GOFO and the Gold Wholesale Market

An essay on the relationship between GOFO, gold forwards, the gold lease rate and the US dollar interest rate.

In order to continue to reveal essential information about the physical and paper gold markets around the world, first I would like to expand on the inner workings of the gold wholesale market. In this post we’ll use the Gold Forward Offered Rates, in short GOFO, as an excuse to illuminate the most vital gears that drive the gold market engine. For, if we truly understand GOFO we also understand gold leasing, forwards and swaps, which are the building blocks of the gold wholesale market. Therefor, the goal of this post is to achieve a thorough understanding of GOFO.

GOFO officially “represents rates at which the market making members will lend gold on swap against US dollars”, but GOFO also resembles the gold forward rate and the difference between the US dollar interest rate and the gold lease rate. The purpose of this post is to explain all this in a simplified way.

Let us start discussing gold forward contracts and work our way through this. Please be aware this post requires some studying and is not an easy read.

Gold Forward Contracts

In the gold market there are several possibilities to enter into contracts for buying or selling gold at a future date. These contracts can be used by gold market participants to lock in a future gold price or for speculation. The most common contracts are forwards and futures. On exchanges (organized markets) such as the COMEX gold futures contracts are traded, in the over the counter (OTC) market gold forwards are traded. For this post we’ll mainly focus on forwards.

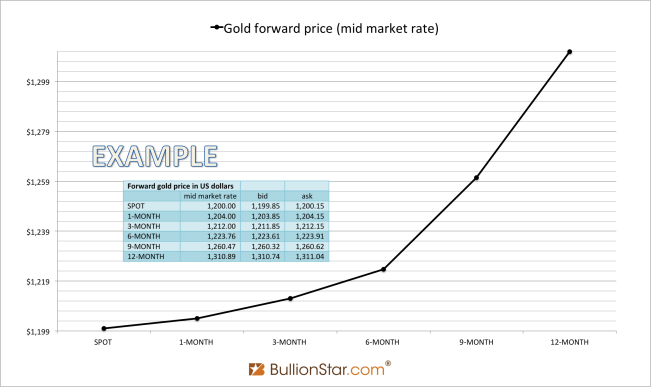

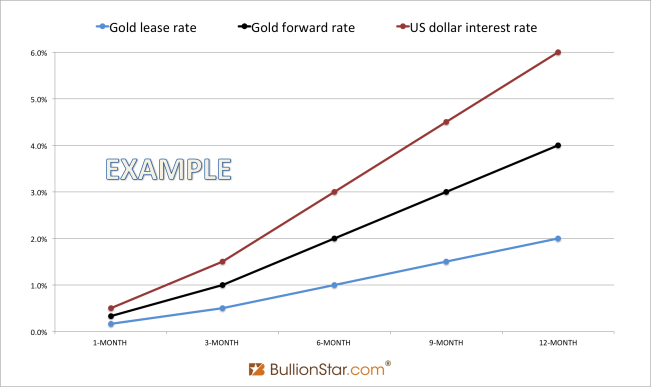

Below is a chart in which I’ve plotted an exemplar gold forward curve based on mid market rates. In addition, I’ve added a table in the chart with the the bid and ask quotes (that set the mid market rates). The bid quotes represent the prices at which market making members are willing to buy gold at a pre-determined date in the future. These are the same prices at which we the market takers are willing to sell gold at a corresponding date in the future. The ask, or offer, quotes represent the prices at which market making members are willing to sell gold at a pre-determined date in the future (market takers buy at these prices). The mid market rate is the mid-point between the bid and ask price. Have a look at the chart and the table.

Please note, forward prices reflect what the market expects now about the future based on present circumstances. Forward prices do not determine what the actual spot price in the future will be.

We can see the bid-ask spread in this example is a constant $0.3 for every gold forward contract. In reality these spreads can vary and are determined by the liquidity of the forward contract. For liquid contracts, which are traded in high volumes, the spread is thin (meaning the spread between the bid and ask quotes is small). For illiquid contracts the spread is wide.

Furthermore, the difference between the mid market rate and the bid (or ask) is called the slippage.

