Guest Post: Eurodollars and The Gold Market – Part One

Written by Alexander Mirolyubov

One of the most important factors driving the gold price is financial stress. When the latter is changing it always finds a resolution in the interest to the yellow metal. However, gold price adjustments can pass immediately or with some kind of delay. This time lag is important to gold investors and speculators, as there is no need to follow stress levels changing if they’re already splashed out in the price of gold. And it’s not so difficult to measure this implied reaction in the gold price.

In general, the larger the market that generates financial stress signals is followed by the public, the quicker will the reciprocal gold price movement be. For example, the impact of official statistics data, such as CPI, GDP and nonfarm payrolls, which are tracked by a large audience, is usually seen in the rear view mirror. The more important and the more valued the market that’s showing stress, the more it influences the gold price. The conclusion is this; for successful positioning in the gold market sophisticated investors should try day by day to monitor stress levels in important and liquid markets that are not largely followed by the general public.

The combination of such conditions is not impossible. A good example is the 3-month Eurodollar futures market, the most liquid market of the world. Its size is unbelievable. “The volume in Eurodollars (traded at the CME) is beyond anything you gold and crude oil groupies can comprehend. Consider the following volume figures for 2012: Gold – 43.8 million contracts, Crude Oil – 134.2 million contracts, Eurodollars – 425.1 million contracts”, argues Peter Brandt a this blog.

Eurodollars are simply the dollars outside the US, not especially in Europe. Eurodollar futures are the contracts traded at Chicago Mercantile Exchange (CME) – under the GE and ED (pit session) tickers. These contracts give the possibility to lock-in the interest rate to borrow or lend money at any point in the future (up to ten years). A short GE/ED contract holder can borrow dollars in the future, a long contract can lend dollars in the future.

The 3-months London Interbank Offered Rate (LIBOR) is connected to the Eurodollar futures rate, they’re more or less the same, and together they reflect the real 3-months credit cost for the banks.

Eurodollar futures contracts specifications: The price of the Eurodollar futures (GE/ED) contracts indicated by CME is expressed as 100 minus the implied interest rate. So a price of ED 97 implies a 3 % interest rate. One ED contract controls $1,000,000 dollars in deposit.

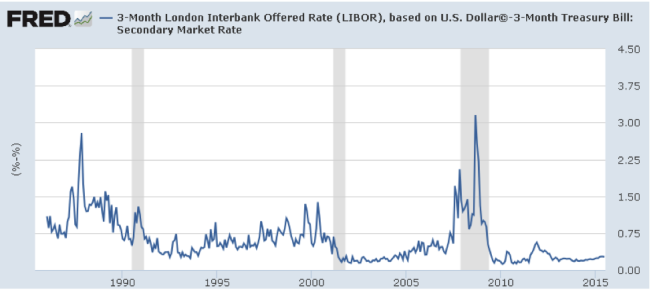

In the chart below we can see the spread between 3-months LIBOR (and thus the Eurodollar futures interest rate) and the 3-months United States Treasury yield. The spread is anything but constant.

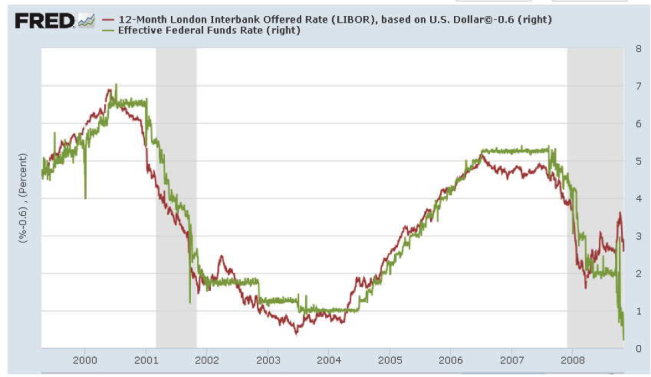

In the next chart chart we can see the importance of the Eurodollar market as a whole. You can see the LIBOR trends (and thus the Eurodollar futures interest rate) can predict easing/tightening cycles by Fed.

The underlying value of Eurodollar futures and options combined is more than $17 trillion (more than $11 trillion in futures only), close to the US federal debt. For reference, crude oil futures and options combined are worth only about $150 billion and gold futures are worth about $72 billion. No doubt the impact of the Eurodollar market on everything under investment sun is huge.

