The History of the World is a History of Gold

The history of gold is nearly as long as the history of human civilisation. Gold has been inextricably linked to human civilisations since at least 6000 BC. There is absolutely no way of looking at the history of the world without encountering the history of gold.

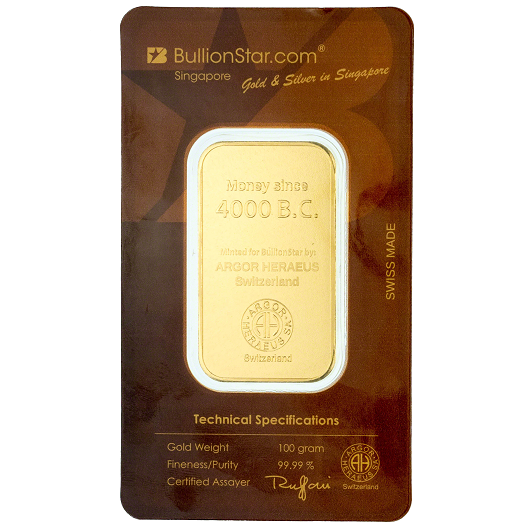

Most importantly, gold has been used as money in countless civilisations for thousands of years, facilitating trade and economic growth and acting as a store of value for accumulated wealth. Indeed, gold has been the ultimate form of money for thousands of years precisely because it is a trusted form of money which retains its purchasing power over time.

Because it can be found in its naturally occurring state, gold was one of the first metals known to man, and early civilizations prized gold for its unique and precious characteristics. However, gold was not found in abundance, something that immediately assigned it a rarity value. and preciousness. With its unique shine and symbolic colour of the sun, gold became central to the spirituality and religions of early societies, and gold’s physical characteristics such as malleability and lack of corrosion made it a natural choice for societies in antiquity to fashion into jewelry and religious ornaments.

As civilisations evolved, gold then also emerged as the natural choice for money. This was again because of its physical properties but also because gold was one of the few metals, along with silver, which was best suited to performing the roles of money and wealth preservation. As an unreactive chemical element that is durable and stable, gold has a relatively low melting point making it easy to fashion into coins and bars. Gold can also be formed into strong alloys with other metals, making it a suitable medium for use in circulating coins. And added to gold’s scarcity value, gold is difficult to counterfeit, and cannot be created or destroyed.

Gold – The Cradle of Civilisations

As one of the seven Metals of Antiquity, gold has played a central part in all of the world’s major historical civilizations, from the earliest evolved civilisations in Mesopotamia, the Indus Valley and ancient Egypt, through to the Greeks, Romans, Aztecs and Incas to name some of the many.

Gold is also unique among metals in being central to many of the world’s religions, and gold has long been associated with the divine sphere. From Islam to Christianity to Hinduism to Buddhism, gold and religion have been symbolically linked in countless civilizations from antiquity to the present day.

Over 5000 years ago, the ancient Egyptians began to mine and smelt gold in southern Egypt and gold was used extensively in the pharaonic society of Egypt for decorative purposes and burial rituals, for example the world famous gold burial coffin and mask of Tutankhamun from the period 1320 BC.

Likewise, in ancient Mesopotamia, which was situated in the region of modern day Iraq, the Sumerian civilisation is recorded to have used gold from circa 3000 BC for ornamentation and burial sites. Nearby in modern day Saudi Arabia, archaeologists have estimated that the Cradle of Gold (Mahd adh Dhahab) gold mine was mined from as early as the 10th century BC, which would interestingly put gold mining there during the reign of King Solomon (961 BC – 922 BC).

In the 7th century BC, the Lydian civilization, which was located in what is now modern day Turkey, began minting coins from a naturally occurring alloy of silver and gold called electrum. These coins had a variable composition of silver and gold, but within a hundred years, the Lydians had discovered how to separate the two precious metals, then creating what are believed to be the first standardised gold coins around 560 BC, during the reign of the Lydian king, Croesus.

For a money to be widely accepted and used, it needs to be easily divisible, durable, portable, difficult to counterfeit, and exist in limited supply. Throughout history, gold has fulfilled all of these characteristics of money with ease, and furthermore, gold has intrinsic value and lacks counterparty risk. Gold thus has emerged as the ultimate form of money throughout human civilisation, preforming the vital monetary roles of medium of exchange and store of value.

Via trade, invasions and the rise and fall of neighboring civilisations, the gold coin minting technology of Lydia was then passed on to the Persians and subsequently to the ancient Greeks, where many gold coins were issued and circulated in Greek city states. Gold was also widely used in the making of jewelry and ornaments in ancient Greece.

