Bullion Bank Nightmare as LBMA-COMEX Spread Blows Up Again

The gaping price differential between spot gold and gold futures that has been plaguing the paper gold markets in London and New York for the last three weeks shows no signs of abating and is continuing to flare up.

In essence, the contango phenomenon we are seeing is one of gold futures prices trading far above spot gold prices, a sign of liquidity problems in the London gold market and a signal that something is completely broken between the world‘s two predominant “gold price discovery" trading venues – which both, by the way, trade paper gold.

As a reminder, London LBMA trades unallocated gold over the counter (OTC), a form of synthetic fractional gold derivative. The vast quantities of unallocated gold which are traded in London are then netted and cleared in an electronic clearing engine called Aurum by 5 LBMA bullion banks that comprices London Precious Metals Clearing Limited (LPMCL), namely JP Morgan, HSBC, UBS, Scotia, and ICBC Standard Bank). Allocation of physical gold is a totally separate process beyond clearing in Aurum.

COMEX trades predominantly cash-settled gold futures contracts on exchange and facilitates the trading of these contracts bilaterally. COMEX futures are 99.9% cash-settled and even those that result in delivery really result in warehouse warrants changing hands but the gold staying in the New York vaults of JP Morgan, HSBC and Scotia.

That the wide-open spread continues to persist is even more remarkable, despite the best efforts of the London Bullion Market Association (LBMA), CME Group (operator of COMEX) and the powerful London-New York bullion bank syndicate to throw all they have at the problem.

At the time of writing, spot gold was trading at US$ 1682.8 against US$ 1740.7 for the front-month (most actively traded) COMEX gold futures contract, a $36 spread with futures over 3.44% over spot. The spread we‘re referring to can be seen in the below 3-day chart, which plots June 2020 gold futures (red and green line) against spot XAUUSD (blue line) from 7 April to 9 April. Notice that over this time the futures price has stayed far above spot, and more importantly, it has persistently done so.

That the spot-futures spread blow out has been running into its third week now can vividly be seen by zooming out for a minute and looking at a similar chart but this time from 23 March until 8 April, the first day that the price spread between London and New York gaped open. Notice the big gaps between futures and spot over 24-25 March, the persistence of the gap over the remainder of the week, and the subsequent re-explosion of the divergence since early April, particularly over the last few days.

Three Weeks and Counting

Its instructive to review a short timeline of some of the events which have contributed to this ongoing saga over the last three weeks, because it shows that no matter what the LBMA and CME do, the spread between London and COMEX continues to stay out there.

Week 1

23 March – COMEX gold futures (April contract) begin trading noticeably above LBMA bullion bank spot gold prices.

24 March – Spreads between COMEX futures and London spot blew out to $100 at one point during the day, while bid – ask spreads within London spot widened substantially.

24 March – Rumors in the gold market suggested that bullion banks that were required to deliver physical gold for COMEX Exchange for Physical (EFP) transactions failed to do so, suffered losses and exited the market, and that this caused the Spread between COMEX and London to widen substantially.

The bullion bank controlled LBMA releases its first control statement, deflecting attention away from London, saying it will help (essentially collude with) the CME-COMEX in the gold market – The official language is that the LBMA “is working closely with COMEX and other key stakeholders to ensure the efficient running of the global gold market."

Note – Who are these other key stakeholders, what do they mean by efficient running, and what gives them the right to think they can “run“ the global gold market?

24 March – LBMA and its bullion banks pressure CME to launch a gold futures contract with a deliverable clause in London 400 oz gold bars.

24 March – At end of day, CME announces the launch of a new gold futures contract that can theoretically deliver 400 oz bars, 100 oz bars and kg bars but that uses a fractional paper concept called Accumulated Certificates of Exchange (ACEs) to divide 400 oz deliverable bars into 100 oz bars, and that critically includes all refiner brands on the LBMA Good Delivery List (current and former Good Delivery refiners). This contract will be called 4GC (See here and here).

