The Not-So-Crazy World of Negative Interest Rates

A few years ago when I was working at a bank, I asked the bond trader who worked next to me what he thought about the newish phenomenon of negative interest rates. “Rate are only negative cause they’re messing around in our markets!" he whispered indignantly. By “they" he meant central bankers.

Was the bond trader right? Are negative interest rates an artificial phenomenon that central bank technocrats have foisted on the world? Or can interest rates naturally turn negative, of their own accord? (In this post I’ll be referring to real interest rates here, not nominal rates. If you have a bond that yields 0.5% per year, but inflation is 1%, then the real, or inflation-adjusted rate, is -0.5%).

This is an increasingly relevant question. As Deutsche Bank’s Torsten Slok recently illustrated, some 25% of all bonds in the world trade at negative nominal interest rates.

25% of all the bonds in the world trade at negative rates — Torsten Slok pic.twitter.com/AgVECnCV8e

— David Wessel (@davidmwessel) July 26, 2019

Even the German 30-year bond rate recently went negative, hitting -0.006%. Why would anyone want to buy a 30-year German bond that yields -0.006%? Combined with expected inflation of 1.7% per year, that’s a dismal -1.706% real return!

Negative real interest rates may seem crazy. But there is a certain logic to them. To illustrate how they can emerge naturally, I’m going to construct a simple imaginary world without central banks (or money). Consider Robinson Crusoe, a castaway on a desert island. Crusoe must climb a tree each morning to harvest his daily ration of coconuts.

The never-ending attack of kipple

Crusoe knows that when he is old, he won’t be able to climb trees anymore. Rather than withering away in his retirement, he’d like to keep eating. So Crusoe starts saving coconuts in a box that washed up on shore with him. He stores the box underground.

Even when they are locked away in a box, coconuts don’t store well. Humans are engaged in a constant war against nature, or as Silvio Gesell described it long ago: “Rust, decay, breakage, drought, light, darkness, dry-rot, ants, keep up a never-ending attack."

In his novel Do Androids Dream of Electric Sheep, Philip K. Dick imagines a slowly decaying world. Due to a nuclear war the earth is covered with dust and smog, much of it unlivable. A mass exodus is occurring as people immigrate to other planets. To complete his post-apocalyptic future, Dick describes a rust-like phenomenon called kippleization, the process by which junk and useless objects – or kipple – take over the world:

“No one can win against kipple, except temporarily and maybe in one spot, like in my apartment I’ve sort of created a stasis between the pressure of kipple and nonkipple, for the time being. But eventually I’ll die or go away, and then the kipple will again take over."

Robinson Crusoe is engaged in a perpetual war against decay, rodents, rust, and kipple. For every three coconuts that he saves, the nutritive value of just two coconuts will survive. Voila, a negative rate of return has emerged. Because three coconuts yields the equivalent of two coconuts, an investment on Crusoe’s island registers a return, or interest rate, of -1/3, or -33.33%.

Even though this is a pretty awful interest rate, Robinson will take it. If he doesn’t, his retirement will be the death of him.

Robinson Crusoe’s retirement plans change

Crusoe’s expected life expectancy can have a big effect on the rate of interest. Say that after a few years of living on the island, Crusoe realizes that his retirement years (the years in which he wants to eat coconuts but can’t climb trees) will probably last longer than he originally expected. And so he’ll have to save up more coconuts.

Unfortunately, the box he has used up until now for storing coconuts for retirement is full. To meet his retirement goals, he’ll have to use a less efficient method of storing coconuts – say wrapping them in palm leaves and burying them. But palm leaves aren’t as effective at keeping out rodents and other pests.

Now for every three coconuts that Robinson saves, just one will survive. That’s an interest rate of -66.7%. So thanks to an increase in his expected life expectancy, the interest rate that Crusoe faces is twice as negative.

