GLD 10-K Omits BoE Gold Holdings Data, CFO Resigns

The latest SPDR Gold Trust (GLD) annual 10-K financial report and statement has recently been submitted to the US Securities and Exchange Commission (SEC) by GLD Sponsor, World Gold Trust Services (WGTS), the fully-owned subsidiary of the World Gold Council.

Alarm Bells

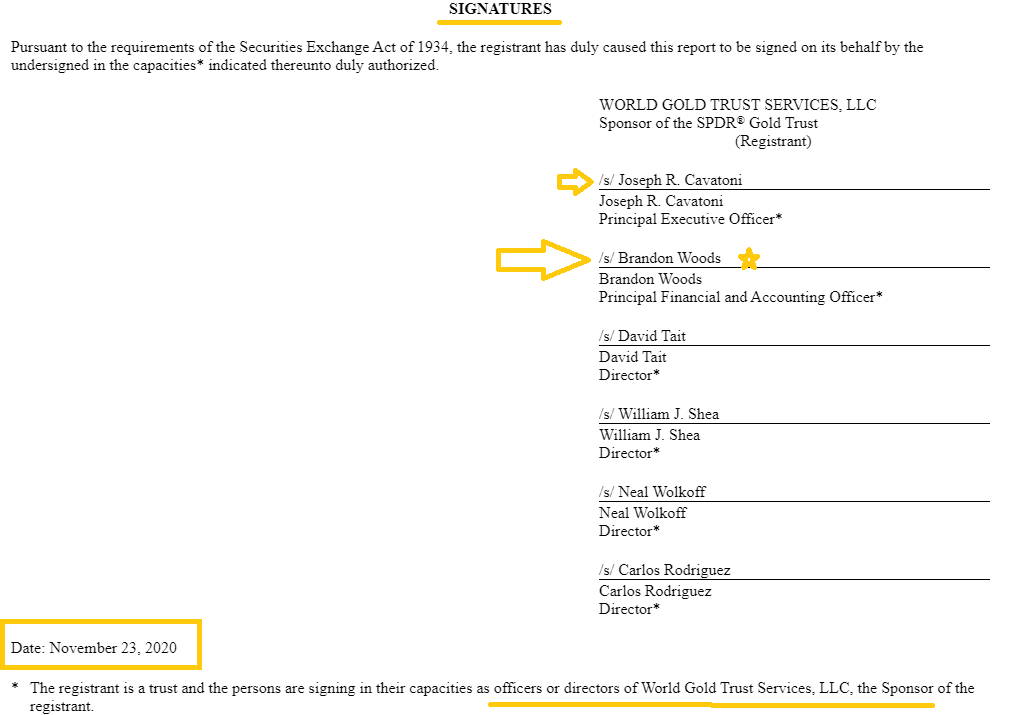

Covering the financial year to 30 September 2020, this GLD 10-K should be raising alarm bells at the SEC given that the Principal Financial and Accounting Officer (CFO) who signed off on it, Brandon Woods, had only been in the CFO position at the GLD Sponsor for one day prior to GLD’s financial year-end. Woods was appointed on 29 September 2020.

To put it another way, the GLD Trust Sponsor’s previous Principal Financial and Accounting Officer (CFO), Laura Melman, resigned from her CFO role at WGTS on 29 September 2020, one day prior to GLD’s 30 September financial year-end.

If anyone knows of a CFO joining a high-profile listed ETF Trust one day prior to financial year-end and then signing off on the annual accounts, please let us know. Likewise, for a CFO of a high-profile listed ETF Trust leaving one day prior to financial year-end and not waiting for financial year-end. None of this, to say the least, is normal.

The World Gold Council would have you believe that everything was hunky-dory, with the 8-K (departure and appointment) form submitted by WGTS to the SEC on 29 September 2020 stating that Melman’s “departure did not arise from any disagreement on any matter relating to the operations, policies or practices of the SPDR® Gold Trust”. However, it also said that Woods’ appointment on 29 September was “effective immediately”, i.e. one day before GLD’s financial year end.

Why did the CFO resign one day before financial year end and not put her name to the annual 10-K submission to the SEC? That fact that the 8-K form was rushed out on 29 September appointing the new CFO “effective immediately” shows that the departure of Melman was abrupt, and that it triggered the rushed appointment of Woods on the same day “effective immediately”.