See BullionStar article “LBMA colludes with the COMEX – To lockdown the global gold market?" for background to the above.

25 March until end of March – For the rest of the week, disinformation from bullion banks to mainstream media about flight cancellations and refinery closures preventing bullion banks delivering gold from London to New York thus causing prices on COMEX and London to diverge. See here, here, here and here for examples. From the below chart you can see that there is never any gold exported from London to New York.

Week 2

30 March – CME published its daily gold vault stocks report (for Friday 27 March) with a new category for “400 oz AND eligible brands", but with all vaults showing zero stocks of 400 oz gold bars. And notably, that the JP Morgan vault in New York had zero holdings.

30 March – When Bullionstar draws attention to this new CME vault report, in “COMEX can’t find a 400 oz bar for its new 400 oz gold futures contract“, the CME then deletes the new report from its website on the morning of 31 March, and replaces it intra-day with a report which reverted to the original version.

1 April – LBMA and CME publish an unprecedented second control statement titled “LBMA and CME group comment on healthy gold stocks in New York and London”, saying that “CME Group and LBMA..will continue to coordinate efforts as market circumstances evolve”. See “LBMA and COMEX try to Reassure the Market – Twice in One Week“ for background.

Note – If LBMA and CME are trading gold bars, why would they need to coordinate efforts, and more importantly, coordinate efforts to what end?

LBMA disingenuously refers to 8326 tonnes of gold in London, a figure that is from 3 months ago, and nearly all of this total tonnage is central bank gold, gold held in ETFs, and allocated gold held by other investors. The real float of physical gold in the london LBMA gold vaults controlled by the LBMA bullion banks is less than 1000 tonnes and some estimates from sources in the bullion banks say it could be between 300 and 500 tonnes.

In the same statement, CME refers to 9.2 million ozs ( 287 tonnes) of gold held in its approved vaults, with irrelevant claims that 5.6 million ozs of this is eligible gold. Eligible gold is gold which just happens to be in the form that satisfies the deliverable unit of the contracts (1 kg bars or 100 oz bars). The rest of this figure is registered gold, which already has warehouse warrants attached.

2 April – The spread between COMEX gold futures prices and London spot gold prices starts to gap up strongly again.

Rest of week – CME Group releases publicly a PowerPoint slide presentation titled “Precious Metals Physical Delivery Process”, which includes the new 4GC contract and explains how to get an electronic warrant if standing for delivery of COMEX gold futures contracts, but that explains nothing about withdrawing gold from the COMEX vaults.

The COMEX presentation also features a slide discussing the COMEX New York approved vaults but unbelievably instead of showing photos of one of its approved New York vaults, this slide contains photos of a HSBC gold vault in London showing gold bars belonging to the exchange traded fund, the SPDR Gold Trust (GLD). This GLD gold has nothing to do with COMEX gold vaults in New York (or does it?).

Week 3

6 April – The spread between the COMEX June gold futures contract and the LBMA spot gold price blows out again very widely to over $80 at one point in the day.

6 April – CME adds back the category “Enhanced Delivery (400 oz AND eligible brands)" to its New York daily vault report. Of the 9 vaults on the report, 5 have 0 holdings in this 400 oz category, 2 (Brinks & Loomis) have a combined 2 tonnes, HSBC claims 21.5 tonnes, JP Morgan appears for the second time, claiming 126.8 tonnes. The first time being 30 January when JP Morgan was listed as having zero tonnes of 400 oz bars.

Note – “400 oz AND Eligible Brands" will be the subject of another article soon, but for now it means as follows. For the new 4GC contract, CME added all LBMA Good Delivery gold bar Brands (Current and Former) as Eligible brands. That’s 68 brands from the existing GC100 contract + 71 brands from the LBMA current Good Delivery List + another 113 LBMA former Good Delivery List.

