More On the Puzzle of Negative Interest Rates

Interest rates on many bonds have plunged into negative territory. But why on earth would anyone be willing to save $1000 only to get $999 in the future? Saving up for a rainy day has always gone hand in hand with a positive interest rate, not a negative one.

In my last post I showed how negative real return on saving could emerge. I invoked a certain type of a economy – a dystopic island where castaways like Robinson Crusoe live. The island’s few meagre opportunities to invest have dried up. Technological advancement has halted. To prepare for his retirement Robinson Crusoe stores coconuts, but the constant assault from rodents and insects meant that he’d end up with less resources than he started with.

Crusoe and other castaways his age can also prepare for old age by lending resources to the island’s younger generation. But if the young are dying out, then the much larger cohort of older islanders will have to offer the few remaining young a lower – even negative – interest rate to coax them to borrow.

A tale of two interest rates

Our world is certainly experiencing many problems. But it doesn’t seem to correspond to the grim reality of a decaying Robinson Crusoe world. Sure, we are getting older and having fewer kids. But it’s hard to argue that technological advancement has ground to a halt or that projects are so non-productive that we are content to earn 0%.

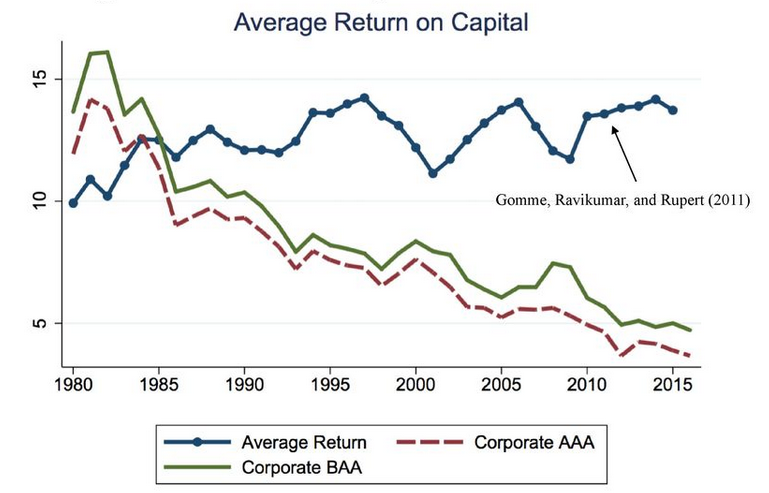

For evidence, take a look at a chart of the rate of return on U.S. business capital:

Negative real interest rates on bonds suggests a decaying world with a shortage of opportunities. Yet the real return on business capital suggests a world of fantastic returns.

Source: https://t.co/6J0ykytQfB (data for “business" goes to 2017Q1, for “all" to 2018Q1) pic.twitter.com/q44K0rDj2H

— JP Koning (@jp_koning) August 8, 2019

The economists Gomme, Ravikumar, and Rupert generate this chart by measuring the after-tax profits that American businesses earn as a percentage of the capital stock, i.e. the amount of money invested in business. This series remains near record highs of 8-9%. Marx, Mojon, and Velde have quantified the return on business capital in Europe and Japan. Returns remain high there as well.

This is a puzzle. The world is currently experiencing negative interest rates on bonds. These can be explained by a stagnating Crusoe economy. But high returns on business capital indicate the opposite: a strong and growing global economy. Which of the two conflicting interest rates should we trust?

Dystopia or a race for safe assets?

There are a few good reasons to doubt both of them. Let’s start with negative interest rates on government bonds.

We don’t need a stagnating Crusoe economy to explain why interest rates are low. Since the credit crisis of 2008, new regulations have increased the demand for safe government bonds. Basel III liquidity standards require banks to hold more government bonds than before. Reforms to the derivatives market have increased the amount of collateralization required of over-the-counter derivative contracts. The types of securities that qualify as collateral must be low-risk and liquid i.e. government securities.

At the same time that the demand for safe assets has increased, the supply of safe assets has been constrained. In many parts of the world austerity politics have kept government debt issuance low. And central banks like the Federal Reserve and European Central Bank have been conducting massive purchase programs, or quantitative easing, which remove large amounts of safe assets from the market.

On top of all that, bonds are not your grandfather’s security. Today’s bond is no longer a piece of paper transferred by foot. It is a sleek electronic entry that trades at lightning speed. Technological advances in market microstructure and improvements in bond market governance have improved the moneyness of bonds. Among large investors, bonds are often passed along as if they were a form of money. If an asset becomes money-like, investors are likely to accept a low, even negative pecuniary return in order to enjoy its liquidity return.

