How Long Will People Trust Fiat Money?

On The Essence Of Exchange Rates

I had an interesting conversation with a central banker a couple of days ago. He’s a friend of a friend and works at the Dutch central bank – will be working at the ECB next month. I invited him for drinks to ask him about banking in general and the Turkish banking system (more on that in a future post). I was very happy to talk to him as it’s always valuable to get information from professionals. Not that I agree with all professionals, but they usually provide solid information for me to analyze.

I had an interesting conversation with a central banker a couple of days ago. He’s a friend of a friend and works at the Dutch central bank – will be working at the ECB next month. I invited him for drinks to ask him about banking in general and the Turkish banking system (more on that in a future post). I was very happy to talk to him as it’s always valuable to get information from professionals. Not that I agree with all professionals, but they usually provide solid information for me to analyze.

I used the opportunity to fire as many questions as I could, hence our conversation jumped from central banking to synthetic ETF’s, bank balance sheets, reserve ratios, interest rates, the ECB, the BIS and finally gold leasing. The following is a reconstruction of a part of our conversation that I found worth sharing.

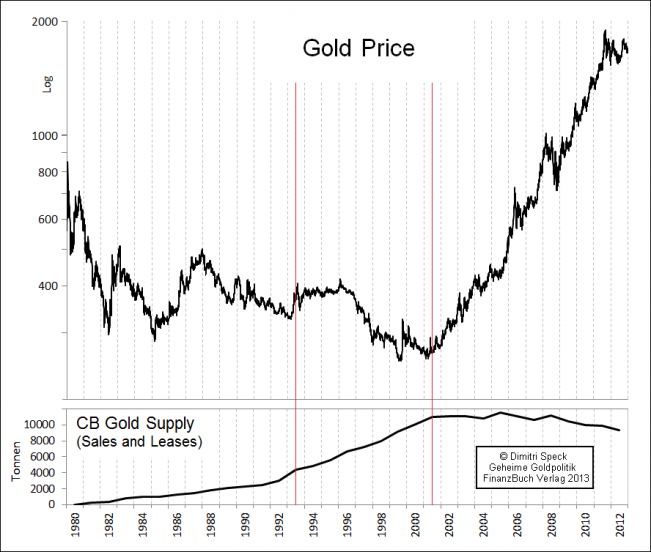

Me: If a central bank (CB) lends 1 metric tonne of gold to Mr X at a 2 % interest rate for one year. Mr X has to repay the CB 1.02 tonnes after one year. So, the more gold is leased – lend out – the more demand for gold there will be in the future to repay these loans. Eventually gold leasing will increase demand.

Him: Not necessarily, the gold loans can be cash settled, there would be no need for more gold in the future.

Me: A gold loan is denominated in gold [ounces, grams, kilograms, tonnes, etc], so in order to repay the loan there is more gold required in the future. It can be cash settled, but this would require more fiat in the future.

Him: That depends on the price of gold in the future.

Me: Of course. However, I still think leasing drives future demand. For example if CB’s lend out 500 tonnes for a year at a 2 % interest rate, surely 10 tonnes of additional gold would be required to repay the loans. This will increase gold demand.

Him: Not if everything is cash settled. Imagine “the Night Watch" [that’s a famous Dutch painting], if it has a value of $1 billion and gets lend out at a 4 % interest rate for one year, a year from now it would require $1.04 billion to repay the loan.

Me: The Night Watch can not be compared to gold. You can’t lend The Night Watch and get back more than one Night Watch when the loan comes due. It’s different with gold; gold is a currency and gold loans are denominated in gold.

Him: Through a book entry it’s really simple, someone could own 1.5 Night Watches on paper.

Me: And eventually … 8 Night Watches can be owned on paper?

Him: Sure.

Me: I don’t understand why anybody wants to own a Night Watch on paper, knowing there are multiple claims on it, while there is only one physical Night Watch. The paper claims are a fiat derivative of the Night Watch.

He used the Night Watch as an example on purpose, knowing there is only one Night Watch. What he consciously/unconsciously did was describe fractional reserve banking. His ideas about economics illustrate how the majority of people has trust in fiat as money and as a ruler of value, while fiat money is greatly disconnected from the value of goods and services. Fiat is created out of thin air and detached from basic economic law. One of those laws is Say’s law: “goods and services shall be paid for with goods and services". This is why I have more trust in gold than in fiat. Gold is not created by a board of governors that decide what the exchange rates of all goods and services should be, ignoring the fact these exchange rates can only be set by the free market, or the price mechanism will be distorted until it finally will cease to function. When that happens, what will be the value of fiat money?

Popular Blog Posts by Koos Jansen

China’s Secret Gold Supplier is Singapore

China’s Secret Gold Supplier is Singapore

Audits of U.S. Monetary Gold Severely Lack Credibility

Audits of U.S. Monetary Gold Severely Lack Credibility

China Gold Import Jan-Sep 797t. Who’s Supplying?

China Gold Import Jan-Sep 797t. Who’s Supplying?

The Gold-Backed-Oil-Yuan Futures Contract Myth

The Gold-Backed-Oil-Yuan Futures Contract Myth

Estimated Chinese Gold Reserves Surpass 20,000t

Estimated Chinese Gold Reserves Surpass 20,000t

Did the Dutch Central Bank Lie About Its Gold Bar List?

Did the Dutch Central Bank Lie About Its Gold Bar List?

PBOC Gold Purchases: Separating Facts from Speculation

PBOC Gold Purchases: Separating Facts from Speculation

U.S. Mint Releases New Fort Knox Audit Documentation

U.S. Mint Releases New Fort Knox Audit Documentation

China Net Imported 1,300t of Gold in 2016

China Net Imported 1,300t of Gold in 2016

Why SGE Withdrawals Equal Chinese Gold Demand and Why Not

Why SGE Withdrawals Equal Chinese Gold Demand and Why Not

Koos Jansen

Koos Jansen