Paulson’s Shareholders Gold Council Finally Launches

In September 2017, news emerged of a plan to launch a broad-based “Shareholders’ Gold Council" to address poor shareholder returns and under-performance in the gold mining sector. This plan was spearheaded by well-known hedge fund Paulson & Co and its founder John Paulson. Initially earmarked for a launch in June 2018 or early July, BullionStar covered this new Council in detail in a late June article titled “The Shareholders Gold Council (SGC) – “Just don’t mention the Gold Price”.

The aims of the new Council include shareholder representation on company boards, company accountability to shareholders, the removal of poor performing CEOs and board members, and the alignment of CEO compensation with share price performance. All of these aims, it should be noted, seek to reduce the cost base of miners and have little effect on top line revenue or the price that a gold mining company can sell its output for.

The new shareholder coalition will also make recommendations on board appointments, CEO pay, company takeovers, and make recommendations on AGM and EGM voting decisions, similar to the myriad reports that are churned out daily by proxy advisory firms Institutional Shareholder Services(ISS) and Glass, Lewis and Co.

16 Members, 4 of which are Anonymous

Throughout the summer, there was no news flow whatsoever about the new Council and the launch appeared delayed. The existence of such a delay was officially confirmed this week when Bloomberg ran a story confirming that the grouping has just been launched. The delay, according to the head of the new Council, Christian Godin, was “because of compliance issues and housekeeping challenges dealing with 16 institutions and back-office teams“. Godin joins to head up the Council from Canadian investment management company Montrusco Bolton Investments.

According to Bloomberg’s story which is titled ‘Paulson Joined by 15 Investors in Council to Oversee Gold Miners’, the new Shareholder’s alliance, in addition to founding hedge fund Paulson & Co, includes institutional and hedge fund firms Delbrook Capital, Tocqueville Asset Management, Livermore Partners, Kopernik Global Investors, Apogee Global Advisors and Equinox Partners. Other named members of the alliance are Adrian Day Asset Management, Swiss based AMG Fondsverwaltung AG, Equity Management Associates, Luxembourg based La Mancha (Naguib Sawiris), and privately-held Sun Valley Gold LP.

According to Bloomberg, there are also four institutional members of the new Council who wish to remain anonymous, bringing the total number of institutions involved to sixteen. Previous coverage of the Shareholders Gold Council mentioned names such as Vanguard, State Street Global Advisors, Blackrock and Van Eck, so these could be some or all of the four that do not want their identities revealed. This preference for anonymity by four institutional shareholders of gold mining companies is itself worrying, because it begs the question that if they haven’t even got the courage to publicly identify themselves, then how committed and motivated are they really to effect change within the gold mining companies that they invest in.

Don’t Mention the Gold Price

But as detailed in BullionStar’s article in June, there is one topic that this new Shareholders Gold Council could research and investigate, but has blatantly chosen not to. This is the issue of the gold price, an issue that goes to the heart of a gold mining company’s operations and the performance of its share price, including as we explained in June:

“how that gold price is discovered and established in today’s gold markets, whether that gold price is manipulated by bullion bank traders, and whether that gold price is subject to central bank interventions that attempt to control and stabilize it."

The gold price as it relates to the health and performance of gold mining companies and their shares (common equity) is also a topic that is of interest to the Gold Anti-Trust Action Committee (GATA). GATA is a US-based educational and civil rights organization that was established 20 years ago to, in its own words “expose, oppose, and litigate against collusion to control the price and supply of gold and related financial instruments“.

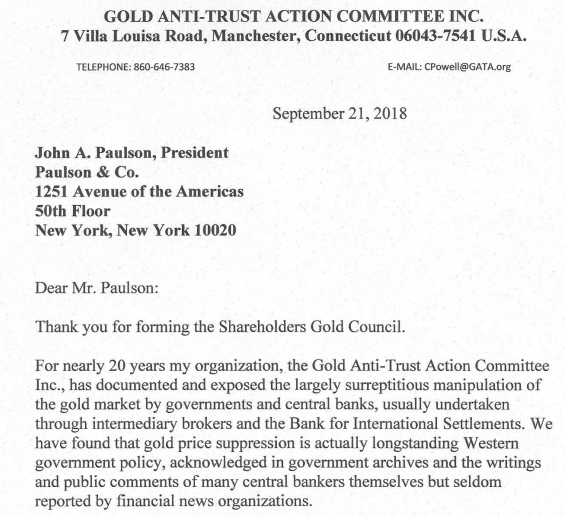

GATA has even gone so far as to write a letter to John Paulson at the Paulson & Co headquarters in Manhattan, requesting that it be allowed to make a presentation to the Shareholders Gold Council “about the longstanding policy of Western governments and central banks to intervene in the gold market surreptitiously to suppress the monetary metal’s price“. GATA’s letter, dated 21 September 2018, can be read in pdf format here.

GATA’s letter to Paulson refers to:

“the largely surreptitious manipulation of the gold market by governments and central banks, usually undertaken through intermediary brokers and the bank for International Settlements."

While making references to the fact that GATA has:

“found that gold price suppression is actually longstanding Western government policy, acknowledged in government archives and the writings and public comments of many central bankers themselves but seldom reported by financial organizations“.

Conclusion

As someone who has found some of the government archives, writings and comments of central bankers that GATA refers to above, I would have to agree with the statements in GATA’s letter to Paulson. That is why it will be very interesting to see how John Paulson responds to the GATA letter, if indeed he responds at all.

GATA has also asked Paulson if it can join the Shareholders Gold Council, another possibly tall order for Paulson’s new grouping to fulfill, especially since the new coalition is already opaque with four large institutional members not having the courage to publicly put their names on record.

So, will this Wall Street centric New Shareholder’s Gold Council investigate the gold price as part of its remit? Or will it, like its similarly named World Gold Council, not bother to really care what goes on in the central bank gold world. It remains to be seen, but the best answer currently would be “Don’t hold your breath!"

Popular Blog Posts by Ronan Manly

How Many Silver Bars Are in the LBMA's London Vaults?

How Many Silver Bars Are in the LBMA's London Vaults?

ECB Gold Stored in 5 Locations, Won't Disclose Gold Bar List

ECB Gold Stored in 5 Locations, Won't Disclose Gold Bar List

German Government Escalates War On Gold

German Government Escalates War On Gold

Polish Central Bank Airlifts 8,000 Gold Bars From London

Polish Central Bank Airlifts 8,000 Gold Bars From London

Quantum Leap as ABN AMRO Questions Gold Price Discovery

Quantum Leap as ABN AMRO Questions Gold Price Discovery

How Militaries Use Gold Coins as Emergency Money

How Militaries Use Gold Coins as Emergency Money

JP Morgan's Nowak Charged With Rigging Precious Metals

JP Morgan's Nowak Charged With Rigging Precious Metals

Hungary Announces 10-Fold Jump in Gold Reserves

Hungary Announces 10-Fold Jump in Gold Reserves

Planned in Advance by Central Banks: a 2020 System Reset

Planned in Advance by Central Banks: a 2020 System Reset

Surging Silver Demand to Intensify Structural Deficit

Surging Silver Demand to Intensify Structural Deficit

Ronan Manly

Ronan Manly 0 Comments

0 Comments