Wikileaks 1976: PBOC Focused On Gold & SDRs

Another piece of the puzzle.

The next Wikileaks cable is a summary of a meeting that took place in October 1976 between, among others, chairman of the Federal Reserve, Arthur Burns, and a delegation of Chinese bankers from the PBOC. For the record, this was five years after Nixon suspended US dollar convertibility into gold and one month after Mao Zedong passed away.

Most notably the Chinese stated they see inflation as economic weakness and particularly expressed their interest in IMF gold auctions and the issuance of SDR’s. Sounds to me the PBOC was particularly not very enthusiastic about the US dollar as the world’s reserve currency in 1976.

Inflation in China has not been close to zero since 1976, nor did they adopt a form of gold standard in the seventies. However, this can all have been according to plan. If China had any ambitions in the late seventies to move away from the dollar and become an economic powerhouse, perhaps they decided it was best to first grow and develop within the existing system before making a change, because this is exactly what happened:

China’s communist economy started to open in the late seventies when Deng Xiaoping ruled the country and implemented the socialist economy; combining the Party’s socialist ideology with a pragmatic adoption of market economic practices. In recent decades China has been the growth wonder of the world making them currently the second largest economy right after the US. In 2002 China reformed its gold market and ever since is effectively stimulating its citizens to save in physical gold, making the People’s Republic the largest gold producer and consumer on earth. Additionally, China is openly calling for replacing the US dollar as the world reserve currency. Did this all adventitiously happen or was it carefully planned many years ago?

In Mao’s era, from 1949 until 1976, Chinese yearly domestic gold mine production increased 261 %, from 1976 until present production increased 2,964 %.

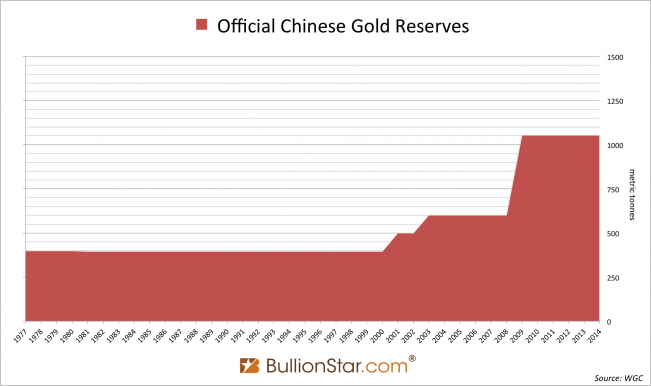

In 1977 for the first time China disclosed their official gold reserves at 395 tonnes, according to the World Gold Council. Since then there have been three increases; 105 tonnes in 2001 (to 500 tonnes), 100 tonnes in 2003 (from 500 to 600) and 454 tonnes in 2009 (from 600 to 1,054 tonnes). Given the fact the PBOC is not buying such amounts in one month, but more likely spread over the years, my assumption is that the official amount disclosed by the PBOC reflects more about China’s political strategy than tonnes in reserve. China claims to have 1,054 tonnes currently, though there is overwhelming evidence they have substantially more in official reserves.

From Wikileaks:

1. SUMMARY: CALL OF CHAIRMAN BURNS ON PU MING, DEPUTY DIRECTOR OF THE PEOPLE’S BANK OF CHINA AND LIN CHI-HSIN, DEPUTY GENERAL MANAGER OF THE BANK OF CHINA COVERED A WIDE VARIETY OF AMERICAN, CHINESE, AND INTERNATIONAL FINANCIAL MATTERS IN THREE-HOUR MEETING. POLITICAL QUESTIONS AND SINO-US BILATERAL RELATIONS DID NOT COME UP. CHINESE EVIDENTLY WERE VERY PLEASED WITH DISCUSSIONS, WHICH USLO CONSIDERS A SUCCESSFUL INTRODUCTION OF US AND PRC CENTRAL BANKING LEADERS.

2. CHAIRMAN BURNS OF THE FEDERAL RESERVE BOARD, ACCOMPANIED BY NORMAN BERNARD OF THE FED. AND USLO OFFICER, CALLED OCTOBER 11 ON PU MING (0592/2494), DEPUTY DIRECTOR OF THE PEOPLE’S BANK OF CHINA, LIN CHI-HSIN (2651/1015/9387), DEPUTY GENERAL MANAGER OF THE BANK OF CHINA, LIU PEN-KUN (0491/2609/2492), DEPUTY DIRECTOR OF THE BANKING DEPARTMENT OF THE BANK OF CHINA, AND TWO NOTETAKERS. THE MEETING LASTED THREE HOURS, AND ALL FOUR OF THE CHINESE MENTIONED ABOVE TOOK PART, LIU, SERVING AS INTERPRETER, BUT SOMETIMES DISCUSSING THE QUESTION BEFORE HE TRANSLATED IT.

3. THE CHINESE ASKED A VARIETY OF QUESTIONS ON THE CONDITION OF THE US ECONOMY, INCLUDING INTEREST RATES, LOANS, THE STATE OF THE RECOVERY OF THE ECONOMY, HOUSING STARTS, UTILIZATION OF CAPITAL, AND THE RATE OF INFLATION AND THE INCREASE IN THE MONEY SUPPLY. THE CHINESE WERE WELL INFORMED ON THE US ECONOMY, AND APPARENTLY HAD DISCUSSED THEIR QUESTIONS BEFORE THE MEETING. THEY WERE OBVIOUSLY PLEASED WITH THE FRANK AND STRAIGHT ANSWERS GIVEN THEM.