Let’s have a look at a simplified example how a gold forward contract can be used. Say, a gold mining company anticipates the gold price will decline in the future. The miner has a steady output of 1,000,000 fine ounces a year and his annual expenses are 1.3 billion dollars, all to be paid at the end of the year. His business is viable starting at a gold price of $1,300 dollars an ounce. To ascertain to stay in business over one year’s time the miner can choose to enter into a 12 months forward contract in order to sell gold for $1,310.74.

The seller of a forward contract is said to be short, the buyer of the contract is said to be long. The total amount of shorts and the total amount of longs are always equal with respect to forward and futures contracts. The total amount of outstanding contracts is what is referred to as the open interest.

The long, in example, is a jewelry company that in turn seeks to lock in a future price for the well being of his enterprise. Perhaps it makes economic sense for the jeweler to borrow gold for the fabrication of gold ornaments, in the now, a loan he’s required to repay in one year’s time. Not to be exposed to future swings in the gold price he can choose to buy 12 months gold forward, assuring him to be able to repay the gold loan when it comes due.

Let us move on to the workings of the gold lending (/lease) market.

The Gold Lease Market

In a free market any currency can be lent out. Whether it’s the US dollar, euro, Norwegian krone or gold. Interest is paid from the borrower to the lender to stimulate supply, compensate for the risk of defaulting on the loan and postponement of using the currency. It’s true precious metals safely stored in a vault do not yield, however, when metal is lent out it will accrue interest. Gold lending in the gold wholesale market is referred to as gold leasing, and the acronym for the gold lease rate is GLR.

The interest on a gold loan can be settled in gold or dollars, although most often the latter is agreed. From the London Bullion Market Association we can read:

Market convention is for the interest payable on loans of precious metals to be calculated in terms of ounces of metal. These ounces are then generally converted to US dollars, based upon a US dollar price for the metal agreed at the inception of the lease transaction.

In the past decades the most prominent gold lenders have been central banks. During perceived economic stability it was thought to be safe for central banks to lend large portions of their official gold reserves. Though, in recent years these leases have been unwound to a great extent.

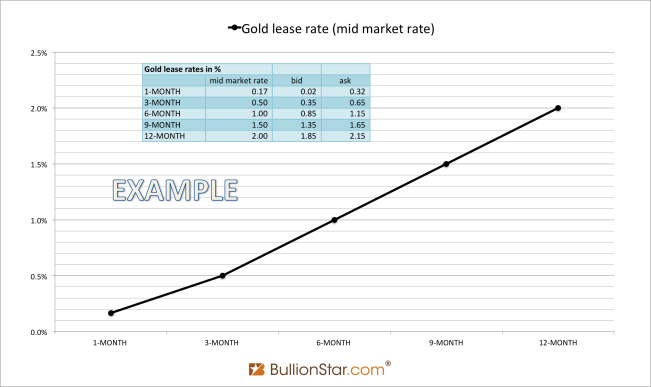

A borrower in the gold market can be, in example, the jewelry company mentioned in the previous chapter. In need of funds for production goods the jeweler can borrow dollars at ie 6 % from a bank, or he could directly borrow gold at ie 2 %. Historically, the normal state of the gold market offered a lower GLR than US dollar interest rate.

Below is a chart with an exemplar gold lease curve – showing the mid market GLR for several tenors. The gold lease bid is the interest rate market making members are willing to pay for borrowing gold (and the rate market takers are willing to receive for lending gold), the gold lease ask is the interest rate market making members want for lending gold (and we the market takers are willing to pay for borrowing gold).

Usually interest rates in financial markets are calculated on a 360 days a year basis.

Let us move on to combine currency lending, spot and forward markets, and come to grips with how these are interrelated and how the wholesale market in general functions.

Interest Rate Parity

Free markets that cater liquid venues for lending currencies, spot exchange and trading in forward contracts give rise to a concept called interest rate parity. This concept can be tough to get your head around, therefor I will describe it first and then show the math to clarify it.

