likes of HSBC and JP Morgan, and has a long history of running the LBMA along with HSBC and JP Morgan.

In London Scotia, was one of the 3 banks that ran the cartel like London Silver Fixing (along with HSBC and Deutsche Bank), and the London Gold Fixing (along with Barclays, HSBC, SocGen and Deutsche Bank). This bullion bank cartel used the private companies London Gold Market Fixing Limited and London Silver Market Fixing Limited to run those daily benchmark auctions. When in 2014 and 2015 the old London Gold and Silver fixes were buried by the London Bullion Market Association (LBMA) and resurrected in the smoke and mirrors replacements of the LBMA Gold Price and the LBMA Silver Price, Scotia was one of the first direct participants in of each of the new fixes.

The trigger for Scotia’s withdraw from the precious metals markets goes back all the way to early 2015 (or even earlier) when the US Department of Justice (DoJ) announced that it was investigating whether the Bank of Nova Scotia and other investment banks were manipulating gold and silver prices. Spoiler: They were.

While this isn’t an article about Scotia’s criminal activities in manipulating gold and silver prices, a quick recap is in order so as to give some flavor as to who we are dealing with when we refer to the Scotia on the COMEX and in the LBMA.

According to Bloomberg in February 2015:

“At least 10 banks, including Bank of Nova Scotia, Barclays Plc, JPMorgan Chase & Co., and Deutsche Bank AG are being probed by the Justice Department’s antitrust division, said one the people, who asked not to be named because the matter is confidential.”

Soon after that, investors filed class action suits in New York courts against London Gold Market Fixing Limited and London Silver Market Fixing Limited, of which Scotia was one of the defendants. See a 2016 article by Allan Flynn for some background – “How to Trigger a Silver Avalanche by a Pebble: “Smash(ed) it Good".

By June 2018, Reuters was reporting that Scotia was to “scrap half its metals business”.

“Scotia pulling back from metals financing

Bank is largest lender to precious metals industry

Cuts heaviest in Europe, no decision yet on Asian business

Scotia still trying to sell parts of metals business”

“Scotia’s pullback comes after a strategic review of Mocatta began in 2016 following a string of lawsuits related to the manipulation of gold and silver benchmarks and dissatisfaction with performance.

It also follows a failed attempt to sell the business.”

By April 2020, that ‘half’ of the Scotia precious metals business had turned into a full 100% sale, with Reuters reporting that “Scotiabank to close its metals business”,

“’Scotia had a global call with all its metals staff and said it was shutting down its metals business,’ said one of the sources.

‘The plan is to unwind the metals business,’ said another.”

But even then in April 2020, Scotia was still a market making member of the LBMA, and a direct participant in the LBMA Gold Price and LBMA Silver Price auctions, and a member of the London bullion bank cartel unallocated gold and silver clearing company, the London Precious Metals Clearing Limited (LPMCL).

Scotia’s Gold and Silver Price Manipulation

Fast forward to August 2020, and the US Department of Justice announced that Bank of Nova Scotia (Scotiabank) had entered into a resolution with the DoJ: “to resolve criminal charges related to a price manipulation scheme involving thousands of episodes of unlawful trading activity by four traders in the precious metals futures contracts markets”, and to pay more than more than US$ 60 million in criminal fines. A flavor of the illegal activities of Scotia in that case is as follows:

“’For over eight years, Scotiabank traders placed thousands of orders for precious metals futures contracts in an attempt to manipulate prices for their own and the bank’s benefit and to deceive other market participants,’ said Chief Robert A. Zink of the Justice Department’s Criminal Division, Fraud Section.”

“’Today, Scotiabank has admitted to their role in a massive price manipulation scheme aimed at falsely manufacturing the prices of precious metals futures contracts to serve the bank’s best interests,’ said Assistant Director in Charge William F. Sweeney Jr. of the FBI’s New York Field Office. ‘The bank’s actions were designed to lead others to trade in ways they never would have without what was believed to be legitimate market activity.’”

Now fast forward to 1 March 2021, the same day as the COMEX and MTB / MKS PAMP vault announcements, and Wells Fargo announces that “it has expanded its precious metals trading business, filling gaps in the market left by the withdrawal of Bank of Nova Scotia (Scotiabank)”.

But not so fast. Did anyone tell Wells Fargo that as of 08 March 2021, Scotia is still a market making member of the LBMA in gold and silver, still a member of the fractionally backed paper gold and silver trading engine, the London Precious Metals Clearing Limited (LPMCL), and still involved in LBMA precious metals vaulting in London even though it doesn’t have its own vault:

“those clearing members without their own vault operations – Scotiabank and UBS – utilise their accounts with one of the LBMA custodians or the Bank of England (BoE)”

And that’s only gold and silver, In addition, Scotia is still a marketing making member of the London Platinum and Palladium Market (LPPM).

How’s that for exiting the precious metals markets?

This will gives the likes of Reuters’ Peter Hobson and Bloomberg’s Eddie van der Walt plenty of future material to write articles such as “Scotia Mocatta still withdrawing from the precious metals markets (Part 6)“.

It’s as if Scotia hasn’t really exited the precious metals markets at all. Just discreetly sold its precious metals vault in New York to another party and quietly slipped out the COMEX door, while transferring over 30 million ozs of silver to MTB / MKS PAMP, as the #SilverSqueeze intensifies.

Popular Blog Posts by Ronan Manly

How Many Silver Bars Are in the LBMA's London Vaults?

How Many Silver Bars Are in the LBMA's London Vaults?

ECB Gold Stored in 5 Locations, Won't Disclose Gold Bar List

ECB Gold Stored in 5 Locations, Won't Disclose Gold Bar List

German Government Escalates War On Gold

German Government Escalates War On Gold

Polish Central Bank Airlifts 8,000 Gold Bars From London

Polish Central Bank Airlifts 8,000 Gold Bars From London

Quantum Leap as ABN AMRO Questions Gold Price Discovery

Quantum Leap as ABN AMRO Questions Gold Price Discovery

How Militaries Use Gold Coins as Emergency Money

How Militaries Use Gold Coins as Emergency Money

JP Morgan's Nowak Charged With Rigging Precious Metals

JP Morgan's Nowak Charged With Rigging Precious Metals

Hungary Announces 10-Fold Jump in Gold Reserves

Hungary Announces 10-Fold Jump in Gold Reserves

Planned in Advance by Central Banks: a 2020 System Reset

Planned in Advance by Central Banks: a 2020 System Reset

Surging Silver Demand to Intensify Structural Deficit

Surging Silver Demand to Intensify Structural Deficit

Ronan Manly

Ronan Manly 5 Comments

5 Comments