4. IN INTERNATIONAL ECONOMICS, THE DISCUSSION CONSISTED MAINLY OF QUESTIONS BY THE CHINESE AND ANSWERS BY DR. BURNS, ALTHOUGH THE CHINESE VIEW THAT INFLATION IS A SYMPTOM OF ECONOMIC WEAKNESS CAME THROUGH CLEARLY. THE CHINESE ASKED ABOUT DR. BURNS’ VIEWS OF THE IMF CONFERENCE AND WERE PARTICULARLY INTERESTED IN THE IMF GOLD AUCTIONS, AND THE ISSUANCE OF SDR’S. THE CHINESE ASKED ABOUT THE PROBLEM OF CONTROLLING THE $200 BILLION IN EURODOLLARS, AND GAVE THE IMPRESSION THAT THEY CONSIDERED THE EURODOLLAR MARKET A THREAT TO EXCHANGE RATE STABILITY, WHICH BY IMPLICATION THEY SEEMED TO FAVOR. THEY ALSO ASKED ABOUT COMPARATIVE GROWTH RATES AMONG THE OECD COUNTRIES. AGAIN, THE CHINESE BANKERS WERE WELL INFORMED AND HAD THEIR QUESTIONS WELL PREPARED.

5. DR. BURNS ASKED A NUMBER OF QUESTIONS ABOUT CHINESE FINANCING. IN THEIR REPLY ON HOW THE PRC FIXES EXCHANGE RATES, THE CHINESE WERE OBVIOUSLY DODGING, BUT CONFIRMED THAT THE RMB, AS A STABLE CURRENCY, TENDS TO FOLLOW THE STRONG CURRENCIES, SUCH AS THE DEUTSCHE MARK, AND PAYS CLOSE ATTENTION TO IMPORTANT CHINESE TRADING CURRENCIES SUCH AS THE YEN. MR. PU OUTLINED THE WORKING OF THE CHINESE BANKING SYSTEM, NOTING THE DIVISION OF LABOR BETWEEN THE PEOPLE’S BANK OF CHINA (THE CENTRAL BANK), THE BANK OF CHINA (FOREIGN EXCHANGE BANK), AND THE PEOPLE’S CONSTRUCTION BANK (INVESTMENT AND CONSTRUCTION BANK). THERE IS NO BANK OF AGRICULTURE NOW FUNCTIONING. MR. PU’S STATEMENTS CONFIRMED THAT CHINESE MONETARY POLICIES ARE VERY RESTRICTIVE, WITH ALL BUDGETS AT A BALANCE OR WITH A SLIGHT SURPLUS, AND THE ISSUANCE OF EACH NEW RMB BACKED BY EIGHT RMB IN COMMODITIES. HE SAID THAT MONEY SUPPLY IN CHINA MEANS CURRENCY IN CIRCULATION ONLY, AND DOES NOT INCLUDE PAYMENTS BY CHECK FROM ONE ENTERPRISE TO ANOTHER.

6. NO POLITICAL SUBJECTS OR BILATERAL US-PRC QUESTIONS CAME UP IN THE DISCUSSIONS. THE CLOSEST APPROACH TO POLITICS WAS MR. PU’S FAREWELL REMARK THAT HE WAS SURE THAT NORMALIZATION OF RELATIONS WOULD GIVE AN EVEN GREATER IMPETUS TO EXCHANGES OF VIEWS BETWEEN THE US AND CHINESE CENTRAL BANKS.

7. THE CHINESE BANKERS WERE EVIDENTLY PLEASED WITH THE VISIT, AS THE THREE HOURS OF CONVERSATION AND THE FACT THAT BOTH THE PEOPLE’S BANK OF CHINA AND THE BANK OF CHINA WERE REPRESENTED SHOW. THE MEETING WAS CORDIAL THROUGHOUT, AND DR. BURNS’ FRANK AND INFORMATIVE ANSWERS WERE MUCH APPRECIATED. USLO CONSIDERS THAT DR. BURNS’ VISIT WAS A SUCCESSFUL INTRODUCTION OF TOP US AND CHINESE CENTRAL BANKERS.

Previously posted historic documents:

1971, October 28. Phone call between Nixon and Kissinger on gold

1973, May 18, Paris, France. Meeting Kissinger And Pompidou on value of gold

1974, April 22 & 23, Zeist, The Netherlands. Meeting European Ministers Of Finance On Gold

Popular Blog Posts by Koos Jansen

China’s Secret Gold Supplier is Singapore

China’s Secret Gold Supplier is Singapore

Audits of U.S. Monetary Gold Severely Lack Credibility

Audits of U.S. Monetary Gold Severely Lack Credibility

China Gold Import Jan-Sep 797t. Who’s Supplying?

China Gold Import Jan-Sep 797t. Who’s Supplying?

The Gold-Backed-Oil-Yuan Futures Contract Myth

The Gold-Backed-Oil-Yuan Futures Contract Myth

Estimated Chinese Gold Reserves Surpass 20,000t

Estimated Chinese Gold Reserves Surpass 20,000t

Did the Dutch Central Bank Lie About Its Gold Bar List?

Did the Dutch Central Bank Lie About Its Gold Bar List?

PBOC Gold Purchases: Separating Facts from Speculation

PBOC Gold Purchases: Separating Facts from Speculation

U.S. Mint Releases New Fort Knox Audit Documentation

U.S. Mint Releases New Fort Knox Audit Documentation

China Net Imported 1,300t of Gold in 2016

China Net Imported 1,300t of Gold in 2016

Why SGE Withdrawals Equal Chinese Gold Demand and Why Not

Why SGE Withdrawals Equal Chinese Gold Demand and Why Not

Koos Jansen

Koos Jansen