There are better things to store than coconuts

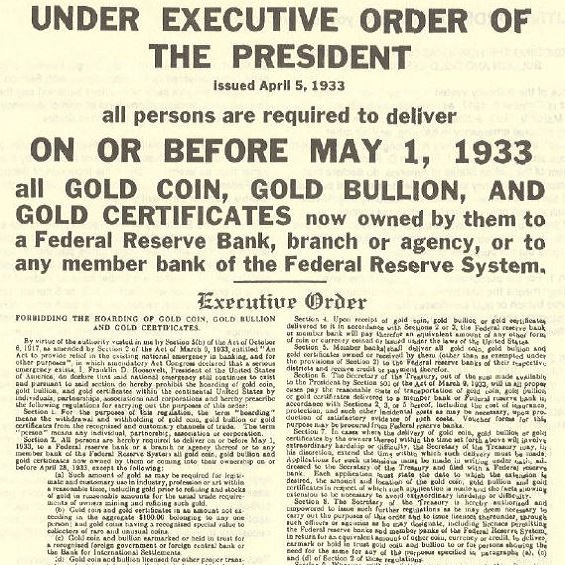

I’ve illustrated how a negative interest rate can emerge in a Robin Crusoe economy. But in the real world, coconuts aren’t the only way to save. We can buy and hold items that are remarkably durable: banknotes, commodities like gold, or gambling tokens like bitcoin.

Let’s say that Robinson Crusoe can somehow get his hands on hardtack, a durable cracker commonly used during long sea voyages. Rather than storing coconuts for retirement, he now hoards hardtack. But even an incredibly durable store-of-value like gold still cost around 0.2% per year to store. Storage space is rare, and the stuff must be insured against theft.

The same goes for hardtack. By storing hardtack until retirement rather than coconuts, Crusoe no longer faces a deeply negative interest rate of -33%. But there will be some costs involved in preserving his wealth – maybe he has to dig the crackers out of the ground every week to air-dry them, and the effort requires he has to eat some of his savings. And so his interest rate will still be a bit negative, say -1 or -2%.

Crusoe Inc.

In the real world we have other options than storing already-existing goods like coconuts and gold until retirement. We can invest in new businesses and pursue new technologies. Say that the deserted island contains a bundle of as-yet unexploited projects that Crusoe can undertake to improve his lot. These new technologies are capable of converting a ‘x coconuts’ into x+1 coconuts. Now Crusoe’s interest rate has turned positive. Instead of three stored coconuts turning into two thanks to deterioration, three stored coconuts can become four coconuts, for five coconuts, or ten coconuts.

But there just aren’t that many of these investments to be made. And perhaps each one is a little less productive than the other. While the first technology Crusoe exploits boasts a high interest rates (three coconuts can be converted into ten), subsequent ones have lower interest rates (three coconuts into 3.1 coconuts).

Interestingly, Crusoe will continue to adopt new technologies, even if they yield negative interest. A technology that yields a -17% rate by turning three coconuts into 2.5 coconuts is better than the original interest rate of -33% Crusoe earned by storing three coconuts in his box only to get two.

So if there are a limited amount of projects on the island, and subsequent projects are less productive, then as Crusoe progressively exploits each one, he drives the interest rate into negative territory.

Robinson Crusoes

We don’t live in a Robinson Crusoe economy. We live in societies with multiple trading partners.

What if we introduce others to the island? Friday, Saturday, and Sunday, three young castaways, wade to shore. Realizing that these newcomers can provide him with coconuts in his old age, Crusoe strikes a bargain with the hungry threesome. He’ll lend them some of his saved coconuts now, thus providing them with the time and resources to get established on the island. In return they’ll have to give him coconuts when he is retired. The exchange rate between future coconuts and present coconuts constitutes the island’s rate of interest.

With three hungry borrowers and just one lender, it may be possible for Crusoe to extract a positive interest rate from them. That is, he may be able to lend Friday, Saturday, and Sunday 100 coconuts each in return for a promise of 150 coconuts each in his retirement. And if more castaways arrive, this may drive interest rates even higher. A larger population of youngsters will be competing for Crusoe’s limited stock of saved coconuts.