The full 8-K statement, which stated the following, can be seen here:

“On September 29, 2020, Laura Melman ceased to serve as Principal Financial and Accounting Officer of World Gold Trust Services, LLC, or WGTS, the Sponsor of the SPDR® Gold Trust. Her departure did not arise from any disagreement on any matter relating to the operations, policies or practices of the SPDR® Gold Trust.

On September 29, 2020, WGTS appointed Brandon Woods to serve as Principal Financial and Accounting Officer of WGTS, effective immediately.”

Perhaps in the world of fly-by-night companies, CFOs depart and appear a day before financial year-end, but this is not the norm when applied to the world’s largest gold-backed Exchange Traded Fund (ETF), a Trust which as a reminder, on 30 September 2020 claimed to hold 40.8 million ounces of gold worth US$ 77 billion with custodian HSBC Bank plc in London, and a Trust whose only asset is “allocated gold bullion”.

While a BullionStar article on 7 October this year pointed out the Melman-Woods switcheroo in the wider context of the fact that the GLD Sponsor has had a staggering six CFOs since 2014 (see “Revolving Door at the SPDR Gold Trust – 6 CFOs since 2014”, that was before the publication of the latest GLD 10-K report, a report that leaves out some critical information about the GLD Trust’s one and only asset, i.e. its gold holdings.

10-K withholds Crucial BoE holdings data

Regular readers may recall that this year from April onwards, the SPDR Gold Trust began holding substantial amounts of gold at the Bank of England vaults in London, the Bank of England being one of GLD’s subcustodians. As a reminder, normally all of GLD’s gold is held in the London vaults of the GLD custodian HSBC.

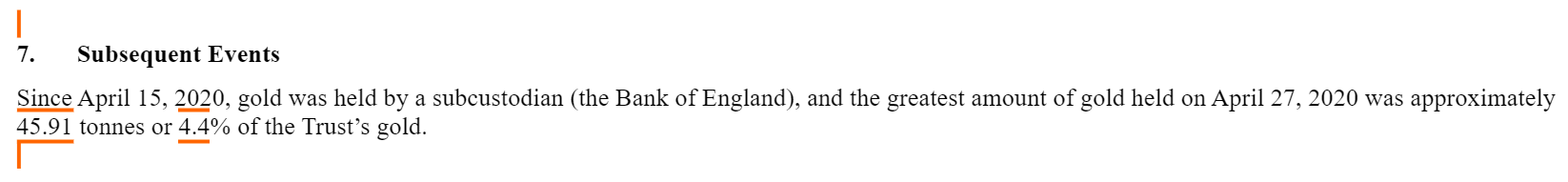

Specifically, the SPDR Gold Trust 10-Q (quarterly report) for Q1 2020, submitted to the SEC on 8 May, revealed in precise language and data that:

“Since April 15, 2020, gold was held by a subcustodian (the Bank of England), and the greatest amount of gold held on April 27, 2020 was approximately 45.91 tonnes or 4.4% of the Trust’s gold.”

This statement was important, we explained, as it implied that during that time, there wasn’t enough gold in the HSBC vault in London to fulfill SPDR Gold Trust basket creation requests from GLD Authorized Participants (APs), and that gold which was ultimately borrowed central bank gold at the Bank of England was being used as a source of GLD gold holdings. Furthermore, the need to tap gold at the Bank of England at that time implied physical gold float shortages in the London physical gold market during the London lockdown. See 13 May BullionStar articles “Amid London gold turmoil, HSBC taps Bank of England for GLD gold bars” for full details.

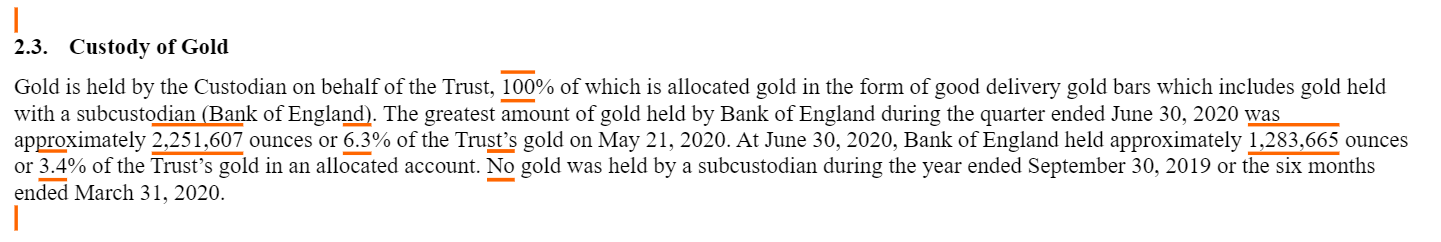

Following this on 10 August, SPDR Gold Trust submitted to the SEC its 10-Q quarterly report for Q2 2020, which revealed that not only did the GLD continue to hold gold bars at the Bank of England during the April to June period, but that GLD gold holdings in the Bank of England vaults had risen to 70 tonnes by 21 May 2020. Specifically, again in precise language and data, the Q2 10-Q stated that:

“The greatest amount of gold held by Bank of England during the quarter ended June 30, 2020 was approximately 2,251,607 ounces [70 tonnes] or 6.3% of the Trust’s gold on May 21, 2020.

At June 30, 2020, Bank of England held approximately 1,283,665 ounces [40 tonnes] or 3.4% of the Trust’s gold in an allocated account.”

These numbers were interesting because the above statements merely refer to total quantities of gold as of various dates and do not say anything about whether the statements refer to the same pile of gold bars being held at all times.

And given that HSBC is obliged to “use commercially reasonable efforts promptly to transport the gold from the subcustodian’s vault to the Custodian’s vault”, the 10-Q statements support a scenario under which, during April, May and June, the SPDR Gold Trust could have sourced up to 150 tonnes of gold at the Bank of England, transferring 110 tonnes to its own vaults by 30 June, and still have 40 tonnes at the Bank of England as of 30 June.

See BullionStar article dated 14 August “GLD continues to source gold at the Bank of England, at an escalating rate” for full details.

Turning to the SPDR Gold Trust latest 10-K (annual financial report for the year to 30 September 2020), and remembering that a 10-K is much more detailed than a 10-Q (quarterly report), we should therefore expect to see references in the GLD 10-K about the quantity of GLD gold held at the Bank of England during the financial year to 30 September 20202, in as precise and as detailed language as those stated in the earlier 10-Q reports. But lo and behold, we don’t. Instead what we find is concealment of details and a lack of numerical data about the GLD gold held at the Bank of England.

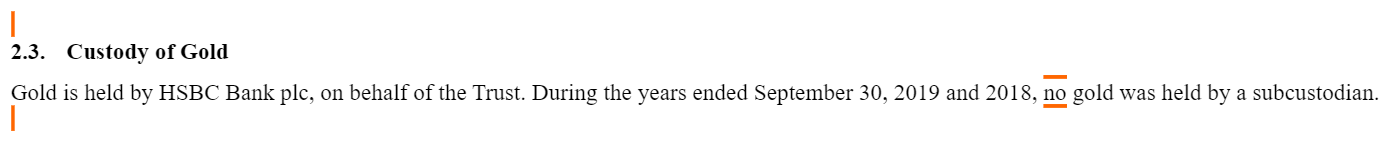

Because, the 10-K annual financial statement for the year to 30 September 2020 states as follows:

“Custody of Gold

During the year ended September 30, 2020, some gold was held with a subcustodian (the Bank of England) from April 15, 2020 to August 13, 2020. Since August 13, 2020, subcustodians have not held any gold on behalf of the Trust.”

Instead of the precise language of “the greatest amount of gold held by Bank of England during the year ended September 30, 2020 was approximately x,xxx,xxx ounces [XXX tonnes] or X.X% of the Trust’s gold”, the GLD Sponsor shockingly has substituted the word “some” in place of numerical quantities.

At this juncture, it’s useful to remind ourselves that financial accountants (the proverbial bean counters) are not in the business of using the word ‘some’, and financial reports and accounts by definition use numbers, and never the obfuscation of using the word ‘some’. Besides, no CFO worth their salt would permit a document submitted to the SEC to use of the word ‘some’ in reference to quantities, unless of course, they were trying to hide something.

More fundamentally, the “Full Disclosure Principle” of accounting states that all relevant and necessary information for the understanding of a financial statement should be included in a set of financial statements.

As the Corporate Finance Institute explains:

“The principle [of Full Disclosure] helps foster transparency in financial markets and limits the opportunities for potentially fraudulent activities."