The same is true of the Roman Republic and the Roman Empire, where gold coins circulated as currency over the centuries as the primary Roman store of value and medium of exchange, for example the Aureus gold coin issued between the first century BC and the fourth century AD. Staying in Italy, the famous gold ducat, first issued by the Republic of Venice in 1246 AD was critical to the growth of Venice’s control over world trade at that time, and went on to be one of the world’s most widely used gold coins for centuries thereafter.

Similarly the gold florin, first issued by the Republic of Florence in 1252 and used for nearly 300 years, was a gold coin which inspired many other gold florins across other parts of Europe such as the gold florin of the Hungarian Empire. Likewise, the success of the Spanish Empire was underpinned by the use of its world famous gold escudo coin, first issued in 1535.

Indeed, the use of gold was a central pillar in the Spanish conquests of Latin America where the Spanish Empire plundered the gold of the Incas and Aztecs to finance the empire’s expansion and survival, and in the Portuguese colonization of Brazil which saw one of the world’s first great gold rushes in the state of Minas Gerais in central Brazil.

Gold Rushes – The Building Blocks of New Worlds

The 1800s continued the gold rush trend, with huge new gold discoveries in the United States, Australia and South Africa spawning mass migrations, economic growth and economic development, and literally being responsible for the establishment of some of the world’s largest and best known modern day cities, such as San Francisco, Sydney, and Johannesburg.

In the nineteenth century, the US witnessed a number of gold rushes, first on the east coast in North Carolina and Georgia in the early 1800s, but then more famously in California beginning in 1848 in the Sierra Nevada mountains. This gold rush attracted huge migration to California and cemented California’s importance to the US, and indeed its admission to the Union in 1850. The latter 1800s also saw further gold rushes in Colorado, Nevada, South Dakota, and in Alaska connected to the famed Klondike gold rush.

South of the equator in Australia, the discovery of gold was instrumental in the development of Australia’s fledgling colonies in the second half of the nineteenth century, with major gold discoveries in Victoria and New South Wales in 1851 precipitating gold mania similar to that witnessed in California, and swelling the populations of Sydney and Melbourne while putting those cities on the global map.

Australia had continued success with gold discoveries in the 1890s, specifically in Western Australia around the areas of Coolgardie and Kalgoorie. This gold rush again directly drove the development and growth of the coastal city of Perth and indeed of the Perth Mint.

The world’s other famous gold rush of the nineteenth century, and one that was to provide the world’s largest and most important gold discoveries was that of South Africa in the 1880s, in the Witwatersrand area of the Transvaal. This also led to vast migrational inflows and the growth of the city of Johannesburg.

The gold rushes of the latter half of the 1800s added hugely to the world’s gold reserves. For example, while approximately 1200 tonnes of gold were produced globally between 1800 to 1850, more than 10,000 tonnes were produced between 1850 and 1900. These huge increases in above ground gold stocks allowed the development of circulating gold currency worldwide and underpinned the monetary gold standards of the nineteenth and early twentieth centuries which in turn boosted and expanded international trade and development.

This newly mined gold was also directly responsible for the subsequent growth and development of some of the world’s best known mints and refineries, such as the US Mint, the Perth Mint (first opened as a branch of the Royal Mint to produce gold Sovereigns), and later in the early twentieth century, South Africa’s Rand Refinery. The Rand Refinery has the distinction of having refined over 50,000 tonnes of gold, more than a quarter of all the gold ever mined throughout history.

Much of the gold from the gold rushes also passed through London, an already important gold centre at that time, boosting London’s status as the world’s most important gold market and explaining the growth of some of the fabled gold bullion firms of the London gold market such as NM Rothschild, Samuel Montagu, Sharps & Pixley, and Johnson & Matthey.

Gold – Underpinning Economies through the Gold Standards

Beyond circulating gold coinages, the historical role of gold evolved to being the central anchor in entire monetary systems, a role which also supported the growth of free trade and economic development.

While gold had circulated as money for thousands of years, the nineteenth century saw the advent of formal gold standards where countries linked their currencies formally to gold, and gold coinage circulated freely as currency. This was led by Britain in 1816 which took the initiative to move to a full gold standard, defining the value of Britain’s currency, the pound sterling, in terms of gold. Gold coins circulated freely as domestic currency, and paper bill currency was convertible into gold. It was at this time, in 1817, that the modern gold Sovereign was introduced by Britain’s Royal Mint.