Let us start at the base: the interest rate of any currency affects the forward value of this currency, because loans based on the interest rate grow into more supply of the currency over time. In example, a $5,000 US dollar loan at a 6 % US dollar interest rate grows into $5,300 in 1 year.

The theory of interest rate parity suggests that the interest rates of two currencies determine the forward relationship between the values of these two currencies (/the forward price of either currency denominated in the other). As, both interest rates generate a return in the future, the volumes of which determine the forward price. With respect to gold, interest rate parity suggests the forward gold price is firmly correlated to the gold lease rate and US dollars interest rate.

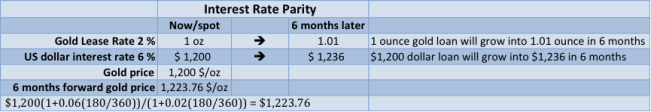

We should get familiar with the math that clarifies interest rate parity. We’ll work with the following exemplar market: the spot gold price is $1,200, the US dollar interest rate is 6 % and the GLR is 2 % – we’ll ignore bid-ask spreads for now. From here it can get complicated. Suppose, a trader borrows $1,200 for 6 months (180 days) at the annual US dollar interest rate of 6 %. When the loan comes due the trader is obliged to repay the principal plus interest to the US dollar lender. In the following formula we can see the principal (1,200), the interest rate (0.06) and the tenor (180/360) going in:

$1,200(1+0.06(180/360)) = $1,200(1.03) = $1,236

With the dollars borrowed the trader can buy 1 ounce of gold on spot and lend it for 6 months. When the gold loan matures the trader will get back the principal plus interest. In the next formula we can see the principal (1 oz), the interest rate (0.02) and the tenor (180/360) going in:

1(1+0.02(180/360)) = 1(1.01) = 1.01 oz

Remarkably, as we know the spot gold price and the volumes the loans grow into, we can compute the 6 months forward gold price: the gold lend by the trader will grow into 1.01 ounces over a 6 months time horizon and his dollar loan will grow into $1,236 over the same period, so consequently the 6 months forward gold price is $1,223.76.

$1,200/1 = $1,200 = spot gold price

$1,236/1.01 = $1,223.76 = forward gold price

As mentioned above, “both interest rates generate a return in the future, the volumes of which determine the forward price”.

In one formula it will show the 6 months forward gold price is:

$1,200(1+0.06(180/360)) / (1+0.02(180/360)) = $1,223.76

We can see the forward gold price is higher than the spot gold price because the GLR is lower than the US dollar interest rate.

The market will set the 6 months forward gold price at $1,223.76, because any undervalued or overvalued forward gold price (bellow or above $1,223.76) would immediately be arbitraged (interest rate parity is said to be “a no-arbitrage condition”).

Let’s have a look at an arbitrage trade in case the forward gold price would diverge from the forward price suggested by the theory of interest rate parity. Suppose, interest rates and the spot gold price are the same as above, but now the quoted forward gold price is too low at $1,220. To arbitrage this opportunity you want to buy (long) this cheap forward gold. Spot–forward arbitrage requires the opposite trade in the spot market – or one would just enter into a forward contract – in this case sell spot gold. If you don’t have spot gold you can borrow it. We can identify two legs in our arbitrage trade:

sell spot gold = buy spot dollars

buy forward gold = sell forward dollars

The chronological order to arbitrage undervalued forward gold would be:

Now,

- borrow 1 ounce of gold for 6 months at 1 % (an annual GLR of 2 % divided by 2. In this example the gold interest will be settled in gold)

- sell 1 ounce of gold on spot for $1,200

- lend the $1,200 for 6 months at 3 % (an annual 6 % US dollar interest rate divided by 2)

- buy long a 6 months gold forward contract for 1.01 ounce at the quoted forward gold price of $1,220 per ounce to repay the gold loan plus interest. The 6 months forward contract will have a notional value of:

1.01*$1,220 = $1,232.2

Then, in 6 months time,

- receive $1,200 plus interest for the dollar loan:

$1,200*1.03 = $1,236

- settle the gold forward contract by paying $1,232.2 for 1.01 oz

- repay the gold loan with 1.01 oz

The total revenue of the arbitrage trade is $1,236 dollars. Having to settle the forward with $1,232.2, leaves a profit of $3.8:

$1,236−$1,232.2 = $3.8

The arbitrage opportunity will be taken advantage of until it’s closed, at that point in time the 6 months forward gold price is $1,223.76. For more clarity I should add that the closing of the arbitrage opportunity happens in the now, not in 6 months time. In addition, when the arbitragers step in the forward gold price could be pushed up from $1,220 to $1,223.76, as we’ve seen in the example trade, though in reality the other variables, such as the spot gold price or the GLR, can give way as well until interest rate parity has manifested. Interest rate parity suggests the spot, lending and forward markets are strongly linked. If one market is moving the others will move accordingly.

In reality everything is more complicated than in our exemplar market because of additional costs involved such as collateral/margin requirements and transaction/shipping/insurance costs (and because interest rate parity is just a theory, which does not always hold).

James Orlin Grabbe, the author who inspired me to pen this post, wrote in the late nineties:

The forward price of gold – the price agreed now for gold to be purchased or sold at some time in the future – is a function of the gold spot price, and the interest rates representing alternative uses of resources over the forward time period.

Introducing GOFO

So, we can compute the forward gold price from the spot gold price, US dollar interest rate and GLR. The formula can be written as:

F(T) = S(1+r(T/360)) / (1+r*(T/360))

F(T) = the forward gold price over a time horizon T days (up to 360 days)

S = the spot gold price

r = US dollar interest rate

r* = GLR

From this equation there is more to reveal. In our exemplar market the spot gold price is $1,200 and the 6 months forward gold price is $1,223.76. Ergo, the 6 months gold forward premium in percentages (/the forward rate) is:

($1,223.76/$1,200)−1 = 0.0198 = 1.98 %

The 6 months forward rate is by approximation 2 % and consequently the annualized forward rate is by approximation 4 %. The difference between the US dollar interest rate (6 %) and the GLR (2 %) is also 4 %. Meaning, the forward rate equals the difference between the US dollar interest rate and GLR. Why? Math. If we play with the formula above we get a nominal forward premium of:

F(T)−S = $1,223.76−$1,200 = $23.76

And by using (r−r*) as difference between the US dollar interest rate and GLR, we get:

S(r−r*)−S = $1,200(0.03−0.01) −$1,200 = $24

The forward rate equals the difference between the US dollar interest rate and the GLR. At this point I would like to bring up GOFO. Grabbe wrote:

Gold forward rates are sometimes referred to as “GOFO" rates, because GOFO was the Reuters page that showed gold forward rates.

Although this is not the official definition of GOFO, it is true that GOFO resembles the forward rate. I say ‘resembles’ and not ‘equals’, because there is a tiny difference we will discuss in the final chapter about GOFO.

Finally, we have explained two descriptions of GOFO mentioned in the introduction of this post. Namely, GOFO resembles the gold forward rate and the difference between the US dollar interest rate and the gold lease rate. The official and exact definition of GOFO we’ll save for last.

GOFO ≈ US dollar interest rate − GLR

GLR ≈ US dollar interest rate − GOFO

US dollar interest rate ≈ GOFO + GLR

When the forward rate is negative this is called backwardation. A negative forward rate implies gold for immediate delivery is trading at a premium to gold for future delivery. This can be caused by tightness in supply now or by market expectations the price will fall in he future. Backwardation is the opposite of contango, a positive forward rate. Historically contango has been the normal state of the gold market whereby the GLR is lower than the US dollar interest rate.