So why then is GLD’s latest 10-K filing to the SEC not following this necessary and accepted principle of accounting when applied to its gold holdings held at its Bank of England subcustodian in London? And why does the GLD Sponsor Board, who signed off on the 10-K, obfuscate with the word ‘some’, and not see fit in the SPDR Gold Trust 10-K to state the how much gold in total, and how much gold in greatest quantity, did the world’s largest gold-backed ETF hold at the Bank of England during a consecutive 121 days between April and August?

The BoE Data is Available – XBRL

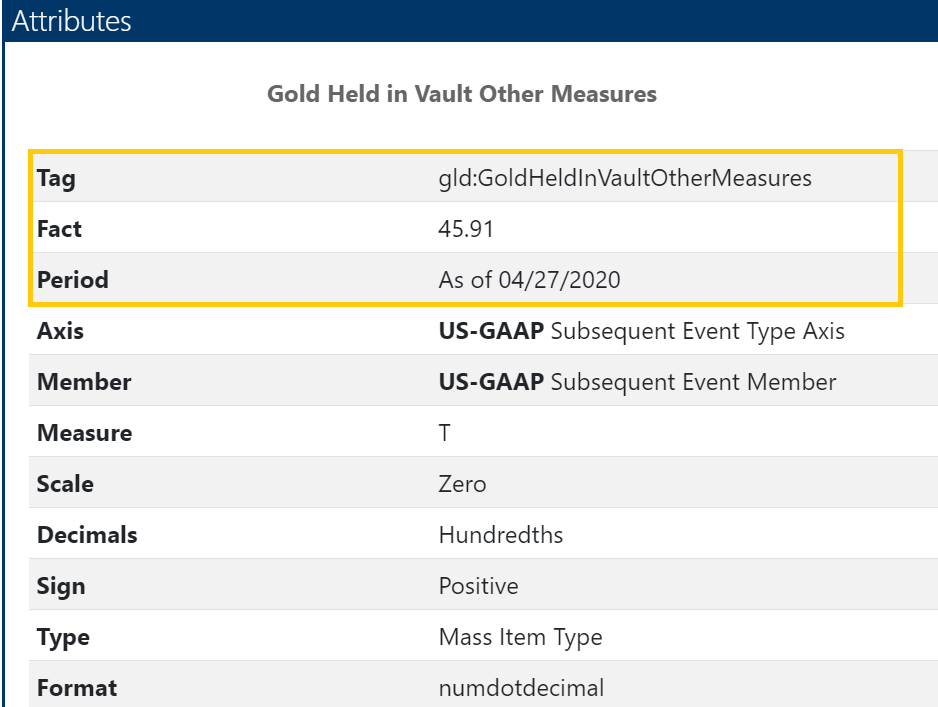

But it gets worse. Since 2018, the SEC has required that financial statement information be submitted to it in XBRL format (eXtensible Business Reporting Language), where submission filers such as the GLD Sponsor WGTS embed XBRL data directly into HTML versions of documents such as 10-K and 10Q filings.