The era of the classical gold standard (in which countries linked their currencies to gold ) really got underway later in the nineteenth century, spurred by the growth of worldwide gold supply following the major gold discoveries in the US, Australia and South Africa. Germany introduced a gold standard in 1871. Belgium, France, and Switzerland did likewise in the 1870s, followed closely by Italy and Holland, and Japan in 1897. The US, which had introduced a bimetallic standard of gold and silver in 1792, moved to a full gold standard in 1900.

During the First World War, many countries, including Great Britain, suspended gold convertibility, while the US kept its gold standard in place at an official gold price of $20.67 per troy ounce. Following the post-war Genoa Conference in 1922, a new ‘gold exchange standard’ was launched where countries could link their currencies to the British pound and US dollar, with the dollar and pound convertible into gold.

Britain re-entered this new gold standard in 1925, but dropped out again in 1933, with many participating countries also dropping out at that time. The US then went off its gold standard domestically in 1933, inflating its money supply and outlawing gold ownership for US citizens. In 1934, the US government enacted legislation transferring all Federal Reserve held gold held to the US Treasury, while raising the official gold price to $35 per ounce, further inflating the US money supply. At that time the US money supply was still 40% backed by gold.

Gold – The anchor of the IMF

Just prior to the end of World War Two, the US and Britain devised and rolled out a new international gold exchange standard at the Bretton Woods monetary conference, a currency system stabilised by gold that aimed to manage official fixed exchange rates between the world’s currencies. The institution created to manage this system was the International Monetary Fund (IMF).

Gold was the anchor of this system with the US dollar officially convertible into gold at $35 per ounce. Currencies of participating countries were then convertible into the US dollar at fixed par values. Only central banks and government monetary authorities were permitted to convert US dollars into gold at this official price of $35 per ounce via the US Treasury ‘gold window’, managed by the New York Federal Reserve.

As gold traded freely elsewhere in the world at higher ‘free market’ prices than the $35 per ounce official price, the guardians of the IMF system subsequently spent years intervening into the London market with physical gold sales in an attempt to keep the international market price of gold as close as possible to the official price of $35 per ounce.

They did so through the Bank of England and the US Federal Reserve, initially informally in the 1950s and then more formally in the 1960s with the infamous London Gold Pool of eight central banks from the US, Britain, France, Germany, Switzerland, the Netherlands, Belgium, and Italy, coordinated by the Bank of International Settlements (BIS) in Switzerland. When market speculative activity became so intense that the US ran out of acceptable gold bars in early 1968 to supply the gold price suppression scheme, the London Gold Pool collapsed in March 1968.

The US then fully scrapped the gold ratio requirement (gold backing) of the US dollar money supply which at that time had fallen to 25%. From March 1968, central banks were still able to convert US dollar surpluses to physical gold using the US Treasury’s gold window at the New York Fed. However, due to continued demand by foreign central banks to swap their surplus US dollars for US Treasury gold, this agreement was famously reneged on by the US in August 1971, with the announcement by US President Richard Nixon that the US was closing the ‘gold window’ and suspending convertibility of US dollars into gold.

This move essentially ended the Bretton Woods system of fixed exchange rates tied to gold, and the system’s demise ushered in a new era of unconstrained money supply growth, freely floating exchange rates, and a sharp rise in the US dollar price of gold throughout the 1970s.

Conclusion

Since it was first discovered by man, gold has played a unique role in the history of the world, in the economic growth of civilisations and in every major religion. The history of the world is inextricably linked to gold. Gold has also played a unique and ever present role in the monetary history of the world.

The use of gold as money has been traced back to 4000 B.C. when the Egyptians used gold bars of a set weight as a medium of exchange. From the 6th century B.C. to the 20th century A.D., gold coins circulated in numerous civilizations all over the world. In doing so, gold facilitated trade and enabled economic activity. It is only in our lifetimes or the lifetimes of our parents that gold has not circulated universally as money. This is a relative blip in time compared to the previous thousands of years in which gold circulated as the ultimate form of money, Gold is not called the money of Kings for no good reason.