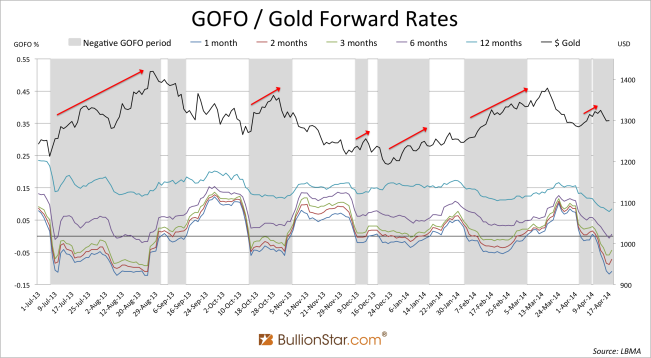

Because GOFO resembles the gold forward rate, negative GOFO implies backwardation in the gold forward price. Unfortunately, GOFO is not being published anymore after it was negative for long periods in 2013 and 2014. The LBMA writes on its website:

GOFO … was discontinued with effect from 30 January, 2015, following discussions between the LBMA and the contributors to the dataset, the LBMA Forward Market Makers.

So much for transparency.

In the chart below we can see GOFO went negative repeatedly in 2013 and 2014. The cause was presumably tightness in spot gold supply, as every time GOFO went sub-zero the spot gold price was pushed up.

In the interest rate parity chapter we examined an arbitrage trade that surfaced when the forward gold price was too low in relation to the prevailing US dollar interest rate and GLR in our exemplar market. Naturally, a comparable arbitrage opportunity arises when the forward gold price is too high in relation to the prevailing US dollar interest rate and GLR. Say, the 6 months forward gold price in our exemplar market is not $1,223.76, but higher at $1,300. This time we want to sell overvalued forward gold and buy spot gold to strike a profit:

buy spot gold = sell spot dollars

sell forward gold = buy forward dollars

Now,

- borrow 1,200 dollars for 6 months at 3 % (an annual US dollar interest rate of 6% divided by 2)

- buy 1 ounce spot gold for 1,200 dollars

- store the gold for a storage fee of $5 for 6 months

- sell short a 6 months gold forward contract at $1,300 for 1 ounce. The forward contract will have a notional value of:

1*$1,300 = $1,300

In 6 months time,

- settle the forward: deliver 1 ounce of gold and receive $1,300

- pay storage costs $5

- repay the initial dollar loan:

$1,200*1.03 = $1,236

The proceeds of the gold forward are $1,300. Total expenses of the dollar loan ($1,236) and storage costs ($5) are $1,241, which leaves a profit of $59.

$1,300−$1,236−$5 = $59

The trade can also be executed by buying spot gold end lend the metal for 6 months instead of storing it. In that case the profit would be higher as the storage costs would be replaced by interest accrued on the gold loan. A 6 months gold loan of 1 ounce would grow into 1.01 ounce. When this gold loan is settled in dollars, the return would be the interest in ounces converted to dollars based on the spot gold price:

0.01*$1200 = $12 (dollar return on 6 months gold loan)

Using a dollar return on the gold loan would give a profit in our previous arbitrage trade of:

$1,300−$1,236+$12 = $76

The difference in profit ($76 – $59 = $17) is of course equal to the storage costs plus the dollar return on the gold loan ($5 + $12 = $17).

More on the pricing of commodity forward/futures contracts and the interaction between the theory of interest rate parity and the theory of storage will be discussed in a forthcoming post.

Gold Forward Swaps & GOFO

We’ve arrived at the official definition of GOFO, the swap. From the website of the London Bullion Market Association we can read the following official definition of GOFO:

GOFO represents rates at which the market making members will lend gold on swap against US dollars.

In parlance of the precious metals markets the word swap usually refers to a forward swap, whereby gold is sold spot and bought forward, or bought spot and sold forward. Essentially this is what GOFO is all about, a forward swap. The swap always has two legs, namely a spot and a forward leg. Consequently, the swap rate equals the forward rate.

gold swap rate = gold forward rate = US dollar interest rate − GLR

When market makers are willing to “lend gold on swap against US dollars” in the official definition of GOFO, they’re willing to execute a forward swap by selling gold spot and buying gold forward. The word “lend” in the official definition can be slightly deceiving, as strictly speaking there is no lending, the swap simulates lending: a gold loan to the market taker collateralized with dollars.

When a swap is executed and the market maker (dealer) sells spot gold to the market taker (client) and simultaneously signs a forward contract to buy it back in due time, the client buys that spot gold with dollars (collateral) and is obligated to return the metal through the forward contract at a fixed price. From the client’s perspective the process can be viewed as borrowing gold (collateralized with dollars), from the dealer’s perspective the process can be viewed as lending gold (on swap against dollars).