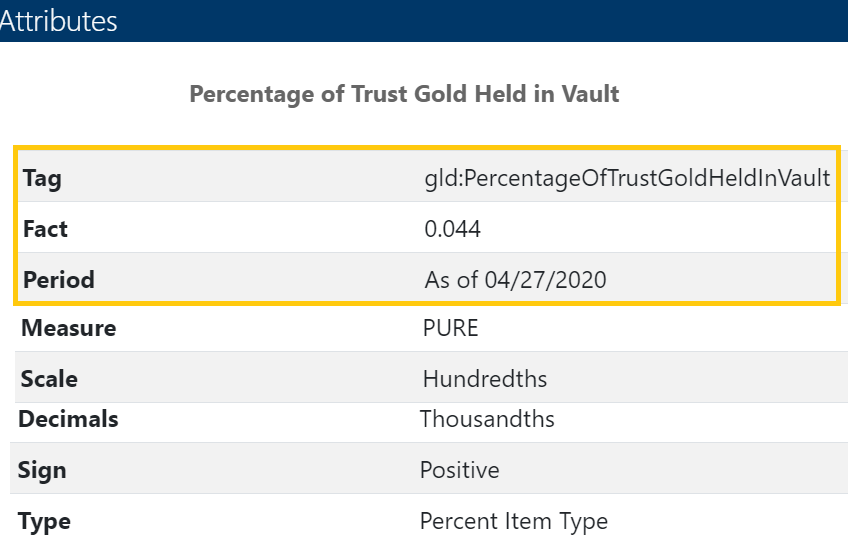

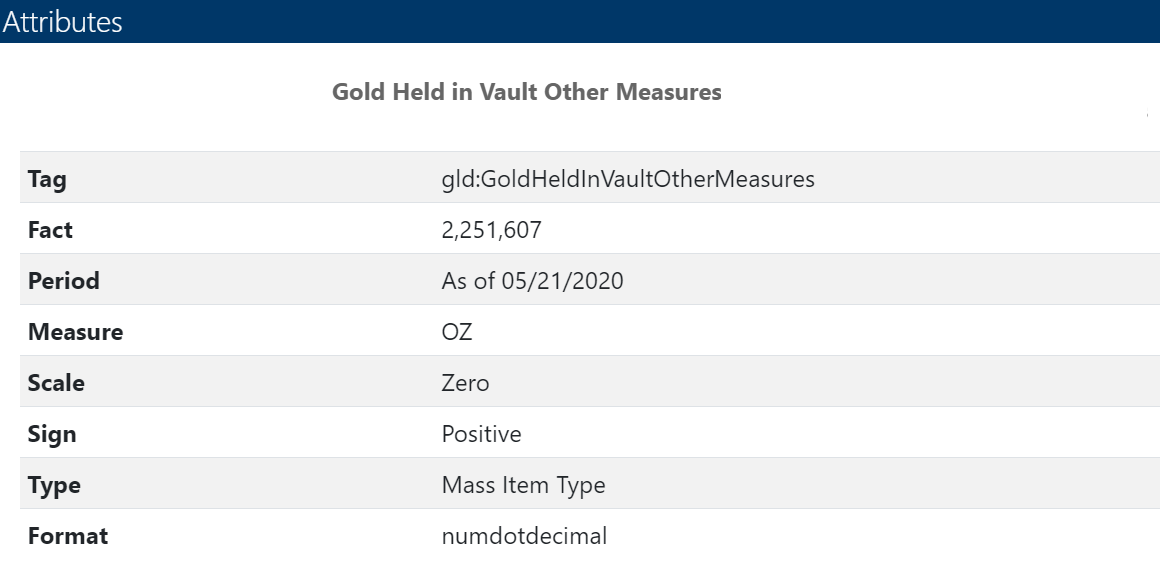

Using XBRL, data and numbers are rendered dynamically ‘in line’ in these documents and controlled by XBRL attributes and tags, with the data appearing as clickable hyperlinked tags with red underline (see screenshots below). And indeed, in compliance with these SEC requirements, the GLD quarterly 10-Q financial reports to the end of March 2020 and end of June 2020 both use these embedded XBRL tags when quoting quantity values for GLD gold held at the Bank of England.

Let’s look quickly at the two 10-Q report in question. First the GLD 10-Q for the three months to the end of March 2020.

When you click on the value 45.91 tonnes in the 10-Q to end of March 2020, it pops up a box showing that the tag of this attribute is “Gold Held in Vault Other Measures", which as of 27 April 2020 had a value of 45.91 (tonnes).

Likewise, clicking on the 4.4% figure in the 10-Q shows that that this value has a tag of “Percentage Of Trust Gold Held In Vault" (Bank of England vault) and, as of 27 April it, had a value of 0.044 or 4.4% of GLD’s gold.

XBRL tag for GLD gold by percent of Trust held in subcustodian vault (Bank of England)

Similarly, the GLD 10-Q for the 3 months to the end of June 2020 makes use of XBRL tags for creating the statements about the maximum gold held at the Bank of England over the quarter and the amount of gold held at the Bank of England at the end of the quarter. See screenshot below.

The 10-Q reports also render this data using the “Gold Held in Vault Other Measures" and “Percentage Of Trust Gold Held In Vault" tags, which as of 21 May had values of 2,251,607 ozs and 6.3% of Trust assets, respectively, and similarly, as of 30 June 2020 had values of 1,283,665 ozs and 3.4 of Trust assets, respectively.

Therefore, as you can see, the GLD Sponsor has all of this data about gold held at the Bank of England available in a financial database for it to use in its SEC filings. So why did the GLD not insert this data in its latest 10-K?

