Real estate booms in Asia: Then and now

Indicator of economic cycles

The real estate sector is one important indicator in determining how far gone a region is in the business cycle. A bubble in real estate was quite noticeable in 1997, and we believe that this time around, with increasing money in circulation in Asia, real estate will serve as a gauge once more.

We will be focusing primarily on Southeast Asia and maybe some neighbors that were affected in the Asian storm of 15 years ago. To this end, China will not be among the countries discussed, even though China has already shown signs of its real estate bubble popping.

Sharp drops in 1997-1998

In looking at the Asian boom-bust story of the 1990s, we must note that price data is not extensive or always reliable, depending on the country. Fortunately, there are other indicators that we can inspect. For example, Thailand, by the time the crisis occurred in 1997, had an excess supply of apartment units, wherein 365,000 of them were vacant, while 100,000 had yet to be completed.

The Philippines is said to be the worst-affected, experiencing a 53.7% price drop, adjusted for inflation, from 1997 to 2004 for luxury condominiums. Before this, from 1995-1997, the price had risen 63%.

Nonperforming loans, much of which were intended for the purchase of real estate, increased drastically during this period among Asian countries. From 1997 to 1998 alone, NPLs rose 15% to 25% in Thailand, 11% to 20% in Indonesia, and 7.5% to 15% in Malaysia.

Stock markets also experienced severe dives. Korea, Malaysia and Thailand fell as much as 70% from their peak. Indonesia, the Philippines, Hong Kong, Singapore and Taiwan didn’t fare that much better, with their stock indexes declining 50%. Property stocks in particular experienced massive average declines in their price-to-earnings ratio, from peak to bottom. For Indonesia the drop in P/E ratio was 88.7%, for Korea 91.2%, for Malaysia 86%, for the Philippines 72.5%, for Thailand 99.1%, for Hong Kong 73%, for Singapore 79%, and for Taiwan 88.5%.

Real estate today

The gravity of the crisis could be gleaned from these property-related figures. Let us see how relevant they are to today, where real estate prices are increasing by single digits or lower double digits. The Philippines, in fact, has property selling at levels still below the peak of the 1990s crisis.

In Thailand, mixed signals are reported, as housing prices are falling, but particular indexes such as for townhouses and condominiums are going up. In Singapore, the rise in housing prices is slowing, but those for higher-end property are going up still. Similarly, in Malaysia, there has been a slowdown in the rise in prices, but a rise all the same.

In Hong Kong, there has been a cooling of the market, but largely because of government efforts to impose limits on housing loans. This doesn’t mean, however, that a bubble will not brew in other sectors, in lieu of local real estate.

There is a surge in real estate in Myanmar/Burma, but this has much to do not with bubble monetary policy but with the economy being opened for the first time in decades. However, investors coming in may be recipients of such loose money, thus fueling the boom.

Are we seeing another 1997-1998 crisis at the moment? Hardly. Property prices may be increasing in some places, but crises elsewhere such as in the US and Europe make for caution. Prices may be still on their way up, but there will be bumps along the way.

It would help to pay attention to Asian countries’ balance of payments, where a deficit or decreasing surplus signifies growing debt and decreasing production, which will inevitably result in a bursting bubble.

Gold’s historical role

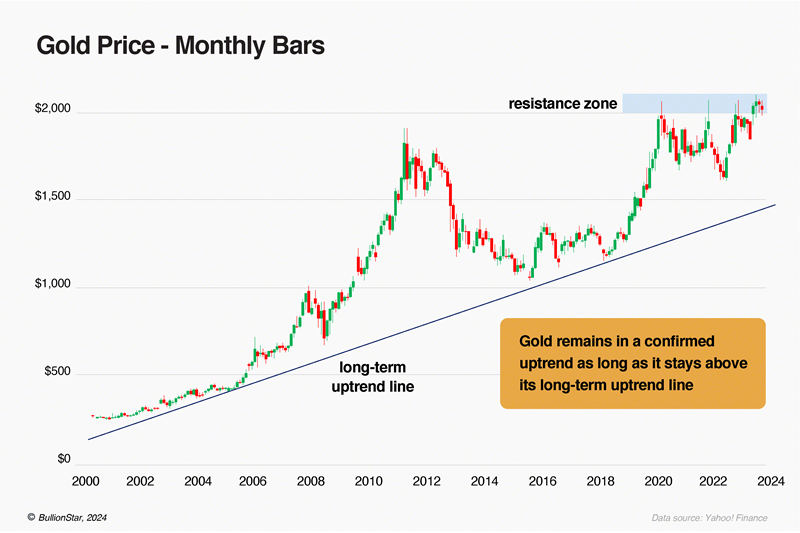

Even amidst the 1997-1998 crisis, gold’s price did not show much significant movement. It is true that gold did not rise in the short term. But fast-forward just five years. As inflation across the world rose at the end of the last century, gold made its record run, to the point where it is today.

A remarkable difference that makes an upsurge in gold more likely to follow quickly is the level of central banks’ present gold buying. It is thus a distinct possibility that funds lifting real estate at the moment will eventually boost the gold price, not taking five years after a crisis to do so.