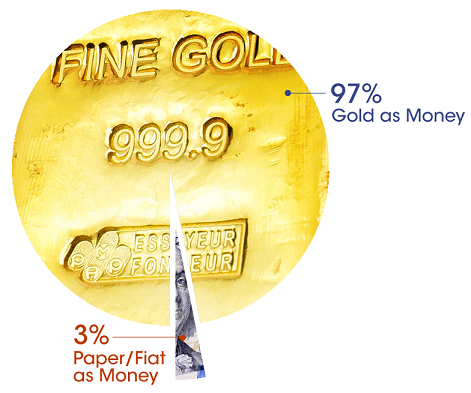

For much of the 19th and 20th century, gold played the role as the anchor stone for the entire international monetary system, from the classic gold standard through to the Bretton Woods era. Since 1971, the world has been engaged in a fiat currency experiment the likes of which have never been witnessed before, with central banks pretending that gold is not important while busily stacking all the gold they can find.

If the architects and rulers of the world’s former civilisations and empires were to see a glimpse into the contemporary world where circulating gold coinage has disappeared, how do you think they would react? The Egyptians, the Lydians, the ancient Greeks and Romans, the rulers of Venice, the Spanish and British Kings, all from societies whose longevity and health depended on the use of gold. They would most likely think the world has gone mad, Likewise for the countless millions who risked everything in the gold rushes of California, Australia and South Africa in the 19th and early 20th centuries. How would they react in knowing that gold has been sidelined by the faceless bureaucrats of the current fiat currency system?

It was Marcus Garvey who said that “a people without the knowledge of their past history, origin and culture is like a tree without roots.” Likewise, a people with no knowledge of the historic role of gold throughout world history is doomed to remain ignorant about the true nature of money.

Today’s western central bankers and monetary system architects know the truth. They just don’t share it in public very often, with the occasional exception. It was Alan Greenspan who said that “in the absence of the gold standard, there is no way to protect savings from confiscation through inflation. There is no safe store of value.”

With unprecedented challenges now facing the international monetary system, will those who understand history make a smart move and allow gold once again to regain its role at the center of the global monetary sphere? Only future historians know the answer to this one.

Popular Blog Posts by BullionStar

How Much Gold is in the FIFA World Cup Trophy?

How Much Gold is in the FIFA World Cup Trophy?

Essentials of China's Gold Market

Essentials of China's Gold Market

Singapore Rated the World’s Safest & Most Secure Nation

Singapore Rated the World’s Safest & Most Secure Nation

Infographic: Gold Exchange-Traded Fund (ETF) Mechanics

Infographic: Gold Exchange-Traded Fund (ETF) Mechanics

BullionStar Financials FY 2020 – Year in Review

BullionStar Financials FY 2020 – Year in Review

What’s Driving Gold to All-Time Highs?

What’s Driving Gold to All-Time Highs?

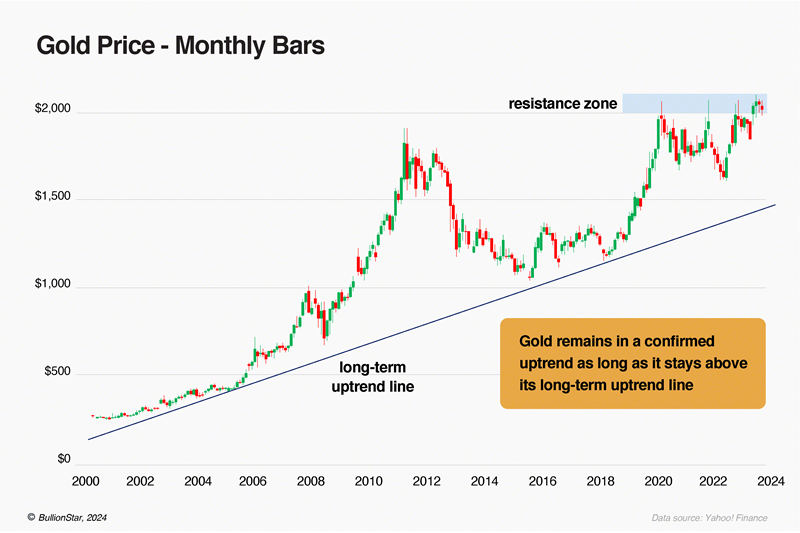

What You Need to Know About Gold's Long-Term Bull Market

What You Need to Know About Gold's Long-Term Bull Market

BullionStar Financials FY 2023 – Year in Review

BullionStar Financials FY 2023 – Year in Review

Year of the Dragon: Surge in Singapore's Gold & Silver Sales

Year of the Dragon: Surge in Singapore's Gold & Silver Sales

The Royal Mint's Growing Interest in Singapore

The Royal Mint's Growing Interest in Singapore

BullionStar

BullionStar 6 Comments

6 Comments