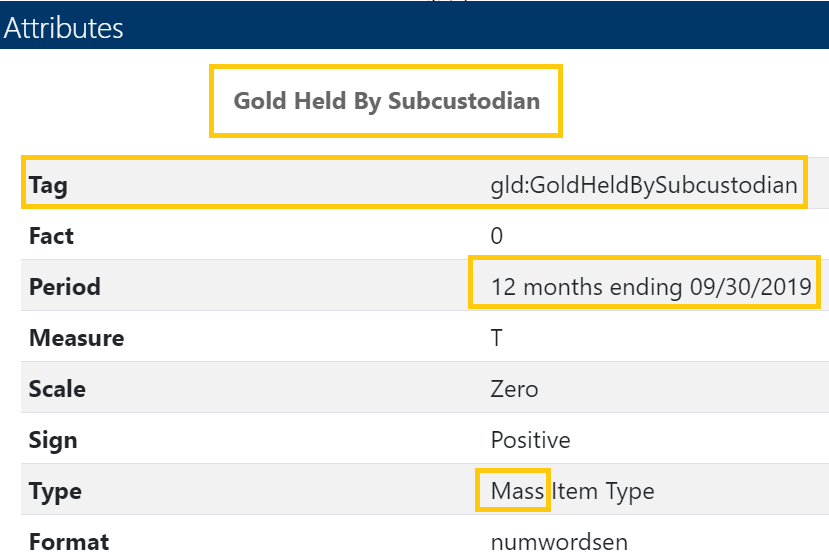

The 2019 GLD 10-K (full year to end of September 2019) is also worth examining for XBRL data related to gold subcustodian holdings. The 2019 10-K states that “During the years ended September 30, 2019 and 2018, no gold was held by a subcustodian." It does this using an XBRL tag to render the ‘no‘, which if you click it shows it to be a an XBRL attribute.

This is where it gets very interesting. Because there is a specific XBRL tag which captures how much gold by quantity is held by GLD subcustodians over a period of time, called “Gold Held by Subcustodian“. In the 2019 GLD 10-K, this tag was set to the period “12 months ending 09/30/2019". See screenshot below:

As a reminder, the GLD 10-K for 2020 only says the following:

“Custody of Gold

During the year ended September 30, 2020, some gold was held with a subcustodian (the Bank of England) from April 15, 2020 to August 13, 2020. Since August 13, 2020, subcustodians have not held any gold on behalf of the Trust.”

As you can see, the GLD Sponsor, World Gold Trust Services, which previously included subcustodian gold holdings data based on this tag in its 10-K in 2019, did not include this data in its 10-K in 2020. In other words, instead of stating how much Gold was Held by Subcustodians over the period 15 April 2020 to 13 August 2020, the GLD Sponsor withheld this XBRL data value from the GLD 10-K submitted to the SEC in 2020, and instead replaced it with the word ‘some‘.

So the question is why? What is the GLD Sponsor trying to hide in not revealing how much gold was held by the GLD at the Bank of England over the 15 April to 13 August 2020? And why has the SEC not picked up on this and requested that the 10-K be amended to include this crucial information?

Interestingly, one piece of relevant information that the above 10-K quote tells us is that all the way up to 13 August 2020, the SPDR Gold Trust continued to hold gold bars at the Bank of England, which means that this year the GLD has held gold in the Bank of England vaults over five calendar months, i.e. April, May, June, July and August, and for a consecutive 121 days in total.

Coincidentally or not, 13 August was one day after BullionStar highlighted in a Tweet on 12 August that the GLD Q3 10-Q was still showing substantial gold holdings of the SPDR Gold Trust at the Bank of England:

STOP THE PRESS (Latest GLD 10Q filing 10 Aug): On 21 May, the SPDR Gold Trust (GLD) was holding 70 tonnes of gold at subcustodian the Bank of England. On 30 June, the GLD held 40 tonnes of gold at the Bank of England. This is borrowed central bank gold. https://t.co/KX3u8uqn9i pic.twitter.com/sdNlgqJiDF

— BullionStar (@BullionStar) August 12, 2020

Critical Audit Matter – KPMG

But where are the auditors in all of this? Good question. As it turns out, the auditors of the GLD financial statements, KPMG LLC (New York), make zero comment in the 10-K about the GLD gold holdings at the Bank of England, but they do, for the first time ever, insert an intriguing statement within the 10-K section “Report of Independent Registered Public Accounting Firm" which KPMG calls a Critical Audit Matter, and which looks very much like an exercise in covering their backs.

This “Critical Audit Matter" says KPMG, “is a matter arising from the current period audit of the financial statements" and it “relates to accounts or disclosures that are material to the financial statements" and that “involved our especially challenging, subjective, or complex judgments."

