Guest Post: Gold Pricing and The Flows Of Gold Metal

Written by 24 carat.

Up until now, the gold price did never caught up with 100 years of currency devaluations. This makes us believe the $ is better than gold, accomplished through the artificial fixing of the gold price. The international $ monetary system still dictates the entire world what the appropriate gold price is. The private gold markets haven’t yet been able to let gold’s value float freely. Private gold cannot yet determine whether a currency is worthy as a temporary store of value. So, there is still a general gold director out there who has the capacities of mispricing gold as to keep the private & official gold flows under relative control. And that can be none other than the BIS as the controlling coordinator of the world’s central banks and their gold reserves.

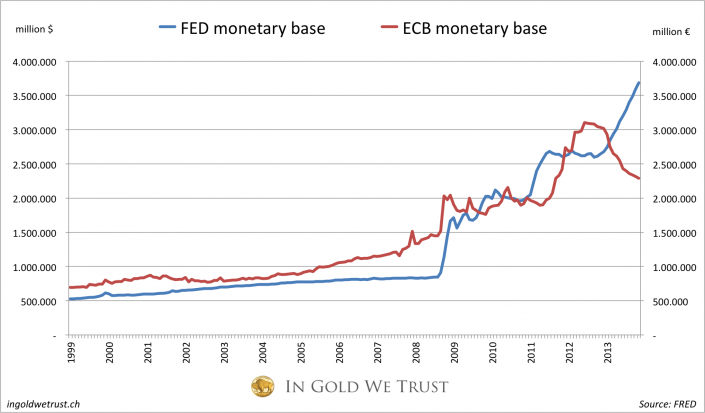

During the London Gold Pool, the central banks also managed to hold the pricing of gold and the private and official flows of gold firmly under their control. Volcker, Greenspan and Bernanke didn’t give the long awaited gold revaluation a single chance. More recently, the ECB was also unable to continue the permitted gradual revaluation of gold, starting from 1999/2001, whilst the Fed balance sheet grew explosively (+ 500%). However, the declining ECB balance sheet, since 2011 managed to hold to its 15 % gold reserve as the main active. The ECB and FED balance, including the 15 % gold reserve, began to diverge at the gold price top ( $ 1925/oz ) in 2011.

More than likely, this is formally / informally agreed on BIS level. Just as the ECB and Fed earlier agreed to construct the Washington Gold Agreement (WAG) in 1999 with the birth of the ECB and European Monetary Union (€-EMU). The emphasis of this gold agreement was originally on –Washington-, and later to be renamed as Central Bank Gold Agreement (CBGA) when the UK left WAG. This is another circumstantial indication that the € – $ agreements are being taken at the BIS level. EMU (€) would not have survived if the Fed hadn’t been willing to provide massive $ / € swaps with the ECB, to avoid the 2008/2009 -crisis total collapse in the EU/EMU. The € and $ were saved…

Then we can also imagine that the BIS has no objection to gold flows to China on condition that the Asians do not force the price of gold higher, without the approval of the $ forces in the BIS. We’ve seen the same dynamics in gold flows to the Middle East (Saudi Arabia) in exchange for preserving the petro -$ during the oil crisis of the seventies and beyond. Therefore the recent long staggered repatriation of German gold reserves do not have any effect on the BIS management of pricing gold.

The BIS central banks system decides when, and which, gold price is appropriate, best suitable for the smooth functioning of the international system of floating currencies.

The main question remains for how long China will accept this, so called, suitable BIS gold pricing. How long can China prosper and expand economically with ever rising Western deficits and subsidized stagnant economies!? That’s China’s pragmatic mercantilist condition for continuing to tolerate the $ supremacy and its firm grip on gold valuation. China is an empire on the globe but is left out of the Western international organizations (IMF-WB). The globe can never have two empires ruling the globe at the same time. The Western and Eastern attitudes about gold’s status are completely opposite, with the Europe floating in between. The days of the Western financial industry (stocks, bonds, etc.) as a store of wealth are being counted. Gold, the wealth reserve metal, is still the one and only an antithesis of unproductive debt. All Western credit has become unproductive debt, because the dysfunctional western economic system is now purely debt driven.

That’s why the West has to keep gold, de facto, fully integrated in its financial & monetary system by continued mispricing of gold’s objective value, electronically. The East wants to value gold, the metal, in a different way, out of the financial capitalism system, with absolutely no links to any currency, just like W. Duisenberg stated in his Aachen speech at the euro’s birth. China promotes gold for its citizens to take as wealth reserve OUT of the system. Whilst the West wants you to keep on holding stocks and bonds and many other manufactured financial products.