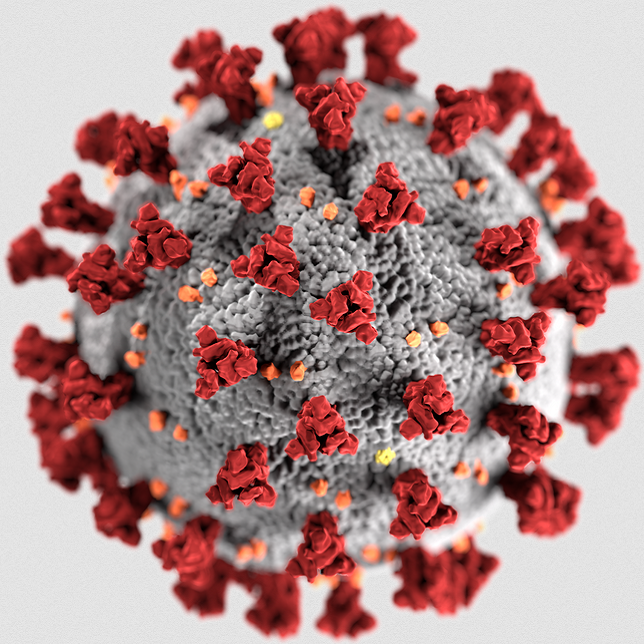

But say that as time passes the island’s demographics start to change. The rate of population growth start to decline. Perhaps no new castaways arrive on the island anymore and a virus is slowly killing off the young who are already there. To make matters worse, Friday, Saturday and Sunday are growing older. Having secured their own coconut trees, they are trying to lend their coconuts too in preparation for retirement.

With a glut of saved coconuts hitting the market, and fewer young borrowers, the creditors may find that they are being forced to offer ever-lower interest rates, even negative ones. Crusoe, Friday, Saturday, and Sunday may even start to lend their stock of coconuts at -30%. It’s better than the -33% they would receive by simply storing the coconuts until retirement.

Moving from a Crusoe economy to our economy

So starting with our allegorical Robinson Crusoe economy – one without money or central banks – we can start to see why interest rates in the real world might be falling, sometimes into negative territory.

First, in the same way that an exhaustion of technological opportunity on Crusoe’s island drove rates down into negative territory, modern day projects may not be as fruitful as projects in previous decades. And so we, like Crusoe, are content with lower rates – even negative ones on the least risky opportunities (i.e. -1.706% on 30-year German government bonds).

Secondly, when Crusoe’s life expectancy increased so did his desire to hoard more coconuts (often inefficiently), driving interest rates even deeper into negative territory. Like Crusoe, there’s a good chance that we are all going to be older than we thought. The combined effort to increase our savings to cope with longer-than-expected lives may be forcing an already low real interest rate into negative territory.

Thirdly, not only are we getting older, but we are having less kids. On Crusoe’s island, fewer new arrivals and pestilence meant less borrowing by young castaways, which drove interest rates into negative territory. In the real world, smaller family sizes means a declining population of young borrowers relative to mid-aged savers. This might be translating into lower, even negative, real interest rates.

So while it may seem odd that investors are keen to lend to the German government for 30-years at a real interest rate of -1.706%, there are a number of technological and demographic factors that might explain their motives. The bond trader at the outset blamed “them" for inflicting negative interest rates on the world. But it may very well be “us" who are responsible.

Popular Blog Posts by JP Koning

How Mints Will Be Affected by Surging Bullion Coin Demand

How Mints Will Be Affected by Surging Bullion Coin Demand

Banknotes and Coronavirus

Banknotes and Coronavirus

Gold Confiscation – Can It Happen Again?

Gold Confiscation – Can It Happen Again?

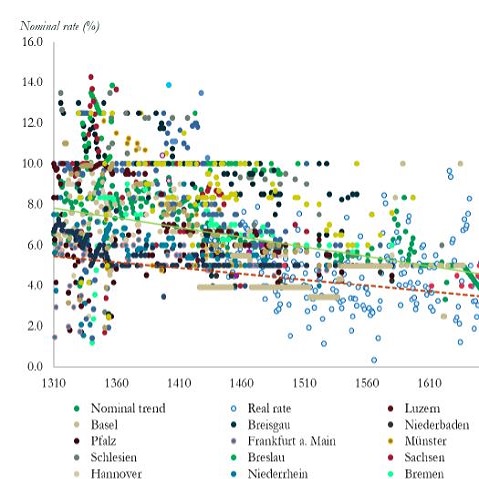

Eight Centuries of Interest Rates

Eight Centuries of Interest Rates

The Shrinking Window For Anonymous Exchange

The Shrinking Window For Anonymous Exchange

A New Era of Digital Gold Payment Systems?

A New Era of Digital Gold Payment Systems?

Life Under a Gold Standard

Life Under a Gold Standard

Why Are Gold & Bonds Rising Together?

Why Are Gold & Bonds Rising Together?

Does Anyone Use the IMF’s SDR?

Does Anyone Use the IMF’s SDR?

HyperBitcoinization

HyperBitcoinization

JP Koning

JP Koning 12 Comments

12 Comments