It is this conflux of improved liquidity, brisk demand and tight supply that may have pushed the price of safe assets like bonds to sky-high levels. Since a bond’s interest rate moves in the opposite direction of its price, interest rates have fallen to artificially low – often negative – levels. Notice that we don’t need a miserable Robinson Crusoe scenario to get there. We only made a few assumptions about the supply and demand for safe assets.

Why are the returns on business capital so high?

The business capital that Gomme, Ravikumar, & Rupert’s chart illustrates is too risky to qualify as a safe asset. Nor is it liquid. Whereas a bond can be bought and sold in milliseconds, a business like a restaurant will require many days to buy and dispose of its restaurant equipment. So unlike bonds, the price of business capital has not been bid up by investors desperate for low-risk and liquid assets. And so the return on business capital hasn’t fallen in-line with bond interest rates.

But there are a few reasons to doubt that returns on business capital are as healthy as the chart would indicate. To begin with, the measure doesn’t include intangible capital – things like copyright and goodwill. If it did, returns probably wouldn’t be as high.

Secondly, some economists have hypothesized that high and stable returns on capital are due to increased monopolization of industry. For instance, here is an article on the topic by Gauti Eggertson, Jacob Robbins, & Ella Wold. Monopolists can price their products at ever higher levels without losing customers, thus pushing their returns on capital higher. Without increased monopolization, the actual returns on capital would be lower and show a falling trend, akin to government bond yields. This would be consistent with a world in which technology is slowing down and projects are becoming less productive. Perhaps not a Robinson Crusoe dystopia, but an economy that has inched a bit closer to one.

In summary

So where does that leave us? The world is a complicated, messy place. While negative interest rates can exist in a Robin Crusoe dystopia, there are other scenarios that can generate them too, including a world desperate for scarce safe assets. And while returns on capital remain high, increased monopolization may be camouflaging a slow decline.

Perhaps a combination of factors from each scenario – aging along with a shortage of safe assets – can be combined to provide the fullest picture. Whatever the case, negative interest rates aren’t as strange as many people make them out to be.

Popular Blog Posts by JP Koning

How Mints Will Be Affected by Surging Bullion Coin Demand

How Mints Will Be Affected by Surging Bullion Coin Demand

Banknotes and Coronavirus

Banknotes and Coronavirus

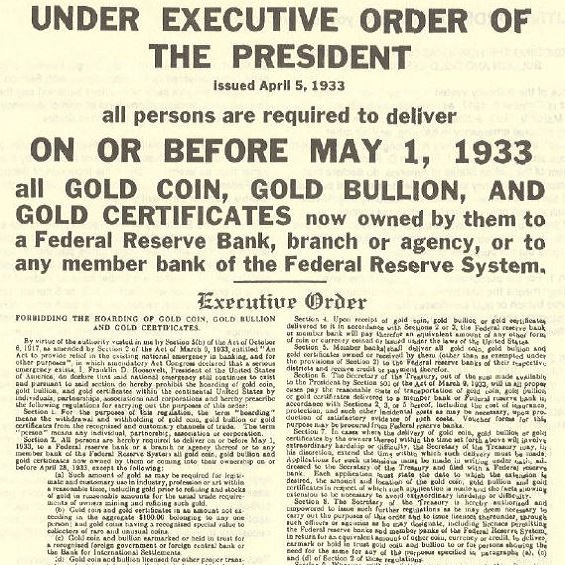

Gold Confiscation – Can It Happen Again?

Gold Confiscation – Can It Happen Again?

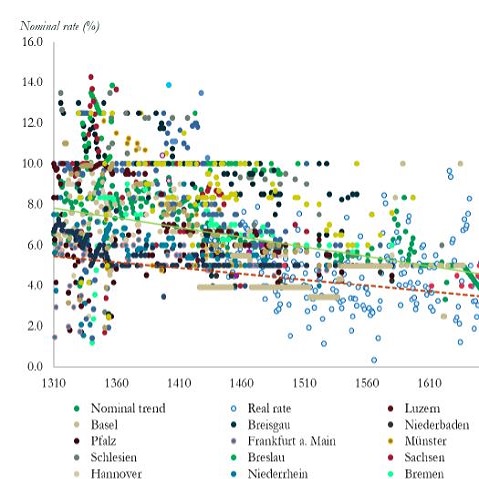

Eight Centuries of Interest Rates

Eight Centuries of Interest Rates

The Shrinking Window For Anonymous Exchange

The Shrinking Window For Anonymous Exchange

A New Era of Digital Gold Payment Systems?

A New Era of Digital Gold Payment Systems?

Life Under a Gold Standard

Life Under a Gold Standard

Why Are Gold & Bonds Rising Together?

Why Are Gold & Bonds Rising Together?

Does Anyone Use the IMF’s SDR?

Does Anyone Use the IMF’s SDR?

HyperBitcoinization

HyperBitcoinization

JP Koning

JP Koning 0 Comments

0 Comments