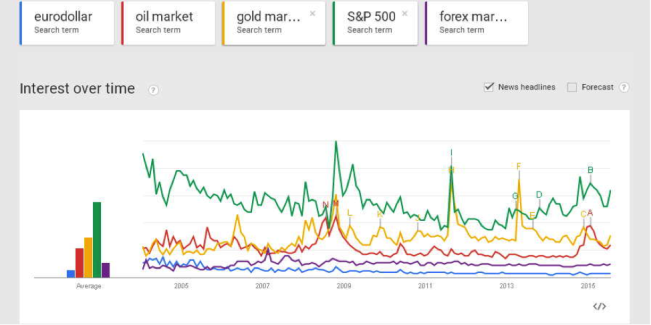

How about the popularity of Eurodollar futures? It seems like it’s not so widely followed in the mainstream media, at least not like the equity, oil, gold and forex market. To visualize this I will direct your attention on Google trends data – in the chart below. You can see that the public interest in the Eurodollar is the smallest when compared to the other markets. Also significant, Google searches for Eurodollar in the US are concentrated in Chicago and New York.

All kind of signals from this underwater iceberg are very strong and correlate with movements in the gold price. Tracking the Eurodollar futures market provides us very important information about impact from different kinds of financial and non-financial news on financial stress levels, “serious money” positioning and the phase of the credit cycle and the distance to its turning point.

To get this kind of information we can analyze the following parameters:

- Eurodollar futures volume.

- Eurodollar futures general price direction.

- Eurodollar futures open interest dynamics.

- Spreads between contracts with different expirations, also known as the money curve.

- Dealer positions by COT reports.

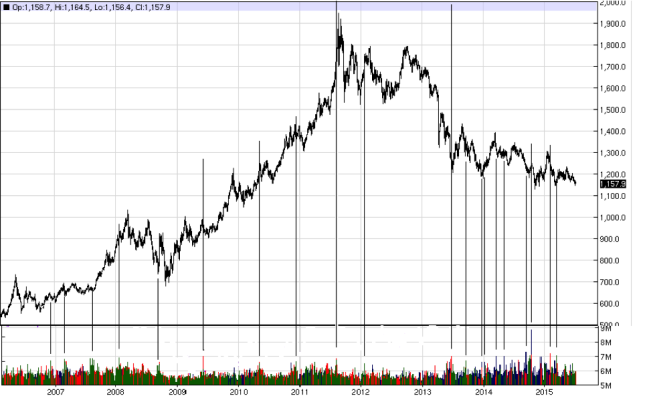

Let’s start with the first parameter, Eurodollar volume and its relationship to financial stress. In general, most of the daily volume is concentrated in 18 – 24 months futures contracts and December tends to attract the largest parts. Average daily volume of the most active contract is about 200,000 – 300,000. So, the financial system’s thermometer is moving when Eurodollar futures volume exceeds this average level. And when the thermometer moves, we can expect a change in the direction of the gold price. Often Eurodollar volume spikes have been accompanied by important gold price turning points, I have marked a few of them in the chart below in which we can see the gold price versus total daily Eurodollar futures volume. Only 3 of 20 volume spikes were completely useless for predicting a gold price movement.

Kindly note that Eurodollar volume not just mirrors gold futures volume. The obvious example is gold’s bottom at the end of June 2013 when gold futures volume told nothing and Eurodollar volume everything. So, just this one parameter can tell much about the direction of the gold price. In addition, this data is easy accessible and indicated even intraday. In the next part we will zoom in on more correlations!

Popular Blog Posts by Koos Jansen

China’s Secret Gold Supplier is Singapore

China’s Secret Gold Supplier is Singapore

Audits of U.S. Monetary Gold Severely Lack Credibility

Audits of U.S. Monetary Gold Severely Lack Credibility

China Gold Import Jan-Sep 797t. Who’s Supplying?

China Gold Import Jan-Sep 797t. Who’s Supplying?

The Gold-Backed-Oil-Yuan Futures Contract Myth

The Gold-Backed-Oil-Yuan Futures Contract Myth

Estimated Chinese Gold Reserves Surpass 20,000t

Estimated Chinese Gold Reserves Surpass 20,000t

Did the Dutch Central Bank Lie About Its Gold Bar List?

Did the Dutch Central Bank Lie About Its Gold Bar List?

PBOC Gold Purchases: Separating Facts from Speculation

PBOC Gold Purchases: Separating Facts from Speculation

U.S. Mint Releases New Fort Knox Audit Documentation

U.S. Mint Releases New Fort Knox Audit Documentation

China Net Imported 1,300t of Gold in 2016

China Net Imported 1,300t of Gold in 2016

Why SGE Withdrawals Equal Chinese Gold Demand and Why Not

Why SGE Withdrawals Equal Chinese Gold Demand and Why Not

Koos Jansen

Koos Jansen