As another aside, where did the JP Morgan New York vault suddenly get 126.8 tonnes of gold suddenly to add to Eligible category for the COMEX 4 GC contract? Was this 126.8 tonnes of gold suddenly shipped in to the JP Morgan vault from London? Hardly. Were 126.8 of London Good Delivery gold bars already sitting in its New York vault. Probably not as its London and not New York which is the center of 400 oz gold bar storage. Was there some type of gold swap involved between London and New York. Possibly.

Another intriguing possibility is that now that former LBMA Good Delivery List gold bars are eligible for the new 400 oz contract, that JP Morgan borrowed Old US Assay Office gold bars from the New York Fed (their two gold vaults are beside each other), and then added these to the Eligible category for the new 4GC gold contract.

Root Cause of Spot vs Futures Gold Price Discrepancy

So what is the cause of this dislocation in pricing between the lower ‘spot’ price and the higher ‘futures’ price, i.e. between the London LBMA gold spot market and the New York COMEX gold futures market? The answer in general is that the problem is with the spot price. And where is the spot price? London.

Ironically, the LBMA bullion banks are trying to shift the attention away from London, when London is exactly where the problem is. The spot price problem appears to be due to liquidity problems of the LBMA market makers in London where they are suspicious of trading with each other. This is despite the fact that these LBMA market makers are obliged to constantly make a market and offer two way price quotations to each other. These market makers are BNP Paribas, Citibank, Goldman Sachs, HSBC, ICBC Standard, JP Morgan Chase, Merrill Lynch, Morgan Stanley, Standard Chartered, Bank of Nova Scotia, Toronto-Dominion and UBS.

The spot price problem has nothing to do with air travel cancellations or shipments of 100 oz gold bars from London to New York. These market makers do not make markets in physical gold. The unit of trading in London is not real gold anyway, its unallocated gold or gold credit which is issued by a bullion bank and which has counterparty risk.