In the official definition of GOFO the dealer is the lender of gold but naturally he offers the reverse swap as well, whereby the dealer is the borrower. Let’s have a look at an example trade in which the dealer borrows gold: a central bank owns gold that it wants to put up as collateral for a 1 year dollar loan. The central bank and its dealer agree on a swap transaction. Based on the data from our exemplar environment the central bank will sell gold on spot to the dealer at $1,200 an ounce and then buy back the metal in 1 year’s time at $1,248 an ounce.

$1,200*(1+(0.04(360/360))) = $1,248

Essentially, the central bank has borrowed dollars for 1 year at 4 % instead of 6 % because it has collateralized the loan with gold (/lend its gold simultaneously at 2 %). Again, the swap rate is the difference between the US dollar interest rate and the GLR.

Let’s take it one step further and add bid-ask spreads to learn what GOFO is exactly. In more academic literature (The Non-Investment Products Code, NIPS code) we can read:

GOFO is the Gold Forward Offered Rate and is the rate at which dealers will lend gold on the swap against US dollars. As such it provides an international benchmark and is the basis for the pricing of gold swaps, forwards and leases. …

From GOFO rates, indicative mid-market gold lease rates can be determined as:

Mid-market lease rate = (US dollar LIBOR less 0.0625%) minus (GOFO plus 0.125%)

To explain the equation mentioned in the NIPS code, we should compare it to the one I penned in the previous chapter:

GLR ≈ US dollar interest rate – GOFO

The formulas are to a great extent similar. Though, the NIPS code uses LIBOR as the US dollar interest rate, which it corrects downwards by 0.0625 % because LIBOR is an offer rate – LIBID is its related bid. To compute the mid market US dollar interest rate the slippage, in this case 0.0625 %, is subtracted from LIBOR. In turn, GOFO is increased by 0.125 % because a “lend gold on swap against dollars” deal from a market maker’s perspective is based on the mid market spot leg, while the forward leg is the bid (in the official definition of GOFO the market maker buys forward, so the forward leg is the bid). To calculate the mid market forward leg GOFO must be increased by the slippage, which according to the NIPS code is 0.125 %. In the Nips code formula LIBOR is adjusted to come to the mid-market US dollar interest rate and GOFO is adjusted to come to the mid-market swap rate, in order to compute the mid-market GLR.

In the end both formulas are:

Mid-market gold lease rate = mid market US dollar interest rate – mid market gold swap rate

Hopefully by now you can see how understanding GOFO helps understanding the essential workings of the gold wholesale market – which is very valuable for understanding gold in general.

Popular Blog Posts by Koos Jansen

China’s Secret Gold Supplier is Singapore

China’s Secret Gold Supplier is Singapore

Audits of U.S. Monetary Gold Severely Lack Credibility

Audits of U.S. Monetary Gold Severely Lack Credibility

China Gold Import Jan-Sep 797t. Who’s Supplying?

China Gold Import Jan-Sep 797t. Who’s Supplying?

The Gold-Backed-Oil-Yuan Futures Contract Myth

The Gold-Backed-Oil-Yuan Futures Contract Myth

Estimated Chinese Gold Reserves Surpass 20,000t

Estimated Chinese Gold Reserves Surpass 20,000t

Did the Dutch Central Bank Lie About Its Gold Bar List?

Did the Dutch Central Bank Lie About Its Gold Bar List?

PBOC Gold Purchases: Separating Facts from Speculation

PBOC Gold Purchases: Separating Facts from Speculation

U.S. Mint Releases New Fort Knox Audit Documentation

U.S. Mint Releases New Fort Knox Audit Documentation

China Net Imported 1,300t of Gold in 2016

China Net Imported 1,300t of Gold in 2016

Why SGE Withdrawals Equal Chinese Gold Demand and Why Not

Why SGE Withdrawals Equal Chinese Gold Demand and Why Not

Koos Jansen

Koos Jansen