Specifically, KPMG’s Critical Audit Matter relates to “Evaluation of the evidence pertaining to the existence of the gold holdings", and for the record is worth quoting as follows:

Evaluation of the evidence pertaining to the existence of the gold holdings“.

As disclosed in the schedule of investment, as of September 30, 2020, the Trust’s market value of gold holdings was $77.0 billion, representing 100% of the Trust’s total assets. All of the gold holdings, which were 40.8 million ounces as of September 30, 2020, were held by a third-party custodian (the custodian).

We identified the evaluation of the evidence pertaining to the existence of the gold holdings as a critical audit matter. Given the nature and volume of the gold holdings, subjective auditor judgment was required to evaluate the extent and nature of evidence obtained to assess the quantity of gold held by the custodian as of September 30, 2020.

The following are the primary procedures we performed to address this critical audit matter. We evaluated the design and tested the operating effectiveness of certain internal controls over the Trust’s gold holdings process, including controls over (1) the comparison of the Trust’s records of gold held to the custodian’s records and (2) the approval of gold deposits and withdrawals by the trustee of the Trust.

We obtained a schedule directly from the custodian of the Trust’s gold holdings held by the custodian as of September 30, 2020. We compared the total ounces on such schedule to the Trust’s record of gold holdings. We also attended and observed part of the physical count of the Trust’s gold holdings performed at the custodian’s location by a third party engaged by the Trust’s sponsor. We obtained the physical count result of that third party and reconciled it to both the Trust’s and the custodian’s records.

/s/ KPMG LLP

Conclusion

Wow! Why would KPMG add in this “Critical Audit Matter" to the GLD 10-K now in 2020 and never before, not once since it began as auditor of the GLD in 2010? This is therefore another question to add to the list of questions about GLDs latest 10-K, a list which would include the following:

• Why did the GLD Sponsor CFO resign on 29 September 2020, one day before financial year end of 30 September?

• Why did a new CFO arrive on 29 September, one day before financial year end, and then sign off on annual financial statements for an entire year covering a period during which he wasn’t the CFO?

• Why does the latest GLD 10-K withhold quantity data on how much gold the GLD held at the Bank of England between 15 April and 13 August, and only use the word ‘some’ which is contrary to the Full Disclosure Principle of accounting?

• Why does the latest GLD 10-K blank out the use of XBRL data tags for “Gold Held by Subcustodian" that would show precisely how much GLD gold was held by GLD at the Bank of England between 15 April and 13 August?

• What is GLD gold doing at the Bank of England for 121 consecutive days if the custodian HSBC is obliged to use “commercially reasonable efforts promptly to transport the gold from the subcustodian’s vault to the Custodian’s vault “?

• Why has the GLD auditor KPMG (New York) suddenly added a Critical Audit Matter to its audit statement about evaluating “the evidence pertaining to the existence of the gold holdings“, when KPMG has been the Trust’s auditor since 2010 and has never done so previously?

Enquiring minds would like to know.

Popular Blog Posts by Ronan Manly

How Many Silver Bars Are in the LBMA's London Vaults?

How Many Silver Bars Are in the LBMA's London Vaults?

ECB Gold Stored in 5 Locations, Won't Disclose Gold Bar List

ECB Gold Stored in 5 Locations, Won't Disclose Gold Bar List

German Government Escalates War On Gold

German Government Escalates War On Gold

Polish Central Bank Airlifts 8,000 Gold Bars From London

Polish Central Bank Airlifts 8,000 Gold Bars From London

Quantum Leap as ABN AMRO Questions Gold Price Discovery

Quantum Leap as ABN AMRO Questions Gold Price Discovery

How Militaries Use Gold Coins as Emergency Money

How Militaries Use Gold Coins as Emergency Money

JP Morgan's Nowak Charged With Rigging Precious Metals

JP Morgan's Nowak Charged With Rigging Precious Metals

Hungary Announces 10-Fold Jump in Gold Reserves

Hungary Announces 10-Fold Jump in Gold Reserves

Planned in Advance by Central Banks: a 2020 System Reset

Planned in Advance by Central Banks: a 2020 System Reset

Surging Silver Demand to Intensify Structural Deficit

Surging Silver Demand to Intensify Structural Deficit

Ronan Manly

Ronan Manly 7 Comments

7 Comments