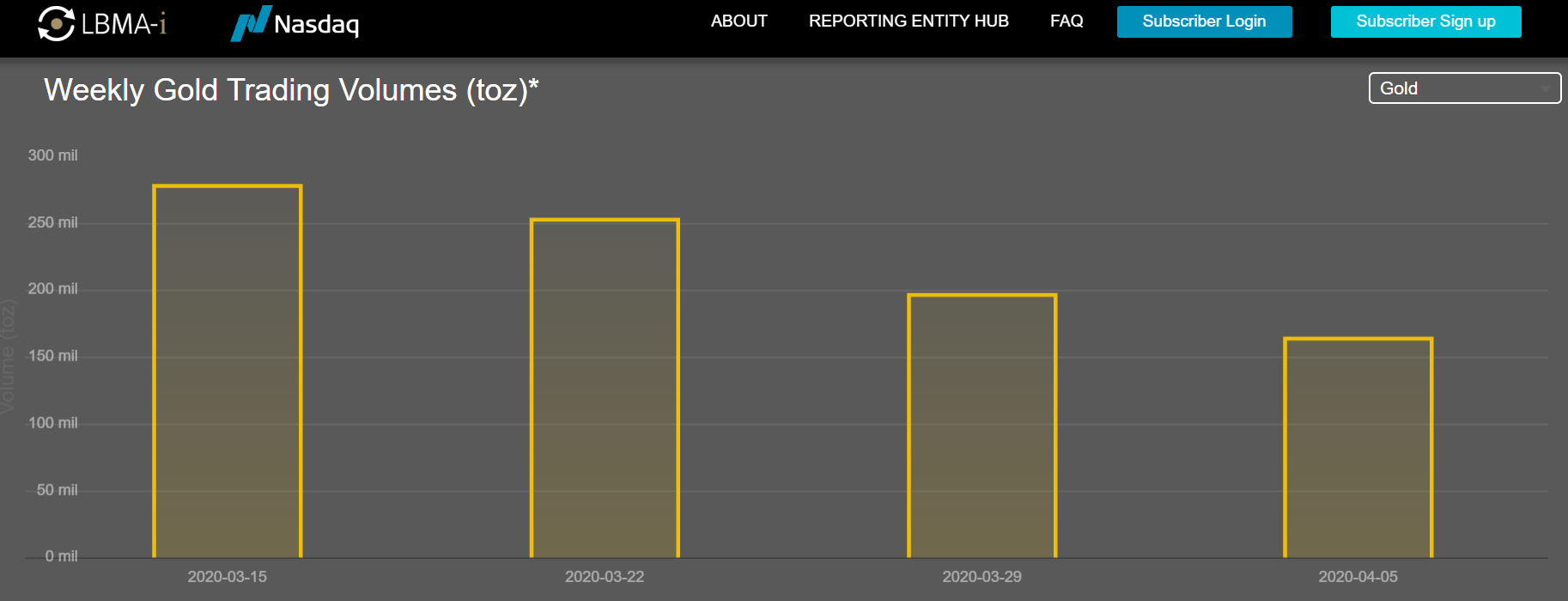

Something has spooked these market makers and caused a drop in liquidity in the London market. These banks, which normally trade with each other, now do not want to trade with each other due to heightened counterparty risk. Unallocated trading volumes in the London gold market have fallen over the last three weeks. See chart below.

Likewise, according to Bloomberg, COMEX gold futures trading volume last week was 80.6 million ounces, a 72% drop compared to the end of February. From the same Bloomberg article, there is an intriguing and obviously dramatic quote from commodities broker Marex Spectron, saying:

“You have a bunch of shell-shocked market makers who are literally hiding under their desks and do not and possibly can not make markets in any size, shape or form,” said David Govett, head of precious metals trading at Marex Spectron. “Hence we have the lack of liquidity, the small volumes and the wide spreads.”

Marex is a broker for EFPs, so maybe the LBMA market makers are not answering calls. Then they are failing in their duty and obligations as market makers. But why would market makers not want to trade and how does this relate to EFP spreads? If banks suffered EFP problems and then the EFP spread between London and New York blew up, and then they use the excuse that the EFP spread is too large for them to make a market in spot because they don’t want to take on risk, then that’s just circular logic and a pathetic excuse. But what causes LBMA market makers to become shell shocked and literally hide under their desks?

Could it be that the gold trading activities of some of these LBMA bullion banks have blown up and they have ceased their market making activities, but have not publicly stated this, and covered it up? Stranger things have happened. All the while, as trading volumes continue to fall in the paper gold markets of London and New York, the opposite is the case in physical gold markets, where BullionStar and other bullion dealers – those that continue to have inventory – see unprecedented demand and increasing trading volumes.

Popular Blog Posts by Ronan Manly

How Many Silver Bars Are in the LBMA's London Vaults?

How Many Silver Bars Are in the LBMA's London Vaults?

ECB Gold Stored in 5 Locations, Won't Disclose Gold Bar List

ECB Gold Stored in 5 Locations, Won't Disclose Gold Bar List

German Government Escalates War On Gold

German Government Escalates War On Gold

Polish Central Bank Airlifts 8,000 Gold Bars From London

Polish Central Bank Airlifts 8,000 Gold Bars From London

Quantum Leap as ABN AMRO Questions Gold Price Discovery

Quantum Leap as ABN AMRO Questions Gold Price Discovery

How Militaries Use Gold Coins as Emergency Money

How Militaries Use Gold Coins as Emergency Money

JP Morgan's Nowak Charged With Rigging Precious Metals

JP Morgan's Nowak Charged With Rigging Precious Metals

Hungary Announces 10-Fold Jump in Gold Reserves

Hungary Announces 10-Fold Jump in Gold Reserves

Planned in Advance by Central Banks: a 2020 System Reset

Planned in Advance by Central Banks: a 2020 System Reset

Surging Silver Demand to Intensify Structural Deficit

Surging Silver Demand to Intensify Structural Deficit

Ronan Manly

Ronan Manly 5 Comments

5 Comments