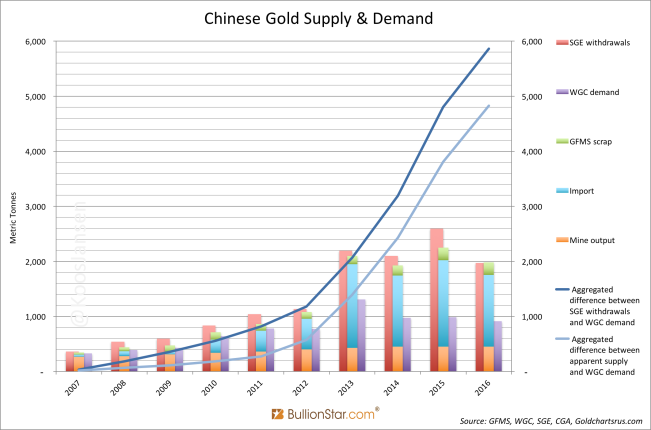

The entire globe longs for a new monetary order, which has already is postponed for quite some time now. But nobody has yet any idea how it will look like and function, as to rebalance the world’s systemic ever growing unbalances of Western deficits and Eastern surpluses. The West cannot even handle its systemic money bubbles and the evolving mania of cheap currency (zero interest rates). For the time being, the East plays along (conspires) with this absurd Western game, whilst accumulating gold from the West until the East has sufficient to enforce new rules. Remember that the ruling $-empire originally had 28,000 tons of gold reserves. What’s left of it, after decades of gold outflows, first to Europe (De Gaulle’s France) and the Middle East and now to the Far East?

On the geopolitical front, the US military order is crumbling. That’s why the East will not compromise on any of the US’ possible new monetary order dictates. The new monetary order will again be golden. The East is not only accumulating the yellow metal, but will soon let gold pull its value by introducing it as a possible settlement in trade as a value for value exchange (barter). The absurd promotion of crypto currencies will not alter this

evolving gold revaluation.

The drying up of the globe’s physical gold market is an illusion. Scarce gold will always flow between strong and weak hands. From deficit zones to producers surplus reserves. Gold flows don’t have any immediate impact on the gold price and the dynamics of gold pricing, gold’s value is not directly affected by the laws of whatever offer/demand, through the pricing in the paper markets. Gold is never functioning as an industrial commodity.

All holders of all kinds of $ debt will crescendo face various forms of depreciation. Those who realize the constant and rising dangers of economic attacks from the dictatorial $-regime, go for protection with the gold. The ECB was the first central bank to mark its gold reserves to the market. This dynamic is exactly what makes gold increasingly more valuable above all manipulated gold derivatives. The increasingly deficit driven Anglo Saxon $-regime is now

rapidly losing the loyalty of many of its former ardent supporters. The global balance of power goes from the ruling West to the East. We’ll have to face this harsh reality rather sooner than later.

Conclusion

The days of Western Rothschild financial capitalism are numbered. The Eastern rising of economic capitalism has still a very long way to go. The rising physical gold flows from West to East over the past decades are now more than obvious. The new gold valuations, out of the $ system, will automatically follow. The $ will be returned back to sender.

Today, when the globe still accepts the dollar’s reservestatus, the correct gold price should be 15% gold reserve of world central banks total balance sheet: $ 3,125/oz. As soon as the dollar is no longer accepted as a central bank reserve, gold’s value will be a multiple of $ 3,125/oz in currency terms.

Keep in mind that the $-gold price so far has been rising double as much as the $-Dowindex since 1973.

24 carat

Popular Blog Posts by Koos Jansen

China’s Secret Gold Supplier is Singapore

China’s Secret Gold Supplier is Singapore

Audits of U.S. Monetary Gold Severely Lack Credibility

Audits of U.S. Monetary Gold Severely Lack Credibility

China Gold Import Jan-Sep 797t. Who’s Supplying?

China Gold Import Jan-Sep 797t. Who’s Supplying?

The Gold-Backed-Oil-Yuan Futures Contract Myth

The Gold-Backed-Oil-Yuan Futures Contract Myth

Estimated Chinese Gold Reserves Surpass 20,000t

Estimated Chinese Gold Reserves Surpass 20,000t

Did the Dutch Central Bank Lie About Its Gold Bar List?

Did the Dutch Central Bank Lie About Its Gold Bar List?

PBOC Gold Purchases: Separating Facts from Speculation

PBOC Gold Purchases: Separating Facts from Speculation

U.S. Mint Releases New Fort Knox Audit Documentation

U.S. Mint Releases New Fort Knox Audit Documentation

China Net Imported 1,300t of Gold in 2016

China Net Imported 1,300t of Gold in 2016

Why SGE Withdrawals Equal Chinese Gold Demand and Why Not

Why SGE Withdrawals Equal Chinese Gold Demand and Why Not

Koos Jansen

Koos Jansen